In 2025, the landscape of digital payments is rapidly shifting. While traditional bank transfers still dominate much of the global financial system, new solutions like OKX Pay are challenging the status quo. For anyone looking to maximize crypto wallet savings in 2025, understanding how OKX Pay compares to bank transfers is critical. This visual guide breaks down the most important differences, using current market data and real-world user experiences.

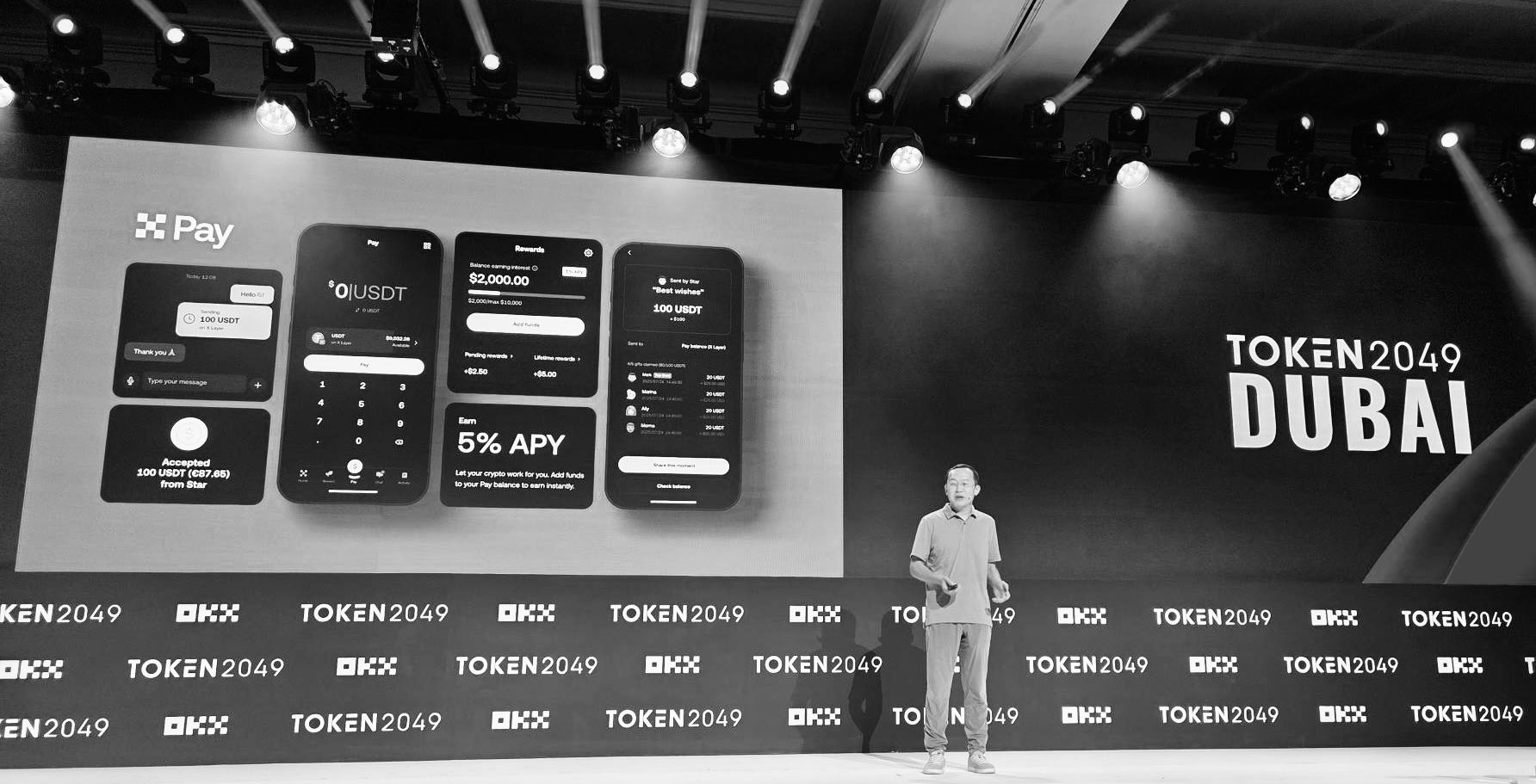

OKX Pay: Zero-Fee Crypto Payments for a New Era

OKX Pay has positioned itself as a next-generation payment platform for crypto users. Unlike conventional banks that often impose transaction charges, OKX Pay enables zero-fee transfers using stablecoins like USDT and USDC. This means you can send money across borders or to friends with no hidden costs eating into your savings.

The system is powered by OKX’s Ethereum Layer-2 network (X Layer), which ensures transactions are not only instant but also cost-effective. With silent rewards, users earn passive income on their deposits – a feature unheard of in most traditional banking setups.

Banks vs. Crypto: Costs and Speed Compared Visually

Traditional bank transfers are notorious for their slow processing times and high fees, especially for international payments. In contrast, OKX Pay operates 24/7 and delivers near-instant settlements regardless of geography or banking hours.

OKX Pay vs Traditional Bank Transfers: Fees, Speed & Security

-

Transaction Fees: OKX Pay offers zero-fee transactions for supported stablecoins like USDT and USDC. In contrast, traditional bank transfers typically charge fees ranging from 1.5% to 5%, especially for cross-border payments.

-

Transaction Speed: OKX Pay processes payments almost instantly, enabling rapid settlement. Traditional bank transfers can take 1-5 business days, particularly for international transfers.

-

Security & Custody: OKX Pay employs a split-key custody model, dividing private key control between user and platform for enhanced security. Banks use centralized custody, where users rely on the institution’s security protocols.

-

Accessibility: OKX Pay is accessible 24/7 globally with no geographic or banking hour restrictions. Traditional banks may limit transfers based on location and operate only during business hours.

-

Additional Benefits: OKX Pay offers silent rewards, allowing users to earn passive income on deposits while maintaining access to their funds—an advantage not provided by traditional banks.

Fee Breakdown:

- Banks: International transfers often attract fees ranging from 1. 5% to 5%, plus potential currency conversion charges.

- OKX Pay: Zero transaction fees when sending supported stablecoins (source). No additional charges or delays.

This fee disparity alone can translate into hundreds or even thousands saved annually for frequent remitters or businesses operating globally.

The Security Edge: Self-Custody Meets Practicality

A major concern with both crypto wallets and banks is security. Here, OKX Pay introduces an innovative split-key custody model: private keys are divided between the user and OKX itself. This hybrid approach gives users practical self-custody without sacrificing safety – a significant step forward compared to typical custodial solutions or bank account access controlled solely by institutions.

If you’re considering switching from bank wires to crypto payments in 2025, this added layer of protection could be a game-changer for your peace of mind.

What truly distinguishes OKX Pay in the current financial climate is its blend of user empowerment and seamless usability. With funds always accessible and silent rewards accruing in the background, users are not just moving money, they’re putting their assets to work. This stands in stark contrast to most bank accounts, where funds often sit idle and interest rates rarely keep pace with inflation.

Visual Guide: How Much Can You Save?

Let’s break down a typical scenario: imagine sending $1, 000 internationally every month. With traditional banks, you could be losing $15-$50 per transfer in fees alone, potentially over $600 each year. With OKX Pay’s zero-fee structure, every dollar arrives intact. The difference becomes even more pronounced for businesses or freelancers moving larger sums.

It’s not just about cost. The speed of settlement means no more waiting days for funds to clear. For users in emerging markets or those supporting family abroad, this immediacy can be life-changing.

Security and User Experience: A Closer Look

The split-key custody model is a practical solution for those wary of both total self-custody (with its risk of key loss) and centralized control (with its institutional vulnerabilities). By sharing responsibility between user and platform, OKX Pay offers a robust compromise that may set the standard for future crypto wallets.

Onboarding has also become frictionless. Users can access OKX Pay directly within the main OKX app, no separate downloads or complex wallet setups required. This streamlined experience lowers the barrier for newcomers while still offering advanced features for seasoned users.

Real-World Adoption: Who Benefits Most?

OKX Pay isn’t just for crypto enthusiasts or tech-savvy investors. Its global reach and instant stablecoin settlements make it valuable for:

- Freelancers getting paid by international clients

- Migrant workers sending remittances home without excessive fees

- E-commerce businesses seeking faster settlements and lower costs

- Savers who want passive income with full liquidity

The Bottom Line on Crypto Wallet Savings in 2025

The data speaks volumes: zero-fee transactions, instant access, and enhanced security combine to make OKX Pay an attractive alternative to legacy banking systems, especially as cross-border commerce becomes more digital and decentralized each year. For anyone serious about maximizing savings or optimizing global payments, the balance is tipping further toward crypto-native solutions like OKX Pay.