Crypto debit cards are rapidly evolving, and the 2025 launch of the MetaMask Card has set a new benchmark for non-custodial spending. As more users look to bridge the gap between their crypto wallets and everyday purchases, the question arises: how does the MetaMask Card stack up against established traditional crypto debit cards like those from Crypto. com, Coinbase, and Wirex? Let’s dive into a detailed MetaMask Card comparison, spotlighting features, rewards, and real user experiences.

MetaMask Card: A Self-Custody Game Changer

The MetaMask Card is not just another entry in the crowded crypto card market. Unveiled in partnership with Mastercard and Baanx, it’s designed for users who value self-custody above all. Unlike traditional crypto debit cards that require pre-loading funds or converting crypto to fiat ahead of time, the MetaMask Card lets you spend directly from your wallet balance. Supported tokens include aUSDC, USDC, USDT, WETH, EURe, and GBPe, with transactions processed wherever Mastercard is accepted globally.

One of its most distinctive features is its integration with the Linea network. This means gas fees are minimal, typically around $0. 02 per transaction, making it as cost-effective as it is convenient. The upcoming limited-edition physical MetaMask Metal Card promises even more exclusive perks and enhanced rewards.

The MetaMask Card is about freedom, your coins stay in your control until you tap to pay. No more trusting centralized custodians with your funds just to buy coffee or groceries.

Traditional Crypto Debit Cards: Rewards-Heavy but Custodial

If you’re after big cashback numbers or lifestyle perks, traditional crypto debit cards still hold plenty of appeal. Here’s how some of the top contenders compare:

Crypto Debit Card Rewards & Perks Compared (2025)

-

Crypto.com Visa Card: Up to 8% cashback on purchases (highest tier), plus perks like free Netflix and Spotify subscriptions. Note: Top rewards require substantial CRO staking.

-

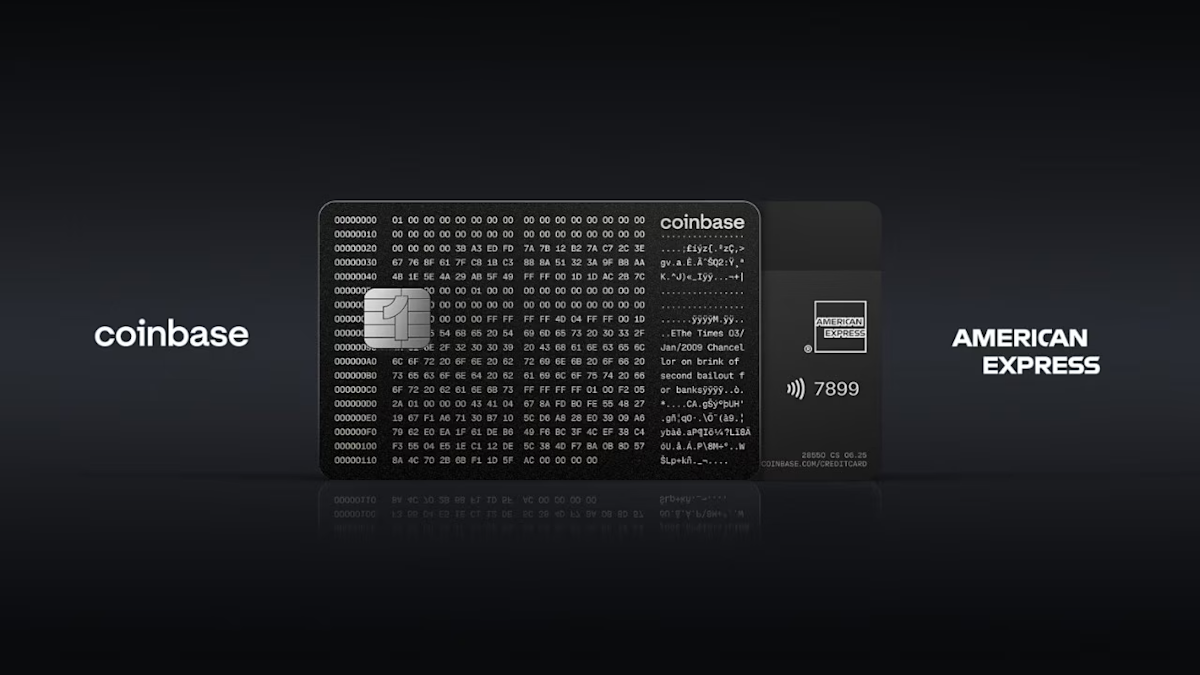

Coinbase Card: Earn up to 4% cashback in crypto on every purchase. Directly linked to your Coinbase account; supports multiple cryptocurrencies. A 2.49% fee applies to crypto-to-fiat conversions.

-

Wirex Card: Receive up to 8% cashback (WXT rewards) on spending. Supports 150+ cryptocurrencies and fiat currencies, with no exchange fees within supported pairs. Available in multiple regions.

- Crypto. com Visa Card: Up to 8% cashback on purchases (with significant CRO staking), plus free Netflix/Spotify subscriptions for top-tier users. However, rewards are often locked behind high staking requirements.

- Coinbase Card: Up to 4% cashback on supported cryptocurrencies but comes with a 2. 49% fee per crypto-to-fiat conversion.

- Wirex Card: Supports over 150 cryptos and fiats; up to 8% cashback; no exchange fees within supported currencies; available across multiple regions.

The trade-off? These cards are custodial, you’ll need to transfer assets into their platforms before spending. While this can be seamless for some users who already keep funds on exchanges like Coinbase or Crypto. com, it does mean sacrificing some degree of control compared to non-custodial options like MetaMask.

User Experiences: Control vs Convenience

User reviews paint an intriguing picture of what it feels like to use these different kinds of cards day-to-day. The Reddit r/Metamask community has been buzzing about the seamlessness of spending directly from one’s wallet with no extra steps or delays, a marked contrast from having to preload funds elsewhere or wait for conversions.

The self-custody model isn’t without its downsides though. Some users note that token support is currently limited compared to custodial rivals, and while a physical card is planned (and highly anticipated), as of now many people are using only digital versions through Apple Pay or Google Pay integrations.

The Rewards Reality Check

This brings us back around to rewards, a hot topic among crypto cashback card fans in 2025! The MetaMask Card offers 1% cashback in USDC on USDC transactions, claimable right inside your dashboard (see details here). While this rate is lower than headline figures on some traditional cards (like Crypto. com’s up-to-8%), there’s no need for staking tokens or locking up capital just to access basic perks.

Reward Structures: MetaMask Card vs. Custodial Crypto Cards

-

MetaMask Card (Non-Custodial): Offers 1% cashback in USDC on USDC transactions, claimable via the MetaMask Card dashboard. No need to pre-load funds; users maintain self-custody until the moment of purchase. Minimal gas fees (about $0.02 per transaction on Linea). Limited token support and physical card availability (Metal Card coming soon).

-

Crypto.com Visa Card (Custodial): Provides up to 8% cashback plus perks like free Netflix and Spotify. High rewards require significant CRO staking and funds are managed by Crypto.com. Supports multiple cryptocurrencies and fiat top-ups.

-

Coinbase Card (Custodial): Delivers up to 4% cashback on purchases. Rewards are paid in crypto, directly linked to the user’s Coinbase account. 2.49% fee on crypto-to-fiat conversions. Wide crypto support; custodial management of funds.

-

Wirex Card (Custodial): Offers up to 8% cashback and supports over 150 cryptocurrencies and fiat currencies. No exchange fees within supported currencies. Funds are held by Wirex until spent; available in multiple regions.

For users who dislike the idea of tying up large sums in platform tokens just to unlock higher reward tiers, the MetaMask Card’s straightforward approach is a breath of fresh air. You earn 1% cashback in USDC on every USDC transaction, no hidden hoops, no fluctuating reward rates. The process for claiming these rewards is fully transparent, and they’re credited directly to your wallet dashboard for easy access. This simplicity appeals to those who value transparency and liquidity over chasing headline-grabbing percentages.

Meanwhile, custodial cards like Crypto. com and Wirex dangle higher rewards but with strings attached. Users report that staking requirements can be steep, sometimes requiring thousands of dollars’ worth of platform tokens locked up for months. Plus, conversion fees (like Coinbase’s 2. 49% crypto-to-fiat charge) can quietly erode your effective cashback rate, especially if you’re not spending in supported stablecoins.

Security and Privacy: Where MetaMask Shines

The self-custody ethos behind the MetaMask Card doesn’t just grant you control, it also means your assets aren’t pooled with an exchange or third-party provider. This can be a major draw for privacy-conscious users or anyone wary of centralized platforms after recent exchange hacks and regulatory clampdowns. With MetaMask, your keys remain yours until you approve each transaction at checkout.

Traditional crypto debit cards do offer robust security measures, but by design they require relinquishing custody to the card issuer or exchange. For many everyday spenders this is an acceptable trade-off for convenience and wider token support, but it’s not ideal if you want to minimize counterparty risk.

The Road Ahead: Physical Cards and Expanding Features

The upcoming release of the limited-edition MetaMask Metal Card has generated plenty of excitement, promising exclusive benefits and enhanced rewards for early adopters willing to snag one when they drop (learn more here). This move could address one of the most common user requests, a tactile payment experience that matches what traditional cards provide today.

As competition heats up between non-custodial solutions like MetaMask and established custodial cards, expect to see both camps racing to add features: broader token support, better international acceptance, and new ways to earn rewards tailored specifically for crypto-native lifestyles.

If you’re deciding between these options in 2025, ask yourself what matters most: ultimate control over your funds with transparent (if modest) rewards, or higher incentives at the cost of locking assets into custodial platforms? For many crypto users today, especially those already living life on-chain, the MetaMask Card finally makes everyday spending feel as seamless as it should.