The MetaMask Card is rewriting the rules for crypto payments, offering a direct on-ramp from your wallet to the real world. Since its launch in April 2025, this Mastercard-linked debit card has quickly become the centerpiece of countless MetaMask Card review threads and user testimonials. Unlike legacy crypto payment cards that require tedious off-ramping and third-party custody, MetaMask’s solution enables true self-custody and near-instant spending of digital assets at any merchant accepting Mastercard.

How the MetaMask Card Works: Features That Set It Apart

At its core, the MetaMask Card is designed for frictionless crypto payments. Users can spend supported cryptocurrencies – including USDC, aUSDC, USDT, WETH, EURe, and GBPe – directly from their MetaMask wallet without needing to convert to fiat first. The process is seamless: when you swipe or tap your card at checkout, funds are settled in real time via the Linea network, usually within five seconds.

This card maintains self-custody, meaning you hold your private keys and retain control of your assets until the exact moment of purchase. This sharply reduces counterparty risk compared to centralized exchange-based cards. Security features from both MetaMask and Mastercard ensure robust protection against tampering or unauthorized access (source).

Setup is straightforward. Early users report that onboarding takes minutes thanks to a fast KYC process – many say it’s quicker than most banks (source). Once verified, you can top up your virtual card directly from your wallet balance and start spending instantly.

Key Benefits: Cashback Rewards and Real-World Use Cases

The headline feature for many is the 1% cashback in USDC on every purchase. This reward structure beats most traditional debit cards and even some leading crypto payment cards. Additional perks include yield opportunities on idle balances and exclusive rewards through MetaMask’s partner integrations.

Top Benefits Users Report About MetaMask Card

-

Seamless Crypto Spending Anywhere Mastercard Is Accepted: Users highlight the ease of making purchases directly with crypto—no need to convert to fiat or use exchanges. The card works at millions of merchants worldwide, wherever Mastercard is accepted.

-

Instant 1% USDC Cashback and On-Chain Rewards: The 1% cashback in USDC on every purchase is a top user favorite, along with additional yield and rewards through MetaMask’s partner network. This incentivizes everyday crypto spending.

-

Fast Setup and Self-Custody Security: Users praise the quick KYC process and self-custody model. Funds remain under user control until the moment of transaction, reducing risks tied to centralized exchanges and making setup faster than most banks.

Everyday spending has never been simpler for crypto holders. Groceries, utility bills, online shopping – anything that accepts Mastercard now accepts your digital assets via MetaMask Card (source). The card also excels for cross-border transactions; freelancers and remote workers can receive payments in crypto and spend them globally without waiting days for bank transfers or paying steep conversion fees (source).

User Experiences: Real Feedback From Early Adopters

User sentiment so far is overwhelmingly positive. Many highlight how easy it is to fund their virtual card with USDC or other supported tokens from their existing wallet balance. The integration with platforms like Monerium and EURe has further streamlined onboarding for European users.

The instant settlement times have become a favorite talking point among reviewers who previously struggled with slow or unreliable crypto payment solutions. The ability to earn 1% cashback in USDC – plus additional rewards through integrations like Linea coin app – adds another layer of value that traditional debit cards simply don’t offer.

Security and privacy remain at the forefront of user concerns, and MetaMask Card’s self-custody model is a major differentiator in the current crypto payment cards comparison. Unlike centralized alternatives that require you to relinquish control, MetaMask ensures your assets stay in your wallet until the moment of transaction. This direct ownership, paired with Mastercard’s anti-fraud protections, gives users a rare blend of crypto-native autonomy and mainstream reliability.

For those wondering how to use MetaMask Card, the process is refreshingly simple. After passing KYC, you’re issued a virtual card that can be added to mobile wallets or used online. Topping up is instant, just transfer supported tokens from your MetaMask wallet. Spending is as intuitive as any debit card: tap, swipe, or enter details at checkout. The card automatically converts your crypto to the required amount at point-of-sale without manual swaps or extra steps.

Comparing Crypto Wallet Cards: Where Does MetaMask Stand?

In head-to-head tests with other top crypto wallet cards, MetaMask consistently scores high for speed, security, and user-centric rewards. Its 1% cashback in USDC is currently unmatched by most competitors. The instant settlement on the Linea network means you avoid delays common with legacy payment rails. And because there’s no need to preload large fiat balances or trust a third party, risk exposure is minimized.

MetaMask Card vs. Leading Crypto Payment Cards

-

MetaMask Card: • Direct crypto spending at any Mastercard-accepting merchant—no pre-conversion to fiat needed.• Self-custody model: Users retain control of private keys until payment.• Instant settlement via Linea network (typically under 5 seconds).• 1% USDC cashback on all purchases.• Supports major stablecoins (USDC, aUSDC, USDT, WETH, EURe, GBPe).

-

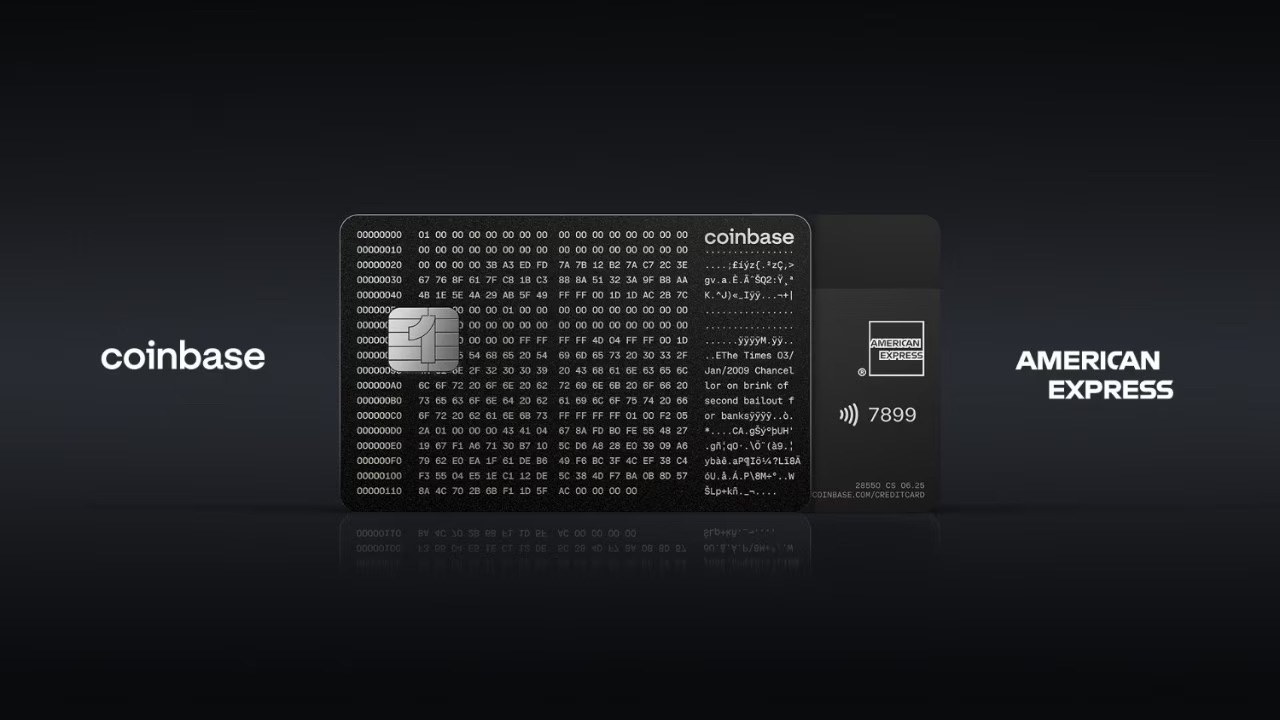

Coinbase Card: • Crypto-to-fiat conversion at point of sale—spend any asset held on Coinbase.• Custodial model: Funds managed by Coinbase until spent.• Visa network acceptance.• Up to 4% rewards (rotating assets, not always USDC).• Supports multiple cryptocurrencies, but requires pre-funding from Coinbase account.

-

Crypto.com Visa Card: • Prepaid model: Top up with crypto, which is converted to fiat before spending.• Custodial wallet: Crypto held by Crypto.com.• Visa network acceptance.• Up to 5% CRO rewards (tiered, requires staking CRO).• Wide range of supported assets, but rewards and features depend on staking level.

-

Binance Card: • Crypto-to-fiat conversion at time of purchase.• Custodial solution: Assets held on Binance account.• Visa network acceptance.• Up to 8% BNB cashback (requires holding BNB).• Supports major cryptocurrencies, but only available in select regions.

For privacy-focused users, it’s also worth noting that MetaMask doesn’t share more personal data than required for regulatory compliance during KYC onboarding. After setup, transaction data remains within your wallet ecosystem, an important distinction from bank-issued cards or exchange-linked solutions.

What Could Be Better? Limitations and Future Upgrades

No product is perfect. Some users have reported limited support for non-Ethereum assets, if you hold Bitcoin natively or other non-EVM coins, you’ll need to bridge or convert before spending. Also, while global acceptance via Mastercard is strong, certain merchants may still flag crypto-linked cards for additional checks depending on region.

Another area for improvement is physical card issuance; as of July 2025 most users are limited to virtual cards only (though this may change soon). Finally, while 1% USDC cashback is industry-leading now, future competition could push reward rates higher, or see new perks introduced via partner integrations.

The Bottom Line: Is the MetaMask Card Worth It?

If you value true self-custody and want to spend stablecoins like USDC directly from your wallet, with instant settlement and tangible rewards, the MetaMask Card delivers where others fall short. Its streamlined onboarding process makes it suitable even for less technical users ready to bridge their crypto into daily life.

The card isn’t a fit if you primarily hold assets outside Ethereum-compatible networks or if you require advanced physical card features right now. But for most active DeFi participants and freelancers paid in stablecoins, it represents a serious leap forward in both usability and security.

As adoption grows and new features roll out, including potential expansion into physical cards, the MetaMask Card is poised to remain one of the most practical tools for integrating digital assets into real-world spending.

If you’re looking for an actionable way to maximize both convenience and rewards from your crypto holdings today, learn more about getting started with the official MetaMask Card here.