Bitcoin is on fire, holding above $118,933 with a fresh 24-hour gain. If you’re gearing up for the next bull run, your crypto wallet choice will make or break your agility. Today, we’re pitting OKX Wallet vs Trust Wallet in a head-to-head battle to help you prep for high-volatility action and maximize every micro-move.

Market Momentum: Why Your Wallet Choice Matters in 2025

The market is buzzing: Bitcoin sits at $118,933, up 0.85%, while Ethereum is pushing toward $3,892.11. In this climate, you need a wallet that’s not just secure but also nimble and feature-packed. With institutional whales moving billions and DeFi protocols heating up, the right wallet gives you an edge, fast swaps, multi-chain support, and bulletproof security are non-negotiable.

“In bull markets, speed and flexibility are everything. The right wallet lets you seize opportunities before they vanish. “

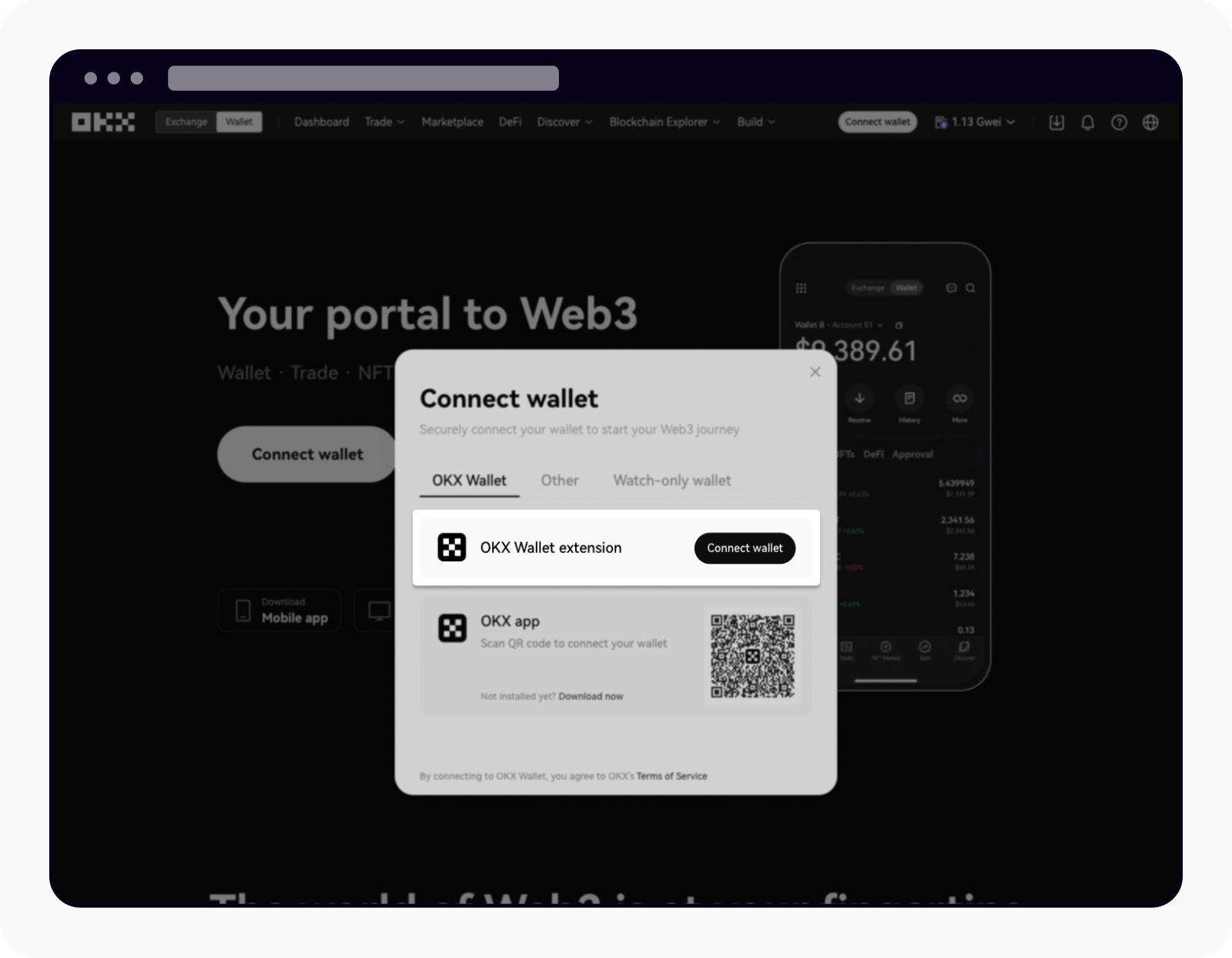

OKX Wallet: Multi-Chain Powerhouse for DeFi Enthusiasts

OKX Wallet is engineered for traders who want to play across more than 80 blockchains without friction. Its non-custodial setup means you keep full control of your keys, no exchange risk here! What sets OKX apart?

- Multi-Chain Support: Effortlessly manage assets on 80 and networks including EVM and non-EVM chains.

- DeFi Integration: Stake, lend, borrow or provide liquidity directly from the wallet interface.

- NFT Management: Store and showcase NFTs across multiple chains with ease.

- DApp Browser: Connect instantly to DeFi apps and NFT marketplaces, no extra plugins needed.

- Tight Security: Non-custodial storage plus multi-factor authentication for peace of mind.

If you’re serious about yield hunting or NFT flipping during peak volatility, OKX Wallet’s all-in-one dashboard is a game-changer. User reviews on platforms like Software Advice consistently praise its reliability and breadth of features (source).

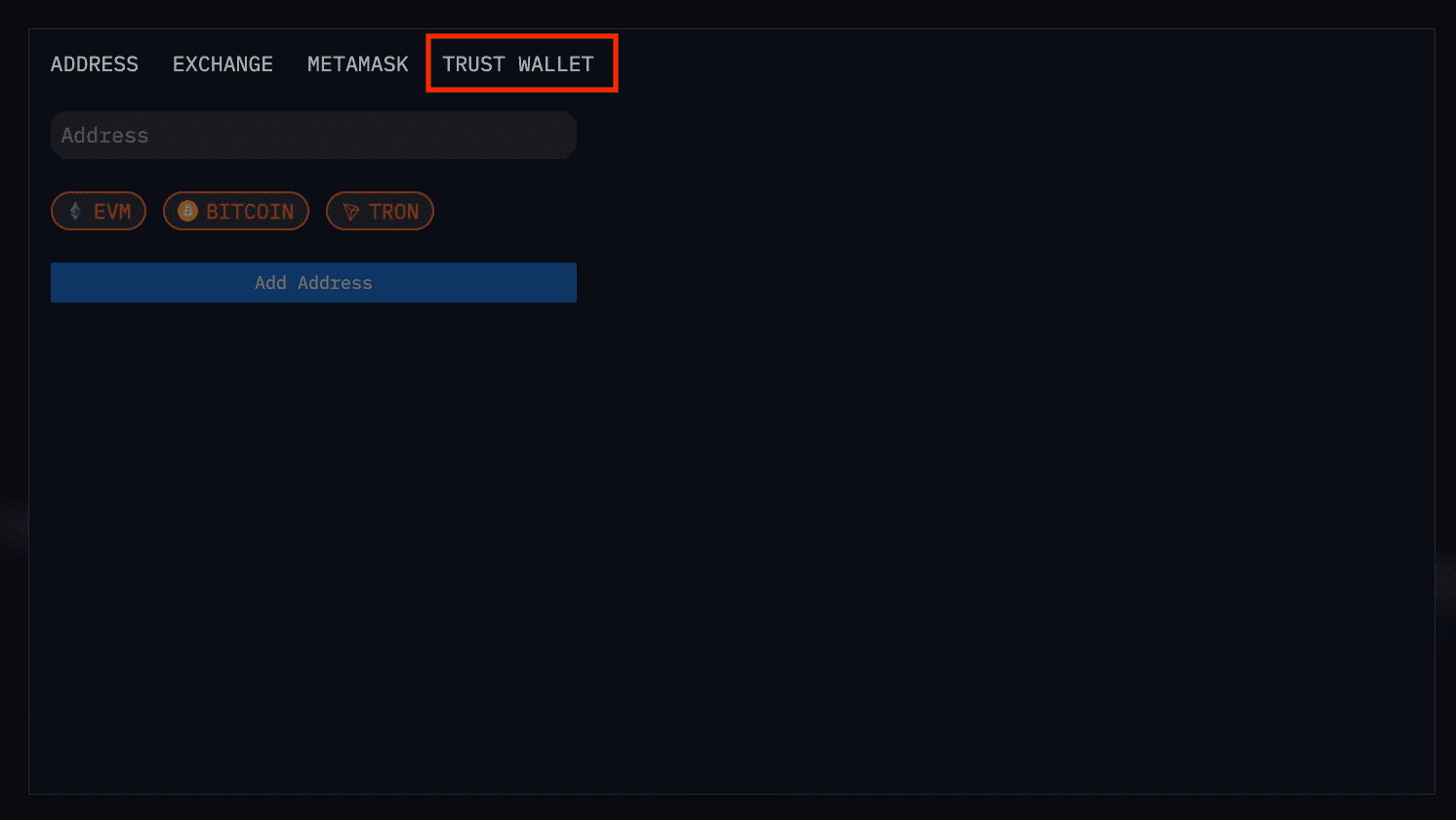

Trust Wallet: Universal Compatibility Meets Simplicity

Trust Wallet, acquired by Binance in 2018, is the go-to choice if you want maximum asset coverage with zero fuss. Supporting over 100 blockchains and millions of tokens, including Bitcoin at today’s price point, it’s built for both beginners and power users who value simplicity without sacrificing depth.

- User-Friendly UI: Clean navigation makes sending, receiving, or exploring wallets effortless, even if it’s your first day in crypto.

- DApp Browser: Jump into DeFi protocols or NFT markets from inside the app, no technical know-how required.

- NFT Support: Manage a diverse NFT collection alongside your tokens in one streamlined interface.

- Total Control: Private keys never leave your device, security stays in your hands at all times.

The biggest draw? Trust Wallet’s sheer versatility. It’s ideal if you want to spread capital across new altcoins or interact with emerging dApps as the bull market heats up (source). For many users on Capterra or GetApp, this universal approach gives them confidence to act quickly when new assets start pumping.

Feature Showdown: Which Stands Out for Bull Market Prep?

OKX Wallet vs Trust Wallet: Feature Comparison for Bull Market Preparation (2025)

| Feature | OKX Wallet | Trust Wallet |

|---|---|---|

| Supported Blockchains | 80+ blockchains (EVM & non-EVM) | 100+ blockchains |

| Asset Diversity | Wide range of cryptocurrencies, tokens, & NFTs | Millions of tokens, major & altcoins, NFTs |

| DeFi Integration | Built-in staking, borrowing, lending, liquidity pools | Access to DeFi apps via DApp browser |

| NFT Management | Secure storage, display, and trading across chains | Management, storage, and trading of NFTs |

| DApp Browser | Integrated for direct DeFi & NFT access | Integrated for DeFi & NFT access |

| Security | Non-custodial, multi-factor authentication, secure key management | Non-custodial, private keys stored on device |

| User Experience | Feature-rich, suited for advanced users | User-friendly, ideal for beginners |

| Platform Ownership | Developed by OKX Exchange | Acquired by Binance (2018) |

| Best For | Active DeFi users, multi-chain asset managers | Users seeking simplicity, broad asset support |

Bull markets reward those who move fast with conviction, and the best crypto wallet for bull market conditions will let you do just that. Here’s how these two stack up on the essentials that matter most right now:

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on current market momentum, adoption trends, and potential bull market scenarios (Baseline Price as of July 28, 2025: $118,933)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Potential Y/Y % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $98,000 | $135,000 | $180,000 | +13.5% | Post-bull retrace or new ATHs |

| 2027 | $110,000 | $155,000 | $210,000 | +14.8% | ETF inflows, institutional adoption |

| 2028 | $125,000 | $185,000 | $260,000 | +19.4% | Pre-halving anticipation, increased adoption |

| 2029 | $145,000 | $235,000 | $320,000 | +27.0% | Halving year, supply shock |

| 2030 | $170,000 | $285,000 | $400,000 | +21.3% | Mainstream adoption, macro tailwinds |

| 2031 | $195,000 | $340,000 | $500,000 | +19.3% | Global asset status, tech integration |

Price Prediction Summary

Bitcoin is poised for continued appreciation through 2031, with average prices expected to rise steadily from $135,000 in 2026 to $340,000 by 2031. Bullish scenarios could see BTC reaching up to $500,000 if adoption accelerates and institutional flows persist, while bearish outcomes may see temporary retracements but higher lows each cycle. Market cycles, halving events, and macroeconomic factors will drive volatility, but the long-term trend remains upward.

Key Factors Affecting Bitcoin Price

- Bitcoin halving cycles (2028, 2032) reducing new supply

- Institutional adoption via ETFs and regulated products

- Global macroeconomic environment and inflation hedging

- Advancements in wallet security and user experience (e.g., OKX, Trust Wallet)

- Regulatory developments in major markets (US, EU, Asia)

- Competition from alternative cryptocurrencies and blockchain platforms

- Further integration of Bitcoin in payment systems and financial products

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Let’s get tactical. When Bitcoin is holding strong at $118,933 and Ethereum is surging to $3,892.11, you need a wallet that won’t slow you down. Both OKX Wallet and Trust Wallet are heavyweights, but your trading style and asset strategy will determine the winner for you.

Security and Speed: Protect Your Edge in 2025

Security isn’t just a checkbox, it’s your moat. Both wallets are non-custodial, so your private keys stay with you. OKX Wallet goes the extra mile with multi-factor authentication and advanced key management, making it a favorite among users who demand enterprise-level protection for their DeFi exploits. Trust Wallet keeps things simple but solid: private keys never leave your device, minimizing attack surfaces and giving peace of mind to both newcomers and veterans.

Speed is the other side of the coin. In a bull market, seconds matter. OKX Wallet’s direct integration with DApps and DeFi protocols means you can stake, swap, or ape in without missing a beat. Trust Wallet’s intuitive UI ensures even complex transactions feel effortless, no manual copy-pasting contract addresses or endless confirmations.

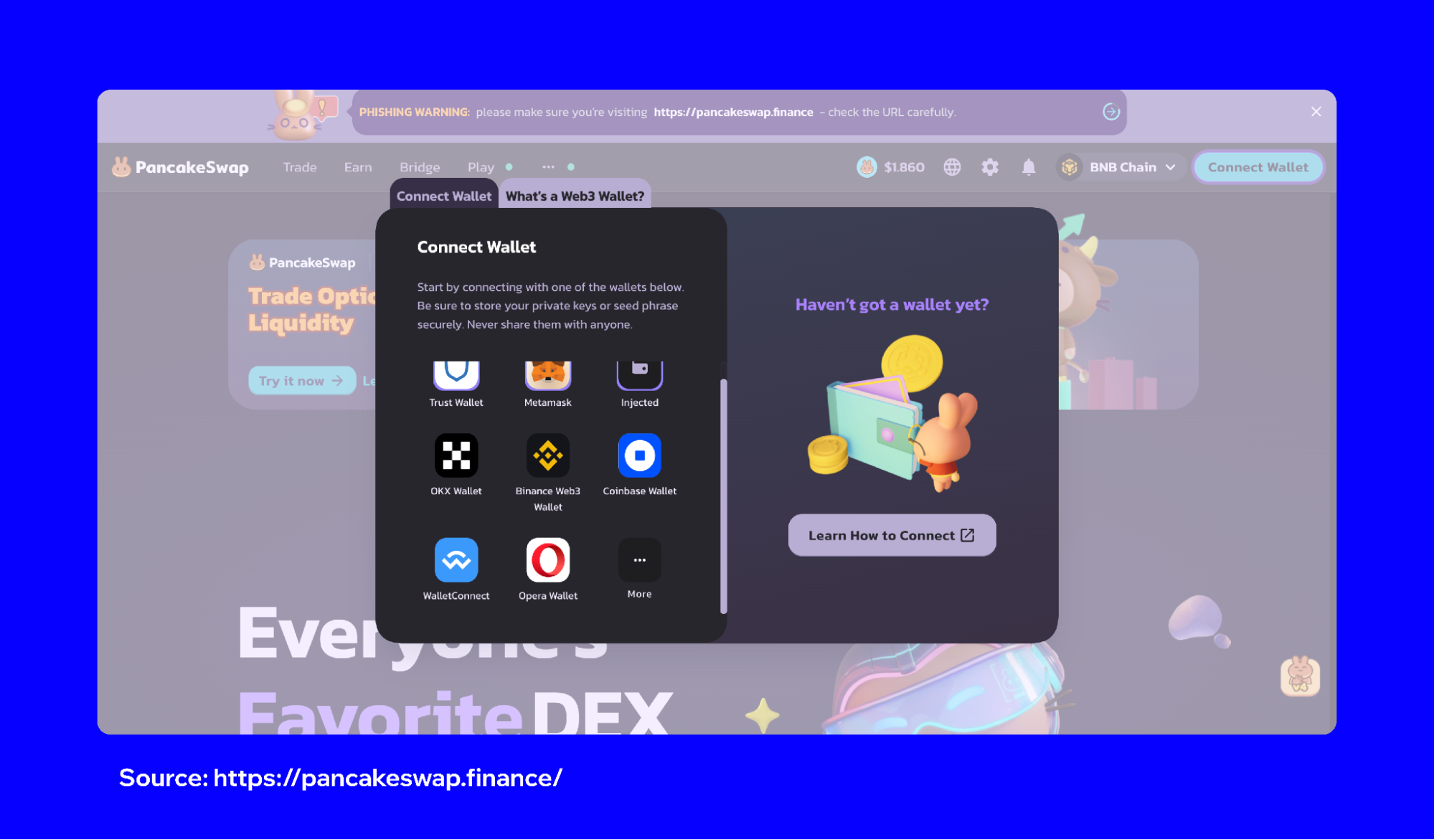

Community and Ecosystem: Who Has Your Back?

The best crypto wallet isn’t just about features, it’s about ecosystem support when things get wild. OKX Wallet benefits from tight integration with the broader OKX exchange platform, making it a top pick for traders who want seamless transitions between spot trading, staking, and wallet management (see more). Trust Wallet counters with massive community adoption and broad compatibility, if there’s an altcoin mooning or a new NFT drop, odds are it’ll be supported here first.

Top 5 Reasons Traders Pick OKX or Trust Wallet

-

Unmatched Multi-Chain Support: OKX Wallet supports over 80 blockchains, while Trust Wallet covers 100+, letting traders diversify assets across major and emerging networks for maximum bull market exposure.

-

Integrated DeFi Access: OKX Wallet offers built-in staking, lending, and liquidity pools for seamless DeFi participation. Trust Wallet also enables direct connection to top DeFi dApps, empowering users to earn and trade during market surges.

-

Robust NFT Management: Both wallets provide secure NFT storage and marketplace access, making it easy for traders to manage, display, and trade digital collectibles as NFT volumes spike in bull runs.

-

Advanced Security Features: OKX Wallet employs multi-factor authentication and secure key management, while Trust Wallet ensures private keys stay on your device, giving traders full control and peace of mind.

-

User-Friendly Experience: Trust Wallet is praised for its intuitive interface—ideal for beginners. OKX Wallet delivers a feature-rich platform that appeals to experienced traders seeking advanced tools for the bull market.

Looking at user feedback from platforms like GetApp and Capterra, both wallets earn high marks for reliability, but OKX gets special mention for its pro-grade features while Trust Wallet wins on simplicity and breadth (source).

Action Plan: Setting Up Your Bull Market Arsenal

If you’re ready to ride this bull run, where every uptick counts, here’s how to set yourself up for success:

Don’t wait until Bitcoin cracks new all-time highs above $118,933. Get your wallet ready now so you can move instantly when opportunity strikes.

Final Thoughts: Which Crypto Wallet Wins?

If your goal is deep DeFi engagement across multiple chains or rapid-fire NFT trades when momentum spikes, OKX Wallet is built for you. If you want maximum coin coverage in an interface anyone can master, and plan to diversify as new projects pump provides Trust Wallet remains unbeatable for its versatility.

The real edge? Whichever wallet lets you act fastest while keeping your assets secure at these market levels. As always: test drive both before loading up serious capital, and stay nimble as the next phase of this bull market unfolds.