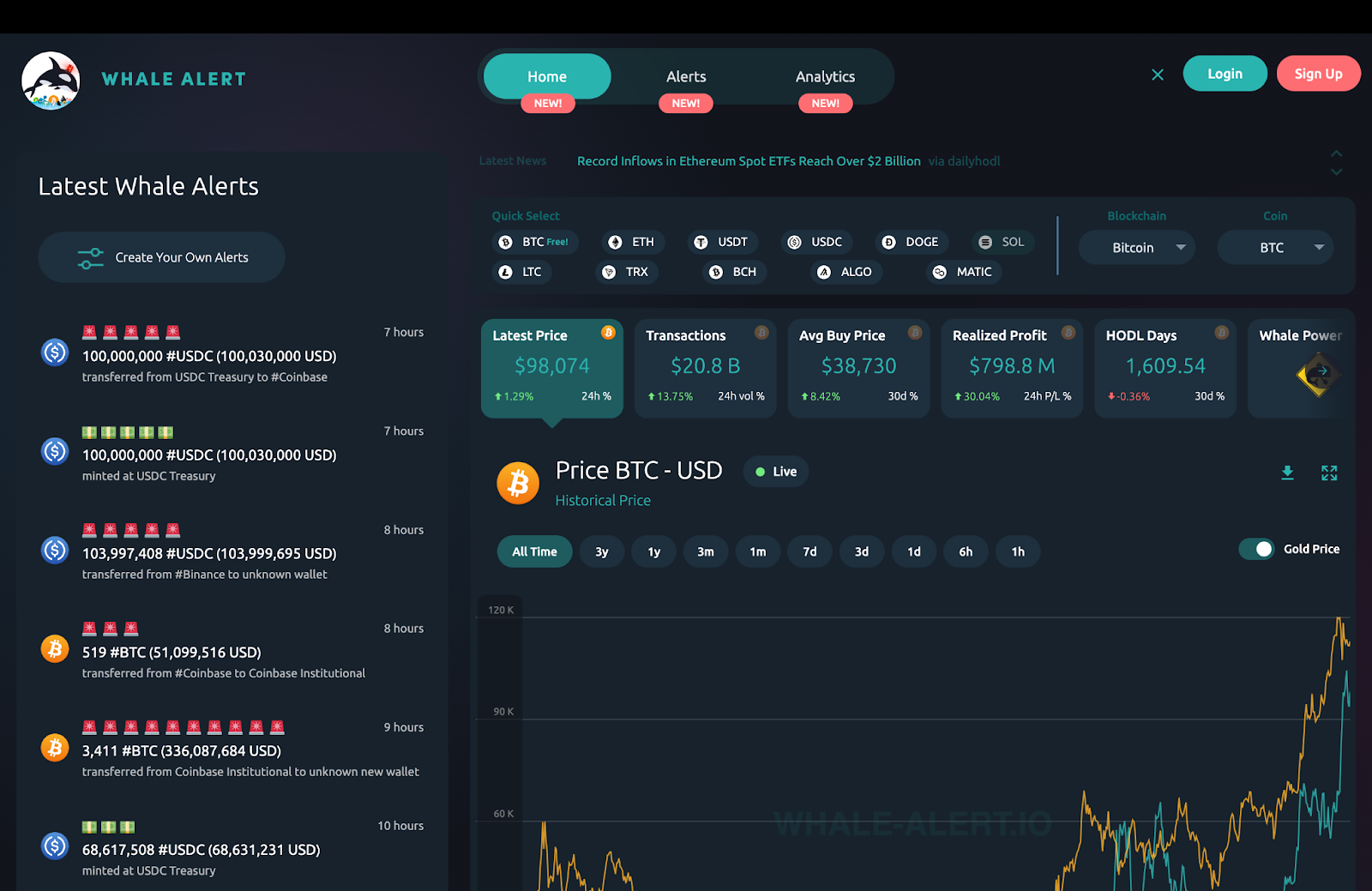

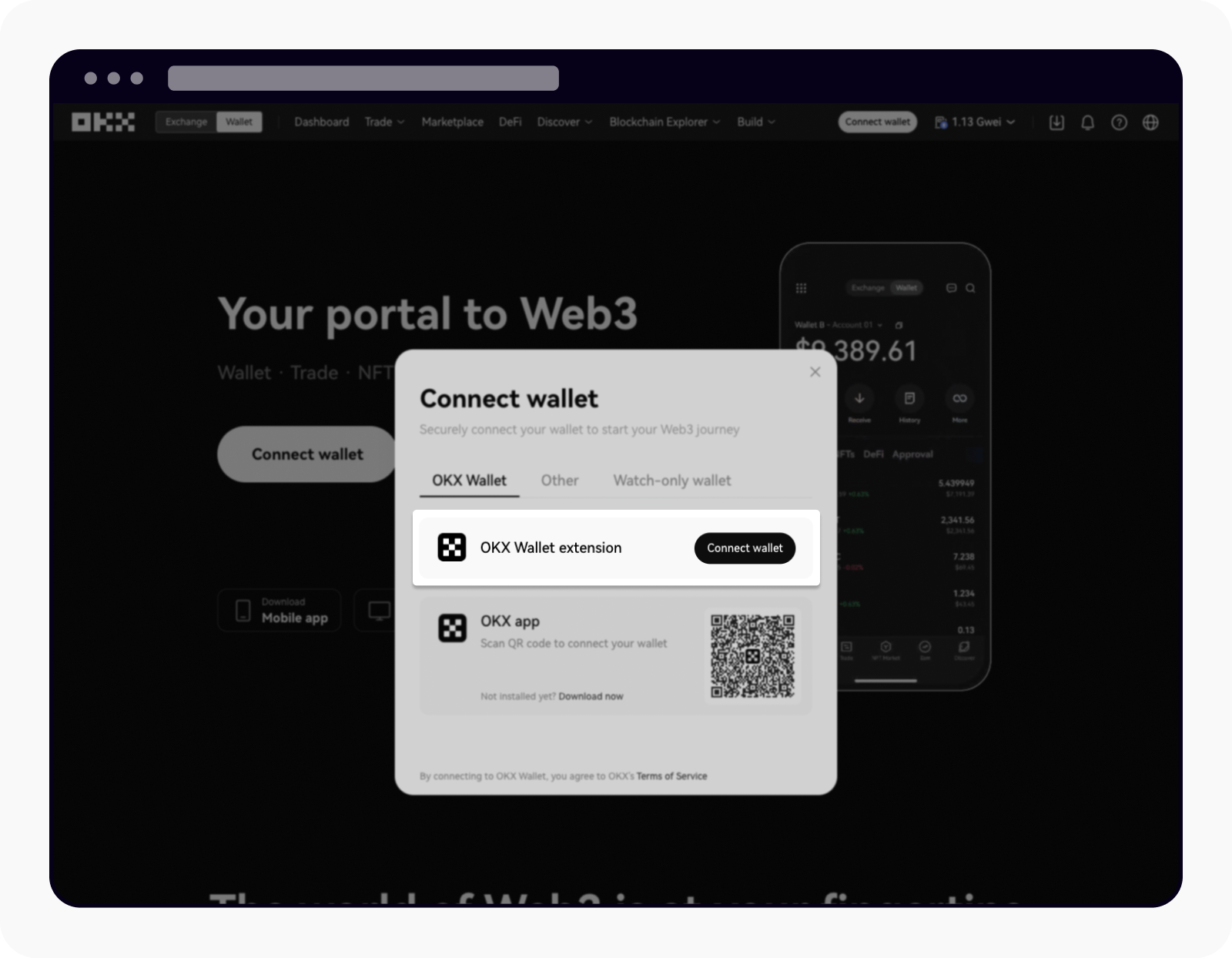

Ever wondered how some traders always seem to catch the big moves before everyone else? The answer often lies in tracking crypto whales – the high-net-worth individuals and funds whose trades can ripple through the entire market. With OKX Wallet’s Whale Watching feature, you don’t need to be a blockchain detective to follow these market movers. This tool brings powerful crypto wallet analytics right to your fingertips, making it easier than ever to spot trends, track crypto inflows, and understand wallet clusters that could signal the next breakout.

Why Whales Matter: Understanding Their Impact on Crypto Markets

Crypto whales are not just mythic creatures of the blockchain sea – they’re real players whose movements can drive price swings, spark sector rotations, or even trigger cascades of buying or selling. By tracking their wallets, you get a front-row seat to smart money flows. Whether it’s a whale accumulating Ethereum ahead of a DeFi surge or exiting a meme coin before the hype dies down, following their actions can give you an edge.

According to OKX, monitoring wallet addresses of top holders is one of the most effective ways for investors to anticipate big market shifts. In fact, keeping tabs on these influential players is now considered an essential part of modern crypto strategy.

Inside OKX Wallet’s Whale Watching Feature

The magic of OKX Wallet whale watching lies in its blend of simplicity and depth. Here’s what sets it apart:

Top Benefits of OKX Wallet’s Whale Watching Feature

-

Monitor Smart Money Moves: Track the on-chain activity of leading crypto whales and top traders in real time, gaining insights into their portfolio shifts and strategic trades.

-

Spot Market Trends Early: Identify emerging narratives and sector rotations before they go mainstream by observing where large wallet clusters are allocating funds.

-

Catch Key Buy and Sell Signals: See when influential wallets are entering or exiting positions, helping you time your own trades and avoid being left behind.

-

Customize and Organize Tracking: Follow up to 100 wallet addresses, assign custom names, and bulk import lists to keep your whale-watching organized and efficient.

-

Analyze Portfolio Performance: Review token balances, profit and loss (PnL), and historical transactions for tracked wallets to learn from successful strategies and adjust your own.

Follow Smart Money: Track up to 100 wallet addresses at once – whales, top traders, or even that mysterious degen who keeps printing money. Assign custom names for clarity and bulk import addresses if you’re managing a watchlist.

Real-Time Activity Feed: Dive into up-to-the-minute transaction histories spanning 180 days. Filter by transaction type, value range, or custom parameters so you only see what matters most – like sudden inflows into a new token or large exits from an established coin.

Portfolio Analytics: Instantly view what tokens each tracked wallet holds, their balances, current valuations, and even profit/loss metrics. Spot when whales rotate into new sectors or trim positions so you can react faster than the crowd.

How Crypto Wallet Clusters Reveal Market Narratives

The real power comes when you start connecting dots between multiple wallets with similar activity – aka wallet clusters. These groups often move in unison around major events like protocol launches, token unlocks, or macroeconomic news. By watching these clusters with OKX’s visual crypto wallet tools, you can identify emerging narratives before they hit mainstream headlines.

This isn’t just about copying trades; it’s about understanding sentiment shifts at scale. When several whale wallets start accumulating a niche DeFi token simultaneously or exit blue-chip assets together, it often signals early momentum that retail traders won’t notice until much later.

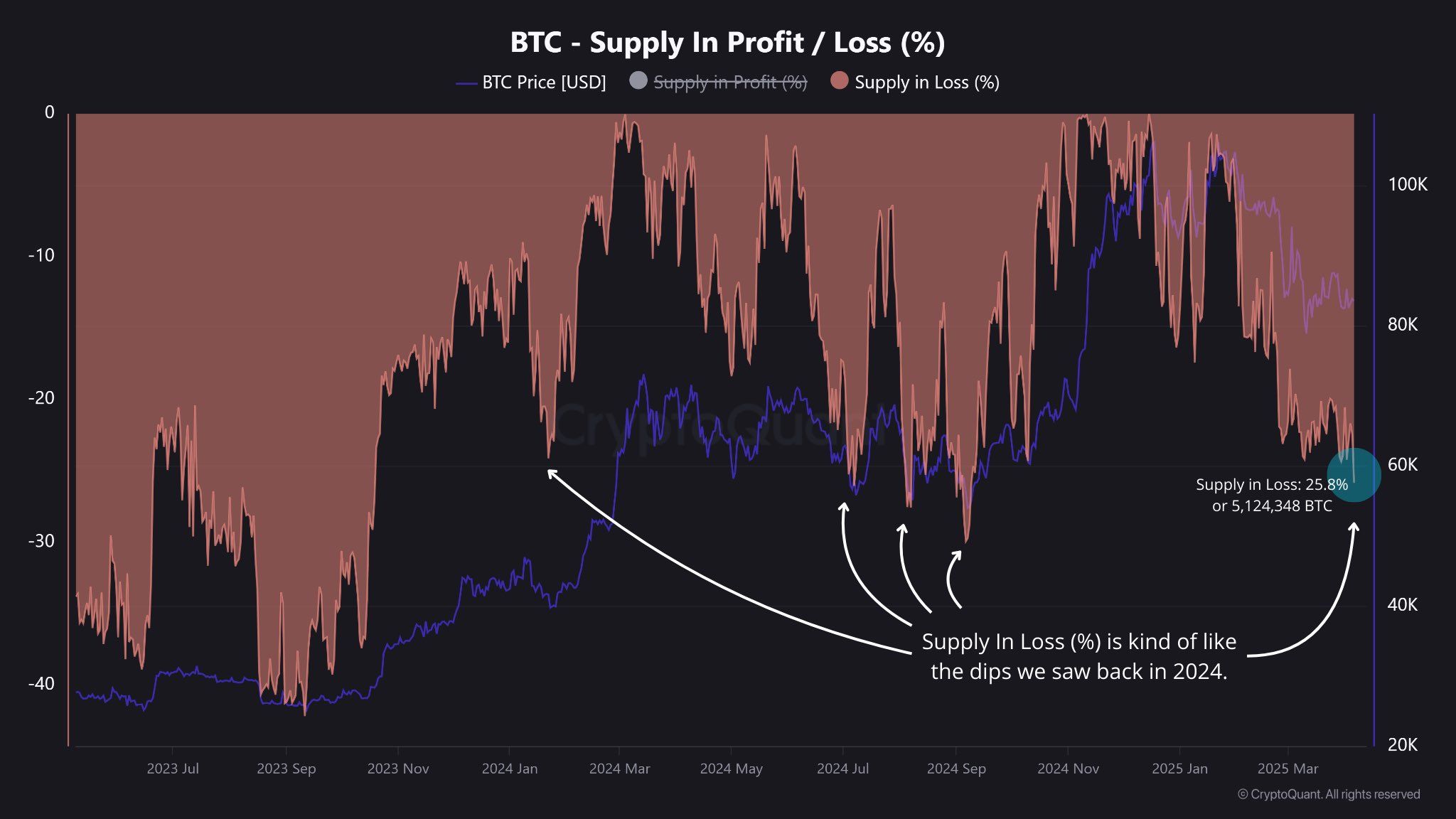

Another edge of the OKX Wallet whale watching feature is its ability to help you avoid becoming exit liquidity. When large wallets start offloading tokens, the price impact can be dramatic. By monitoring these exits in real time, you can sidestep sudden downturns and better manage your risk exposure. The platform’s visualizations make it easy to spot coordinated outflows or inflows that might otherwise go unnoticed in a sea of blockchain data.

Pro tip: Use custom wallet names and bulk import tools to organize your own watchlist, whether you’re tracking legendary whales, active traders, or even quirky wallets that seem to always ape into the next big thing.

Practical Use Cases: From Alpha Hunting to Risk Management

Let’s break down some practical scenarios where OKX Wallet’s whale watching feature really shines:

Real-World Use Cases for Tracking Crypto Wallet Clusters

-

Catching Early Sector Rotations: By monitoring wallet clusters with OKX Wallet’s Whale Watching feature, traders can spot when whales shift funds from one sector (like DeFi) to another (such as Layer 2 or AI tokens). This early insight helps users position themselves ahead of major narrative trends.

-

Monitoring Meme Coin Pumps: Whale activity often precedes massive price surges in meme coins. Tracking large inflows into meme coin wallets lets traders catch early signals of coordinated buying, as seen in recent DOGE and TRX whale movements.

-

Avoiding Large-Scale Dumps: By keeping an eye on sudden outflows from whale wallets, users can identify when a big holder is preparing to sell. This helps avoid becoming exit liquidity during sharp market downturns.

-

Following Smart Money Strategies: Observing how top traders allocate their portfolios and manage risk provides valuable lessons. OKX Wallet’s tracking tools let users analyze real-time portfolio changes and profit/loss metrics of successful whales.

-

Detecting Coordinated Market Moves: Whale clusters sometimes act in sync, signaling major market events. Tracking these coordinated inflows or outflows can help traders anticipate volatility and adjust their strategies accordingly.

Alpha Hunters: By following wallets known for early entries into trending tokens, you can spot opportunities before they become crowded trades. This is especially useful for those seeking an edge in fast-moving sectors like DeFi or NFTs.

Risk Managers: Watching for coordinated exits from whales helps you avoid being left holding depreciating assets. If several high-value wallets start dumping at once, it’s often a sign to reevaluate your position.

Narrative Spotters: When wallet clusters begin accumulating a token tied to an upcoming protocol upgrade or ecosystem partnership, it often foreshadows sector-wide momentum shifts. OKX Wallet’s analytics make these patterns visible and actionable.

Best Practices for Using Whale Watching Tools Like a Pro

The real art is in how you interpret the data. Here are some tips for making the most of OKX Wallet’s whale watching suite:

- Don’t blindly copy trades. Use whale activity as one input among many, combine it with technical analysis and macro trends for balanced decisions.

- Watch both inflows and outflows. Big buys signal confidence; big sells may mean caution is warranted.

- Identify recurring patterns. Some whales use similar strategies across cycles, learning their habits can pay dividends over time.

- Diversify your watchlist. Track different types of wallets: long-term hodlers, active swing traders, and experimenters alike.

Staying Ahead with Visual Crypto Wallet Tools

The crypto landscape moves fast, and so do the whales. With OKX Wallet’s robust analytics and visual tools for tracking clusters and inflows, retail investors now have access to insights that were once reserved for institutional players. Whether you’re aiming to catch the next wave or simply want to avoid getting caught in a dump, leveraging these features puts you on stronger footing in volatile markets.

If you’re ready to level up your trading strategy with smarter signals and sharper awareness of market movers, give the whale watching feature a try. The more you practice interpreting wallet flows and cluster behavior, the more intuitive spotting those “whale waves” will become, and that’s where real alpha lives!