In crypto, the question of who holds your keys is more than a technicality – it’s the foundation of your financial sovereignty. The battle between custodial vs non-custodial wallets shapes how you access, secure, and ultimately own your digital assets. The difference comes down to private key control: do you trust a third party, or do you take the reins yourself?

Custodial Wallets: Convenience with a Catch

Custodial wallets are managed by third-party services such as exchanges or fintech platforms. These providers store your private keys on your behalf, making crypto management feel as simple as using online banking. This ease is why many newcomers gravitate to custodial options – no need to worry about losing a seed phrase or navigating blockchain intricacies.

The trade-off? You are trusting someone else with your funds. If the custodian suffers a breach or fails operationally, your assets could be at risk. As Kraken points out, custodial wallets offer less control over security and privacy. Still, their popularity persists due to their user-friendly nature.

Non-Custodial Wallets: True Ownership, Total Responsibility

If you value autonomy above all, non-custodial wallets put you in full control of your private keys – and therefore your crypto. These wallets align with the core philosophy of decentralization. No one can freeze your funds or block transactions. But this power comes with significant responsibility: lose access to your keys or seed phrase and there’s no customer support safety net. Your assets are gone for good.

This heightened self-custody attracts seasoned users who prioritize security and privacy over convenience. As detailed in Crypto.com’s guide, non-custodial wallets are ideal for those who want direct access without intermediaries.

The Visual Guide: Custody at a Glance

The differences between these wallet types aren’t just theoretical – they have real-world implications for security, accessibility, and peace of mind. For a clear breakdown, check out this infographic by Haven Wallet, which visually maps out where control lies in each model.

Custodial vs Non-Custodial Wallets: Pros & Cons

-

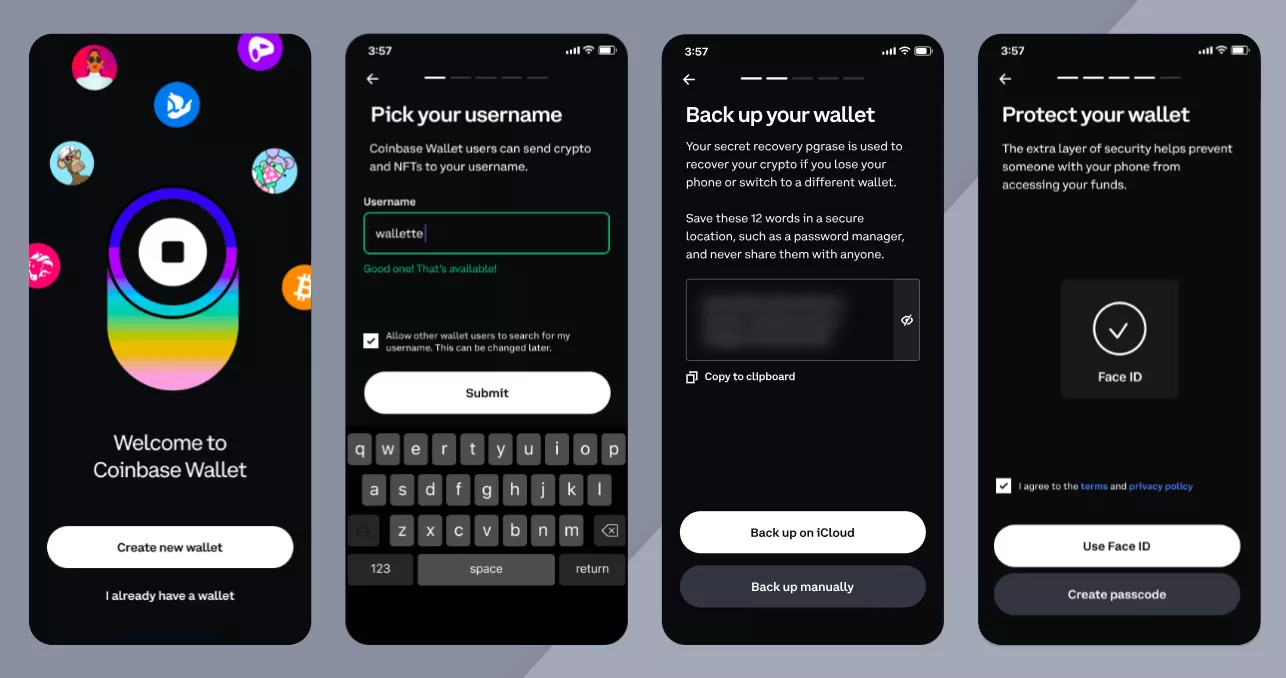

Custodial Wallets: Easy Recovery & User Support (e.g., Coinbase, Binance)Third-party providers manage your private keys, offering password recovery, customer support, and simplified onboarding—ideal for beginners.

-

Custodial Wallets: Reliance on Third-Party SecurityFunds are only as secure as the custodian. Users face risks from hacks, platform insolvency, or regulatory freezes beyond their control.

-

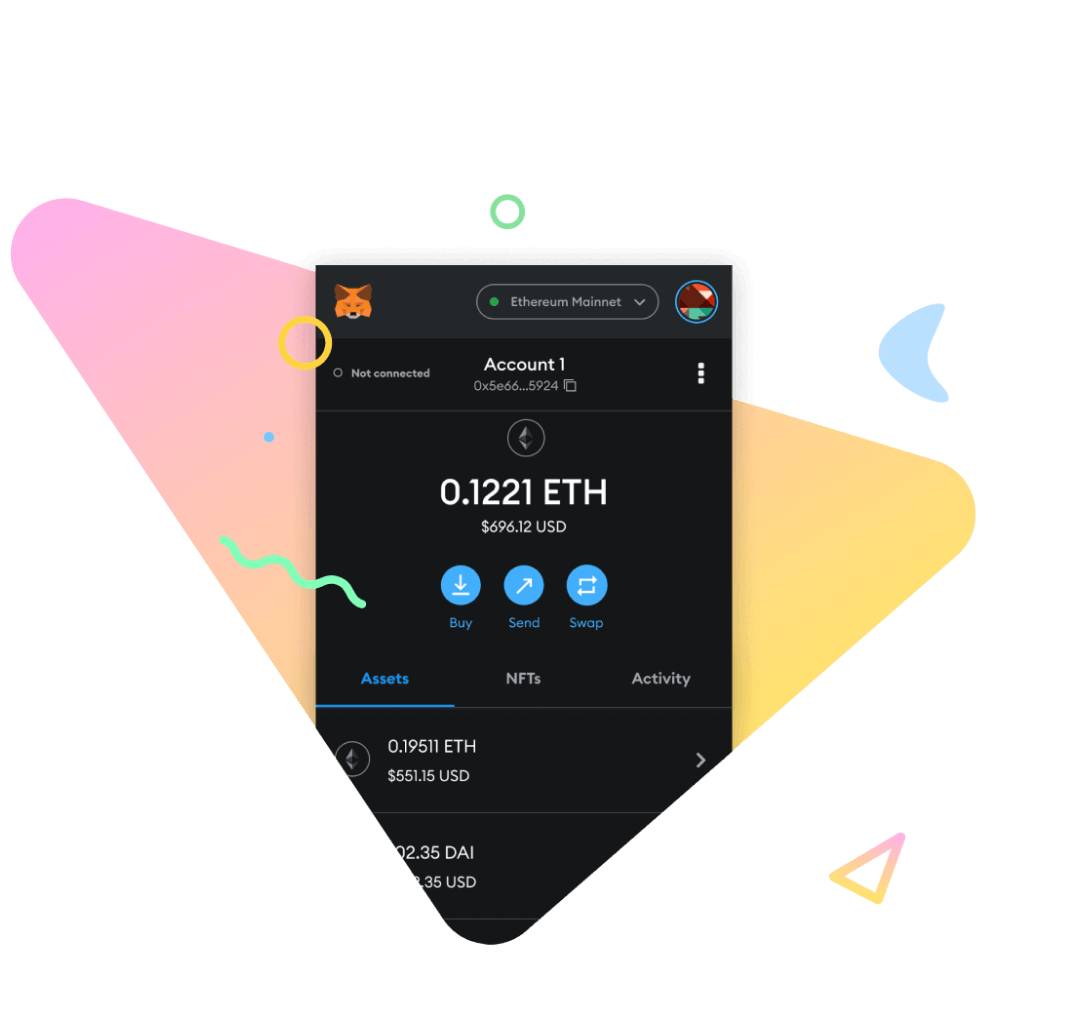

Non-Custodial Wallets: Full Control & Privacy (e.g., MetaMask, Trust Wallet)You alone hold the private keys, ensuring true ownership, enhanced privacy, and no intermediary access to your funds.

-

Non-Custodial Wallets: Sole Responsibility for SecurityIf you lose your private keys or seed phrase, your assets are irretrievable—there’s no recovery help or customer service.

Your choice boils down to how much trust you’re willing to place in yourself versus an institution – and how much risk you’re prepared to shoulder in pursuit of true crypto self-sovereignty.