Looking to turn your Bitcoin into cash or stablecoins without the hassle? Trust Wallet makes it surprisingly simple to sell your BTC, even if you’re new to crypto. With Bitcoin currently trading at $108,257 as of August 30,2025, knowing exactly how to sell at the right moment can make a big difference in your final payout. This guide will walk you through every step visually and practically – with no jargon or guesswork.

Why Sell Bitcoin Directly from Trust Wallet?

Trust Wallet isn’t just a place to store your coins – it’s a full-featured gateway for buying, selling, and swapping crypto assets. Selling BTC directly from the app means you can react fast to market swings like today’s -2.71% dip, all while keeping control of your private keys. No more sending funds off to centralized exchanges unless you want to cash out directly to fiat.

“The best time to sell is when you have a plan, not when the market panics. “

Bitcoin Holds Strong Above $100,000: What This Means for Sellers

The psychological milestone of $100,000 has become the new battleground for Bitcoin traders. With BTC bouncing between $107,492 and $111,277 in just 24 hours, timing your sale is everything. If you’re sitting on profits or want to minimize losses during this dip, Trust Wallet’s streamlined interface helps you move quickly.

Your Step-by-Step Visual Guide: How to Sell Bitcoin on Trust Wallet

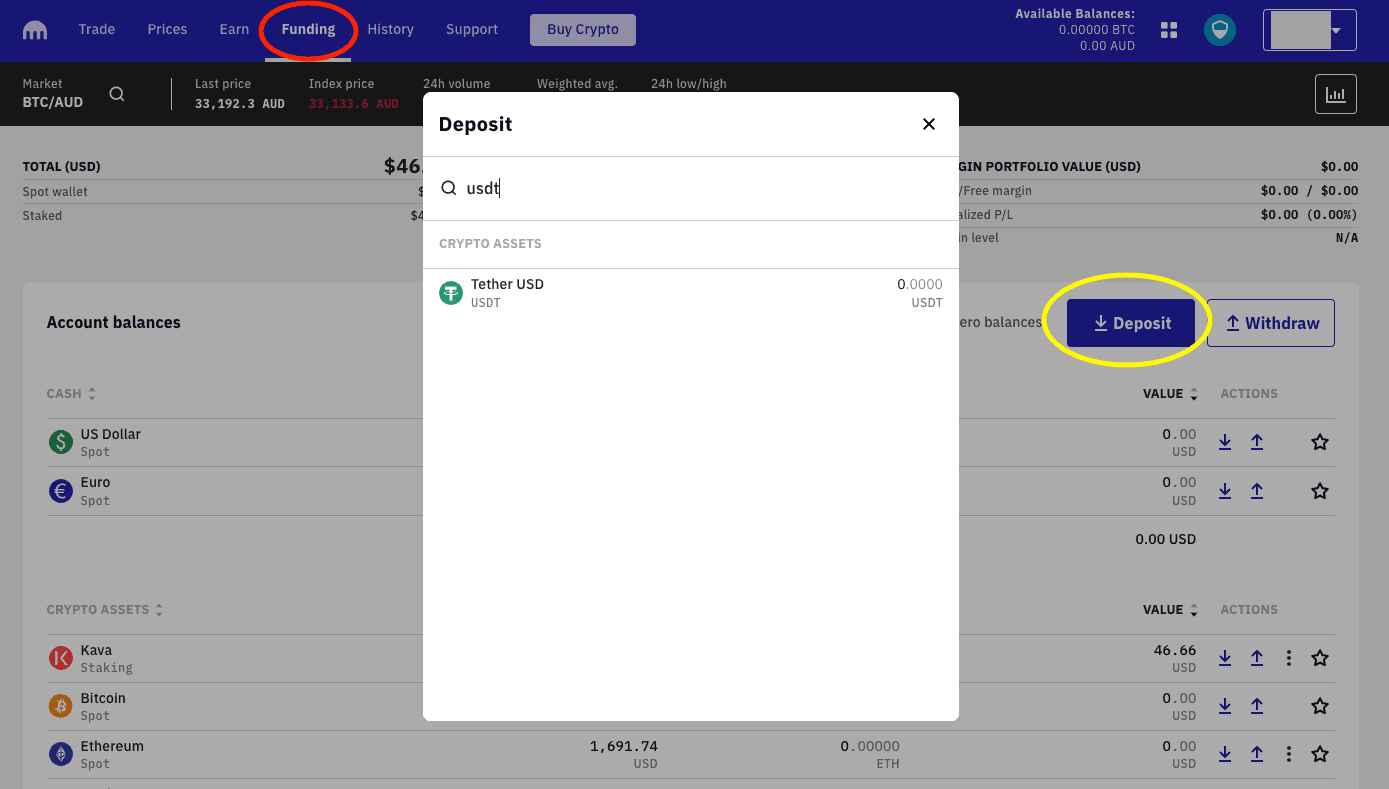

This process works whether you want cash in hand (via bank withdrawal) or plan to swap into stablecoins like USDT/USDC.

- Open Trust Wallet: Enter your credentials. Make sure your app is updated for the latest features.

- Select “Buy and Sell”: Find this option right on the home screen for easy access.

- Navigate to “Sell”: Tap over from “Buy” and select Bitcoin (BTC).

- Choose Your Amount: Decide how much BTC you want to sell at today’s price of $108,257. You can sell a fraction or all of it.

- Select Payout Method: Options may include bank transfer (fiat), stablecoins, or P2P sales depending on your region.

- If withdrawing fiat: You’ll typically be prompted for KYC verification if required by local laws.

- If swapping for stablecoins: The transaction happens instantly within the app – check network fees before confirming!

If you need more details about moving funds off-wallet or want tips on maximizing profits during volatile periods like today’s dip, see official resources such as How to Sell Crypto – Trust Wallet Support.

Bitcoin (BTC) Price Prediction 2026-2031

Short- and Medium-Term Outlook Based on 2025 Chart Patterns and Market Context

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $90,000 | $112,500 | $135,000 | +4% | Mild bull continuation, moderate volatility |

| 2027 | $82,000 | $120,000 | $155,000 | +6.7% | Halving after-effects, potential new all-time highs |

| 2028 | $100,000 | $140,000 | $180,000 | +16.7% | Strong adoption, institutional inflows |

| 2029 | $115,000 | $160,000 | $210,000 | +14.3% | Regulatory clarity, technology upgrades |

| 2030 | $130,000 | $185,000 | $250,000 | +15.6% | Mainstream integration, limited supply narrative |

| 2031 | $150,000 | $210,000 | $300,000 | +13.5% | Global macro acceptance, digital gold status |

Price Prediction Summary

Bitcoin is projected to see moderate growth in the short term (2026-2027) with some corrections, followed by accelerated gains from 2028 onward due to increasing adoption, institutional participation, and potential positive regulatory shifts. Maximum price scenarios reflect potential for new all-time highs, while minimum predictions account for possible market corrections or bearish macro trends. Progressive year-over-year growth is expected, with volatility remaining a defining feature of the asset class.

Key Factors Affecting Bitcoin Price

- Post-halving supply dynamics (2028) increasing scarcity and price pressure

- Continued global adoption as a store of value and payment medium

- Potential for regulatory clarity in major markets (US, EU, Asia)

- Institutional inflows and ETF-driven demand

- Ongoing development of Bitcoin scalability and Layer-2 solutions

- Macroeconomic factors: inflation, fiat devaluation, and geopolitical events

- Competition from other digital assets and evolving blockchain technologies

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Troubleshooting Common Issues When Selling BTC on Trust Wallet

Selling isn’t always smooth sailing! Network congestion can impact transaction times when volatility spikes around key price levels like $108K. Always double-check recipient addresses if transferring funds off-wallet and keep an eye out for phishing attempts masquerading as support requests.

One of the most common hiccups is delayed confirmations during high-volume selloffs. If your BTC transaction seems stuck, don’t panic. Bitcoin’s network can get congested when prices swing rapidly, like we’re seeing with today’s -2.71% drop. Usually, it just takes a bit more time for your sale to finalize. You can always track your transaction status directly in Trust Wallet or using a block explorer.

What to Do After Selling: Next Steps and Withdrawal Options

Once you’ve sold your BTC, what happens next depends on your payout choice:

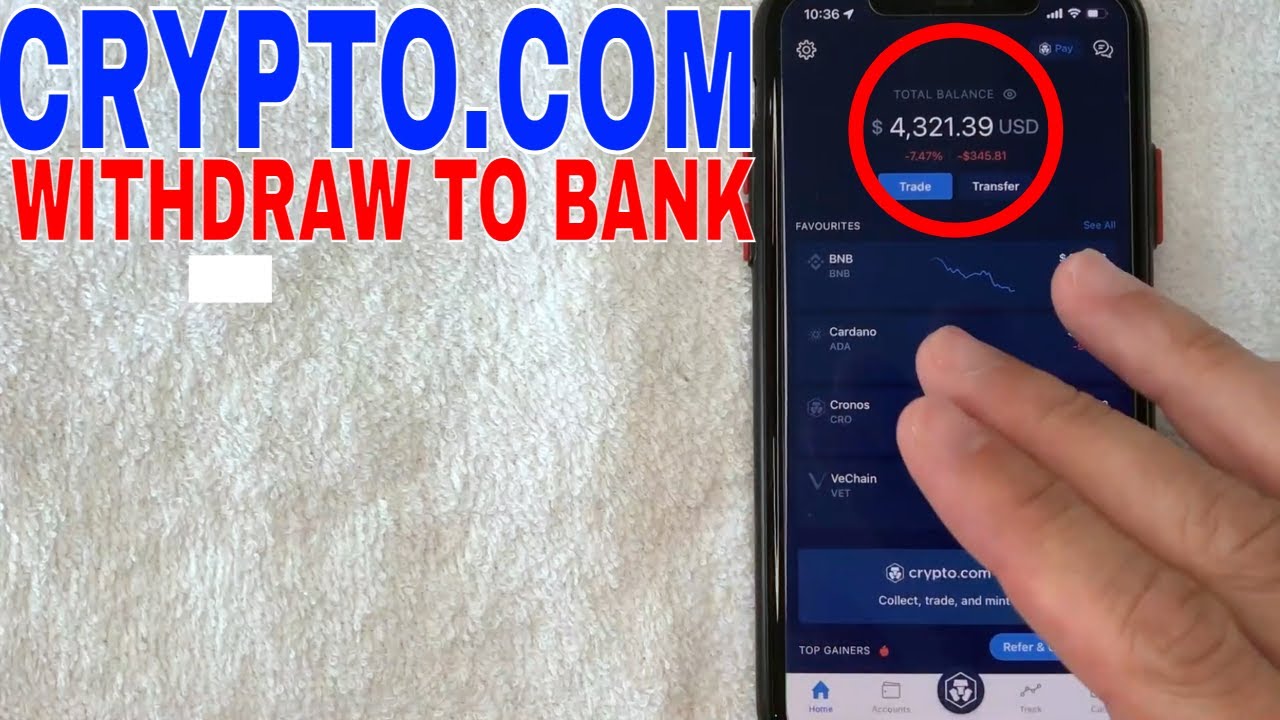

- Withdrawing to Bank (Fiat): If you opted for fiat withdrawal, follow the prompts to enter your bank details and complete KYC if needed. Processing times can vary by country and payment method.

- Swapping to Stablecoins: Your new USDT/USDC balance will show up instantly in Trust Wallet. From here, you can hold, swap into other coins, or transfer out as needed.

- P2P Sales: Always use reputable P2P partners and confirm payment receipt before releasing funds.

If you run into issues withdrawing funds or verifying your identity, check out this handy resource from Trust Wallet Support.

Top Mistakes to Avoid When Selling Bitcoin on Trust Wallet

-

Sending Bitcoin to the Wrong Address: Double-check the recipient exchange or wallet address before confirming your transfer. Transactions on the Bitcoin network are irreversible, and sending to the wrong address can result in a permanent loss of your funds.

-

Not Checking Current Bitcoin Price: Always verify the latest Bitcoin (BTC) price—currently $108,257—before selling. Market prices can fluctuate rapidly, so selling without checking may lead to unexpected losses or missed opportunities.

-

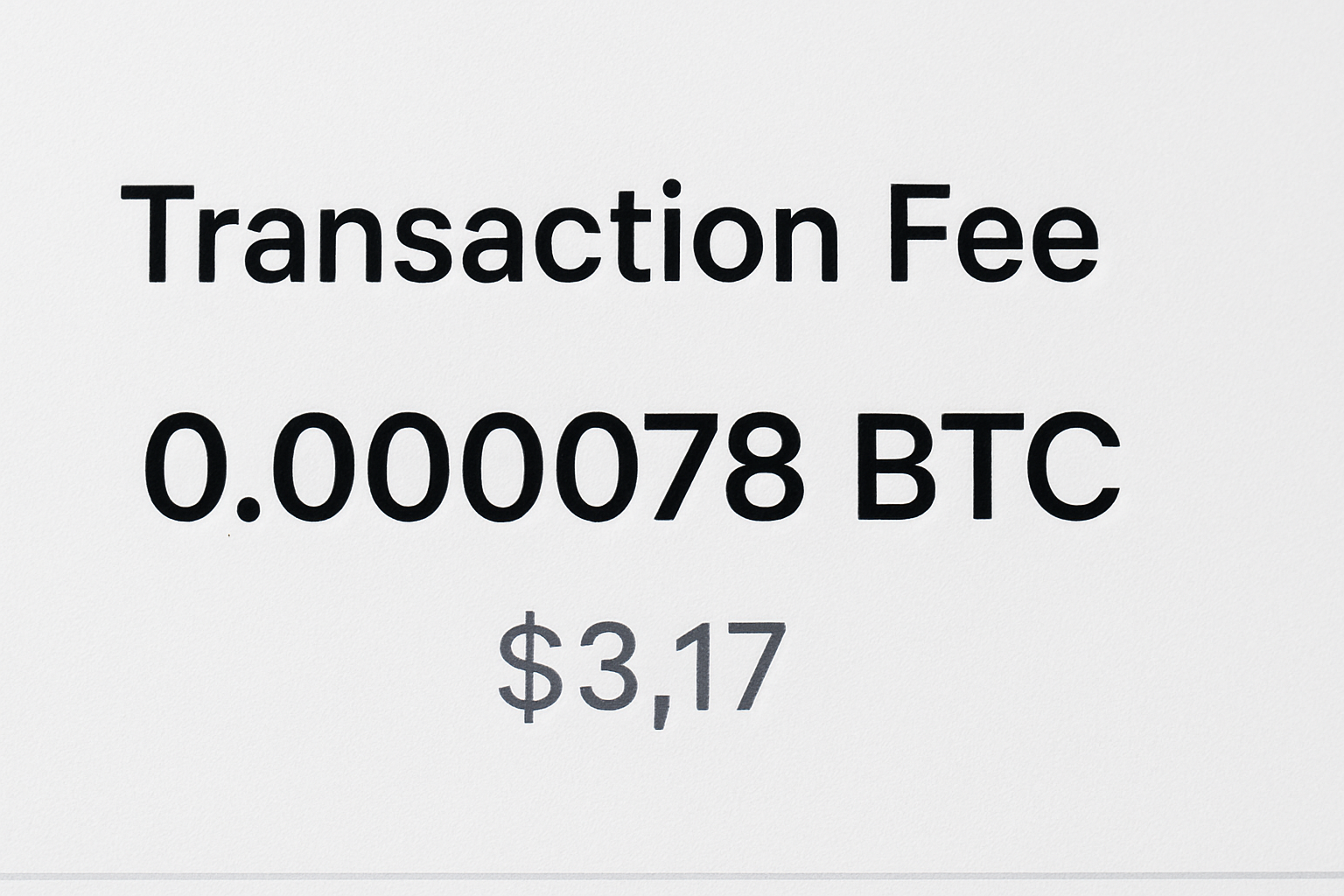

Ignoring Network Fees: Be aware of Bitcoin network fees when transferring to an exchange or another wallet. High fees can significantly reduce your final payout, especially during periods of network congestion.

-

Skipping KYC Requirements on Exchanges: Most major exchanges like Binance, Coinbase, or Kraken require identity verification (KYC) before you can sell crypto for fiat. Not completing KYC can delay your withdrawal or even block your sale.

-

Forgetting to Use the ‘Sell’ Tab in Trust Wallet: Trust Wallet now offers a Buy & Sell feature directly from the home screen. Make sure to use the ‘Sell’ tab for a smoother, more secure selling process, rather than sending funds manually without guidance.

-

Not Confirming Bank Withdrawal Details: When withdrawing fiat from an exchange to your bank, always double-check your bank account details. Incorrect information can cause delays or failed withdrawals.

-

Neglecting Security Best Practices: Always enable two-factor authentication (2FA) on both Trust Wallet and your exchange accounts. This helps protect your funds from unauthorized access during the selling process.

Tax Implications and Record-Keeping

Selling Bitcoin at these historic levels (over $108,000) could have significant tax consequences depending on where you live. Always keep a record of your transaction date, sale price, and method of withdrawal. Many users forget this step and scramble come tax season! If you’re unsure about local regulations or need help tracking sales for capital gains reporting, consider using crypto tax software or consulting a professional.

“Patterns tell the real story, but don’t let profits slip through the cracks because of paperwork. “

Final Thoughts: Selling BTC at $108K and Is Simple with Trust Wallet

The beauty of Trust Wallet is how it puts powerful tools right in your pocket, no matter if you’re cashing out after a moonshot rally or managing risk during a dip like today’s. With Bitcoin holding strong above $100K ($108,257 as of August 30,2025), knowing how to sell efficiently gives you an edge in fast-moving markets.

If you’re ready to take action or want more tips on maximizing your crypto journey with Trust Wallet, check out their official support channels and stay tuned for more guides here at Cryptowalletscompare.