Imagine sending digital dollars across the globe, instantly, with zero fees and no need to hold a blockchain’s native token. That’s the promise behind Plasma ($XPL), a Layer 1 network engineered for gasless stablecoin transfers. In a DeFi landscape where transaction costs often undermine the appeal of stablecoins for micro-payments and cross-border remittances, Plasma’s approach is more than just technical innovation, it’s a strategic leap toward mainstream adoption.

Plasma Chain: The Architecture Behind Gasless DeFi Payments

Plasma Chain isn’t just another blockchain vying for attention. It is purpose-built to solve a specific pain point: the friction of transaction fees in daily stablecoin usage. At its core, Plasma leverages a unique protocol-managed paymaster system that covers gas fees for eligible USD₮ (Tether) transfers. This means users can transfer value without needing to acquire or manage $XPL tokens just to send money.

Here’s how it works in practice:

- User Initiates Transfer: You select USD₮, enter the recipient’s address, and hit send.

- Eligibility Verification: To prevent abuse, Plasma uses lightweight identity verification (via zkEmail or zkPhone), ensuring only legitimate users access zero-fee transfers.

- Gas Fee Coverage: Upon successful verification, the protocol’s paymaster automatically covers all gas fees using its XPL reserves, no deduction from your transfer amount.

- Instant Settlement: Thanks to sub-second block times powered by PlasmaBFT consensus, funds arrive almost instantly.

This architecture doesn’t just cut costs, it removes barriers. Users unfamiliar with crypto wallets or native tokens can now experience seamless DeFi payments with familiar assets like USD₮.

$XPL Price Update and Tokenomics Snapshot

As of September 2025, Plasma ($XPL) trades at $1.40, reflecting both market volatility and growing interest as DeFi users seek alternatives to high-fee networks. Notably, while USD₮ transfers are fee-free for verified users, non-stablecoin transactions on Plasma still utilize a modified EIP-1559 burn mechanism, a model designed to balance network incentives with cost efficiency (source).

The ability to use whitelisted ERC-20 tokens (including BTC) as gas adds an additional layer of flexibility for both builders and end-users. This design choice positions Plasma as not just another L1 but as an ecosystem tailored for frictionless value transfer, and it is already seeing traction on platforms like OKX and Bitfinex.

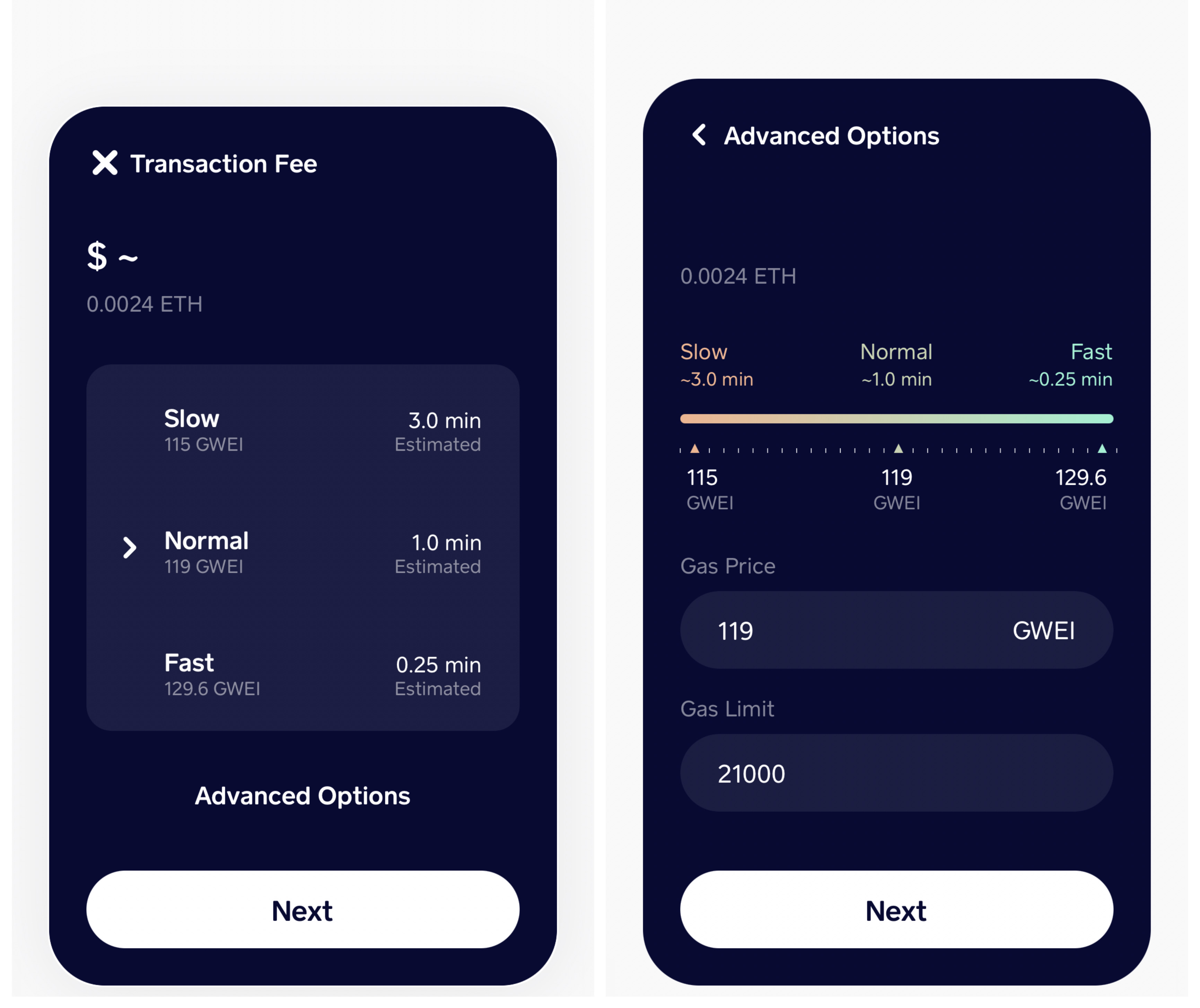

A Visual Walkthrough: How Gasless Stablecoin Transfers Work on Plasma

The user journey on Plasma is strikingly simple compared to legacy payment rails or even other blockchains:

This intuitive workflow eliminates two major hurdles: transaction costs and token juggling. For anyone accustomed to paying $5-$20 in gas on Ethereum or navigating multiple wallet assets just to move stablecoins, the difference is night and day.

The implications for global payments are significant. By making micro-transactions economically viable and reducing onboarding complexity, Plasma opens up new use cases, from remittances in emerging markets to real-time payroll and decentralized commerce, all without sacrificing speed or security (more details here).

Where Plasma stands out is its blend of user-centric design and technical rigor. The protocol’s use of zkEmail or zkPhone for eligibility checks is not just about spam prevention, but a pragmatic answer to regulatory and compliance expectations. This approach keeps the system open and permissionless, while still deterring abuse, a delicate balance that most DeFi protocols struggle to achieve.

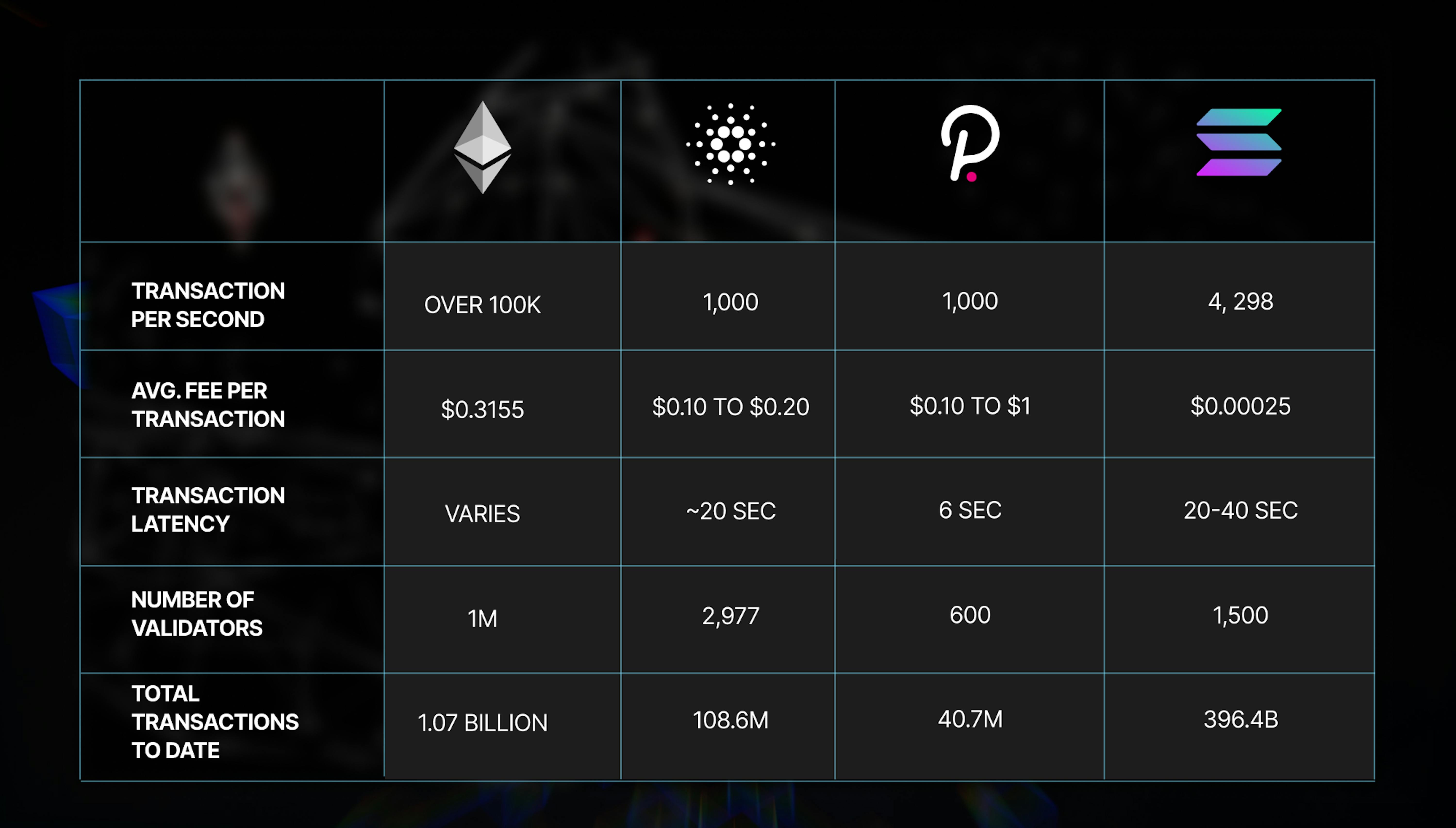

Plasma vs. Traditional Payment Systems: A Strategic Comparison

Let’s put Plasma’s model in context. Traditional payment networks like ACH and SWIFT impose settlement delays, intermediary risk, and significant fees, especially for cross-border transfers. Even established stablecoin networks on Ethereum or Solana often require users to pay gas in the native chain token, adding friction and cost.

Comparing Plasma Gasless Transfers vs. Ethereum, Solana, and ACH/Wire

-

Plasma Chain (XPL): Gasless Stablecoin TransfersPlasma enables zero-fee USD₮ (Tether) transfers using a protocol-managed paymaster that covers gas fees for eligible users. No need to hold XPL for stablecoin transactions. Features include sub-second settlement, high throughput (1,000+ TPS), and support for custom gas tokens.Current XPL Price: $1.40

-

Ethereum: Stablecoin Transfers with Gas FeesOn Ethereum, stablecoin transfers (e.g., USDT, USDC) require users to pay variable gas fees in ETH, which can be high and unpredictable, especially during network congestion. Settlement times typically range from seconds to minutes depending on network activity.

-

Solana: Low-Fee, Fast Stablecoin TransfersSolana offers low transaction fees (fractions of a cent) for stablecoin transfers and near-instant settlement (typically under a second). However, users must still hold SOL to pay for transaction fees, and network outages have occasionally affected reliability.

-

Traditional ACH/Wire Transfers: High Fees & DelaysACH and wire systems are slow (1–3 business days for ACH, same-day for wire) and often involve high fees (up to $30+ for wires, $1–$5 for ACH). Transfers are limited to banking hours and are not borderless or permissionless.

With Plasma at $1.40, network participants benefit from a robust tokenomics model that aligns incentives without taxing everyday users. The zero-fee transfer mechanism for USD₮ positions Plasma as a serious contender for mainstream money movement, not just speculative DeFi activity.

Wallet Integration and Ecosystem Growth

Plasma’s architecture is designed for wallet integration and seamless onboarding. Leading crypto wallets are already exploring direct DeFi integrations with the protocol, leveraging its custom gas token support to onboard users who may never touch $XPL directly. This opens the door for fintech apps to move stablecoins globally, at scale, without worrying about gas abstraction or UX hurdles.

The protocol’s confidential payments module also enables shielded transfers, hiding metadata while preserving transaction verifiability, a feature that could prove critical as privacy regulations evolve (see technical docs).

Risks and Strategic Considerations: What Could Hinder Adoption?

No system is without risks. For Plasma, the sustainability of zero-fee transfers depends on continued paymaster funding and careful management of spam/abuse vectors via identity verification. If XPL price ($1.40) fluctuates significantly or if paymaster reserves are depleted faster than replenished through network incentives, fee-free transfers could become unsustainable in the long run.

There are also broader questions around regulatory clarity for stablecoin-centric platforms; however, Plasma’s modular design allows it to adapt quickly as policy landscapes shift.

The real test will be whether users value frictionless payments enough to migrate from legacy rails, and whether wallets can abstract away complexity without sacrificing security or compliance.

The Future of DeFi Payments: Why Plasma Matters Now

As DeFi matures and traditional finance experiments with blockchain rails, solutions like Plasma set a new standard for what digital payments can be: instant, borderless, user-friendly, and critically, free from hidden costs that have long plagued both crypto and fiat systems.

If you’re evaluating platforms for global remittances or embedded finance applications, a close look at Plasma ($XPL) is warranted. Its current price of $1.40, combined with unique features like zero-fee USD₮ transfers and flexible gas options, makes it one of the most strategically interesting L1s in today’s market landscape (learn more here). The next wave of wallet integrations will tell us just how far this frictionless future can go.

![A confirmation screen with a checkmark, showing 'USD₮ Received: [full amount]', with a fast-moving digital network background.](https://b3-contents.b3.fun/c618902b-8d84-4759-ace3-569528767167-transaction-processing-and-confirmation.png?w=640&h=640)