Crypto airdrops have become the new battleground for wallet providers looking to entice and reward users. In 2025, two giants stand out in the crowd: OKX and Binance. But when it comes to the real-world experience of claiming, receiving, and maximizing airdrops, which platform truly delivers? Let’s dig into the nuances of the OKX vs Binance airdrop comparison for crypto wallet users who want more than just hype, they want results.

How Do Binance and OKX Approach Airdrops?

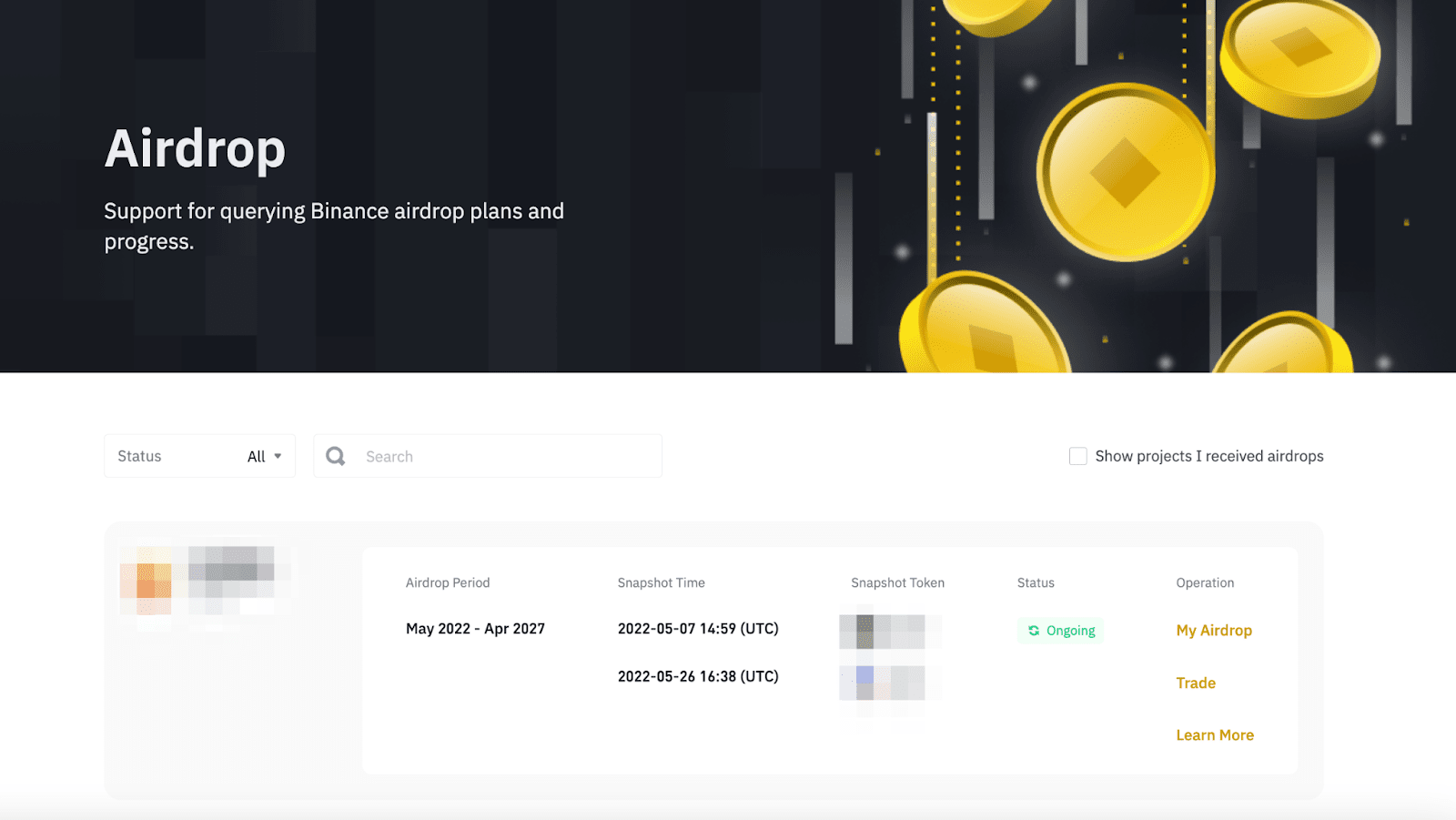

If you’ve spent any time chasing airdrop rewards, you know not all platforms are created equal. Binance has carved out a reputation for major, headline-grabbing events like its 28th HODLer Airdrop in July 2025. During this event, Binance distributed 20 million Chainbase (C) tokens directly to BNB holders, no forms, no jumping through hoops. Eligible users woke up to free tokens in their wallets, thanks to an automated retroactive distribution model. This frictionless experience is a big deal for anyone tired of convoluted claim processes.

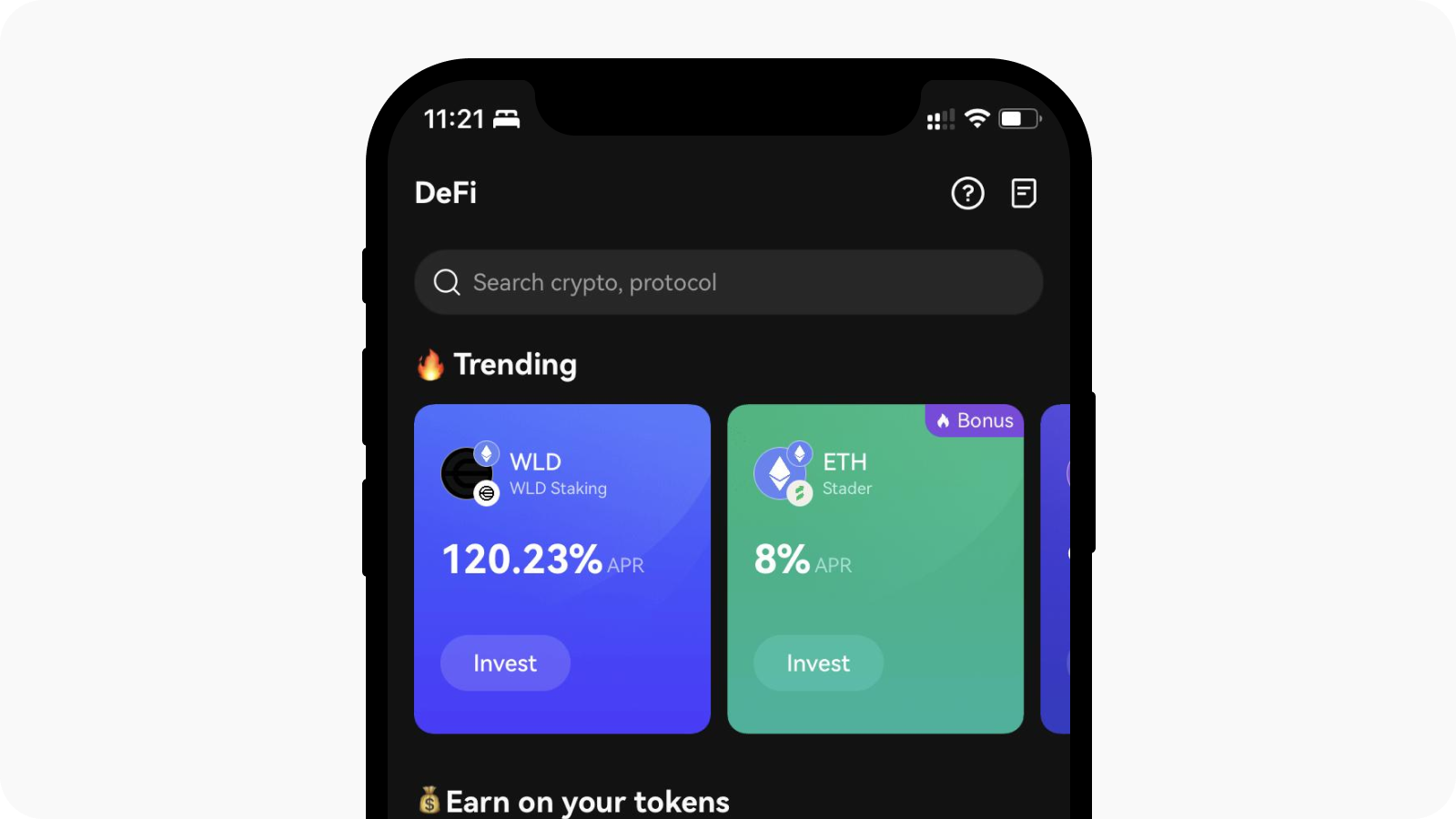

OKX, on the other hand, takes a slightly different route. While details about frequency or scale aren’t always front-and-center, OKX does offer its own flavor of rewards through features like Jumpstart. Here, users can access early-stage projects and participate in token sales, sometimes with exclusive airdrop perks. However, these tend to require more active engagement from users compared to Binance’s hands-off model.

User Experience: Simplicity or Engagement?

The core difference between these platforms boils down to user experience. Want a set-it-and-forget-it approach? Binance’s retroactive drops mean you may be rewarded just for holding eligible assets at the right time, no manual claims necessary. This is particularly attractive for casual investors or those new to crypto wallet onboarding rewards.

If you’re an active user who enjoys diving into new projects early and participating in community-driven campaigns, OKX’s Jumpstart may be more your speed. While it requires more effort, staking tokens or completing tasks, the flipside is often access to promising projects before they hit wider markets. The trade-off? Not every user will qualify automatically; some opportunities demand attention and action.

Key Differences in Binance vs OKX Airdrop Experiences

-

Frequency & Scale: Binance runs airdrops more frequently and on a larger scale—such as the July 2025 Chainbase (C) airdrop, which distributed 20 million tokens to BNB holders—while OKX airdrops are less frequent and typically smaller in scope.

-

User Accessibility: Binance offers retroactive airdrops that are automatically credited to eligible users, making participation effortless. OKX may require more active engagement or manual claiming for some airdrops.

-

Platform Features: Binance enhances the airdrop experience with Launchpad and Launchpool, letting users engage with new tokens and projects. OKX provides similar opportunities via OKX Jumpstart, which focuses on early-stage investments and token launches.

-

User Experience: Binance prioritizes simplicity by minimizing user actions required for airdrop eligibility, while OKX often ties airdrop access to participation in specific platform activities, such as Jumpstart events.

-

Transparency & Communication: Binance publicly announces airdrop details and eligibility criteria in advance, fostering trust and clarity. OKX‘s airdrop communications are less prominent and may require users to seek out information.

The Frequency and Scale Factor

No one likes missing out on free tokens simply because they didn’t check their app at the right moment. Here’s where frequency matters, and according to recent data, Binance leads the pack. Their regular schedule of large-scale events ensures that BNB holders have multiple chances throughout the year to benefit from major token distributions like Chainbase (C).

OKX’s approach is less predictable but potentially more lucrative for power users willing to engage deeply with their ecosystem. The platform prioritizes quality over quantity by focusing on curated project launches rather than frequent mass distributions. It’s less about constant rain and more about targeted showers, if you’re paying close attention.

For many users, the ideal crypto wallet airdrop experience is about more than just quantity or frequency. It’s about seamless onboarding, transparency, and the feeling that you’re not missing out because of confusing eligibility rules or clunky interfaces. Binance’s automated, retroactive model is a breath of fresh air for those who want to “set it and forget it, ” especially when compared to the more involved processes sometimes required by OKX’s Jumpstart or Airdrop Earn events.

Which Platform Is Right for You?

Your choice between OKX and Binance will likely come down to your personal style as an investor or collector. If you value simplicity, automation, and frequent rewards, Binance has crafted a system that rewards loyalty with minimal effort. Their recent Chainbase (C) token drop is a textbook example of how big exchanges can use scale to remove friction for users.

On the flip side, if you see yourself as an early adopter who enjoys discovering new projects before they go mainstream, and don’t mind staking tokens or completing tasks, OKX’s ecosystem might offer more upside. The platform’s approach favors those willing to put in some legwork for potentially higher rewards, particularly through unique projects on Jumpstart.

Pros & Cons: Binance vs OKX Airdrop Models

-

Binance: Frequent, Large-Scale AirdropsBinance regularly hosts high-profile airdrop events, such as the July 2025 Chainbase (C) airdrop, where 20 million tokens were distributed to BNB holders. This consistent activity means users have more opportunities to benefit from new projects and rewards.

-

OKX: Selective Airdrop OpportunitiesOKX offers airdrops primarily through its Jumpstart platform, focusing on early-stage projects. While these can be valuable, airdrops on OKX are generally less frequent and not as widely publicized as Binance’s, potentially limiting user exposure.

-

Binance: Effortless User ParticipationBinance often uses a retroactive airdrop model, automatically crediting eligible users without requiring extra steps. This streamlined approach makes it easy for users to participate and ensures broader distribution.

-

OKX: Early Access to New ProjectsThrough Jumpstart, OKX users can gain early investment access to promising tokens, which can sometimes include airdrop allocations. This appeals to users looking for high-growth opportunities, but may require more active participation.

-

Binance: User-Friendly ExperienceBinance’s airdrop process is generally simple and transparent, with clear eligibility criteria and automatic distribution. This enhances user trust and engagement compared to more manual or opaque processes.

-

OKX: Advanced Web3 Wallet IntegrationOKX provides a robust Web3 wallet that supports airdrop participation and management, appealing to users interested in decentralized finance and self-custody.

Beyond Airdrops: Wallet Ecosystem Perks

It’s also worth looking at what each platform offers outside direct airdrops. Binance Launchpad and Launchpool give users additional ways to earn new tokens, sometimes even before official listings, while keeping things streamlined within the same ecosystem. This multi-channel approach means passive users can still benefit from holding assets on Binance without constantly monitoring announcements.

OKX shines in other areas too: its built-in Web3 wallet supports advanced DeFi features and NFT integration, which appeals to users who want all-in-one functionality beyond just trading or collecting drops. While this doesn’t always translate into more frequent airdrops, it does create a richer set of tools for power users who want flexibility.

What Real Users Are Saying

The community verdict is split but insightful. Many casual users praise Binance for its reliability and ease, the retroactive drops feel like “free money” for simply being loyal holders. Meanwhile, some advanced traders prefer OKX because it feels like being part of an exclusive club where early action can lead to outsized gains.

The bottom line? There’s no one-size-fits-all answer in the wallet onboarding rewards race. Your best bet is to match your activity level and goals with each platform’s strengths, and maybe even use both wallets to maximize opportunities as they arise.