Trading perpetual contracts (or “perps”) on mobile is now possible directly through MetaMask, one of the world’s most popular self-custodial crypto wallets. With the introduction of MetaMask Perps, users can access over 150 markets with up to 40x leverage, all from the convenience of their phones. This step-by-step guide will walk you through each part of the process using the latest features in MetaMask Mobile (version 7.56 or later), so you can confidently open, manage, and close positions while keeping risk in check.

MetaMask Mobile Perpetuals: What You Need to Know

Before diving into trading, it’s essential to understand a few key points:

- Regional Restrictions: Perpetual trading is not available in certain regions, including the USA, UK, Ontario (Canada), Belgium, and countries on the US sanctions list. Always check your eligibility before proceeding.

- Risk Management: Trading with leverage amplifies both potential gains and losses. Make sure you understand how leverage works and set clear risk parameters for every trade. For further reading on this topic, see MetaMask’s official guide on leverage and liquidation.

Step-by-Step: How to Trade Perpetuals on MetaMask Mobile

This guide specifically covers these steps:

- Open MetaMask Mobile and Navigate to the Perps Tab

- Fund Your Perpetuals Account with Supported Tokens

- Select the Trading Pair and Market (Long/Short)

- Set Leverage and Enter Order Details (Amount, Price, Type)

- Review, Confirm, and Execute Your Trade

- Monitor Open Positions and Manage Risk (Stop Loss/Take Profit)

Navigating to Perpetual Trading in MetaMask Mobile

The first step is making sure your app is updated to version 7.56 or newer. Once updated:

- Open MetaMask Mobile and Navigate to the Perps Tab:

Launch your app and look for the new ‘Perps’ tab right on your home screen. Tap it – this is where all perpetual trading activity happens.

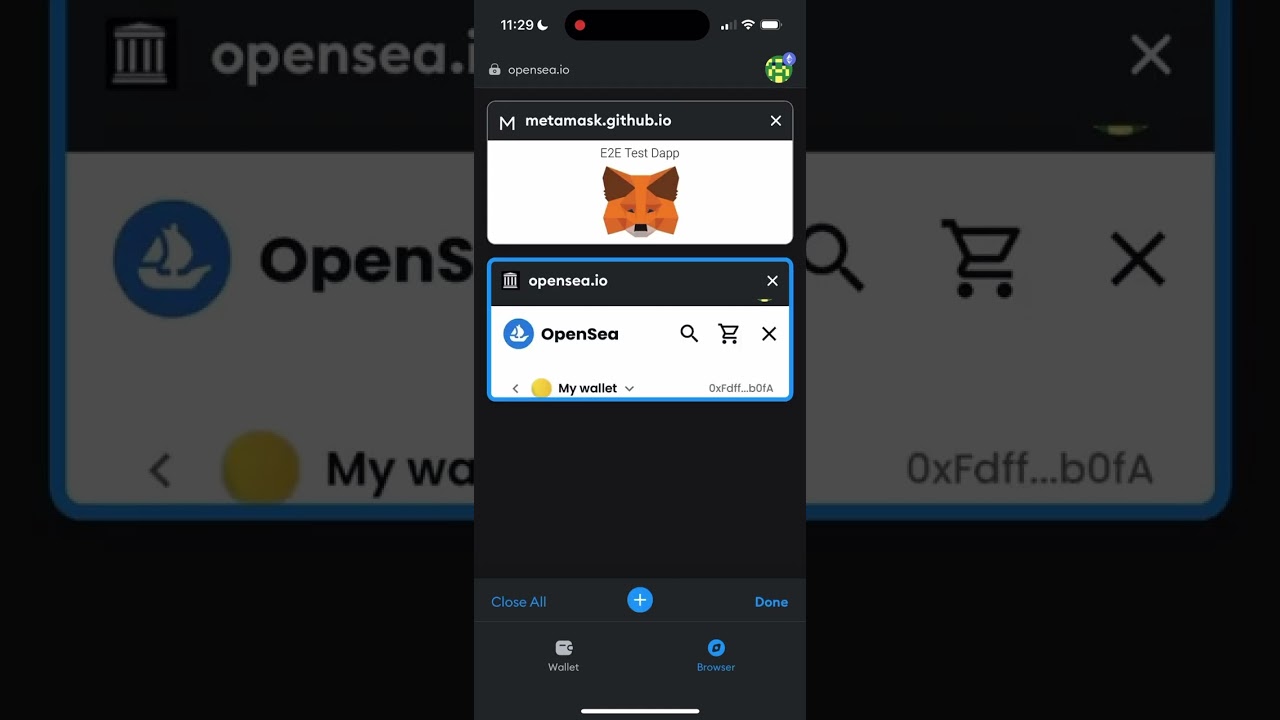

This streamlined integration means you no longer need third-party dApps or complicated wallet connections; everything happens inside your existing wallet interface.

Ethereum Technical Analysis Chart

Analysis by Jenna Holbrook | Symbol: BINANCE:ETHUSDT | Interval: 1W | Drawings: 7

Technical Analysis Summary

Start by drawing a horizontal line at the current price ($3,802.27) to anchor your analysis. Draw horizontal lines at $3,200 (moderate support), $2,400 (strong support), and $4,800 (strong resistance). Add a downtrend line connecting the recent high near $4,800 (late Q3 2025) to the current price for short-term trend context. Highlight the sharp correction from $4,800 to $3,800 as a recent distribution zone. Use rectangles to mark periods of consolidation between $2,400 to $3,200 (early-to-mid 2025). Annotate the recent large red candle with a callout noting the heightened volatility. If volume and MACD are available, note the momentum and signal cross, marking them with appropriate arrows or text. Mark July 2025 as a special event with a vertical line and callout, as this marks the top and subsequent sharp reversal.

Risk Assessment : medium

Analysis : The sharp correction from $4 ,800 to $3 ,800 , coupled with increased retail leverage from the MetaMask perps launch , raises near-term volatility and downside risk . However , strong supports remain below , and fundamentals are unchanged .

Jenna Holbrook ‘s Recommendation : Wait for signs of stabilization and accumulation near key supports before considering new long positions . Focus on capital preservation and avoid high leverage in this environment .

Key Support & Resistance Levels

📈 Support Levels :

- $3 ,200 – Moderate support from prior consolidation and reaction lows in the first half of2025.moderate

- $2 ,400 – Strong support , tested multiple times in2024–2025 period.strong

📉 Resistance Levels :

- $4 ,800 – Recent peak and strong resistance , tested in late Q32025.strong

- $4 ,000 – Psychological and technical resistance just above current price.moderate

Funding Your Perpetuals Account with Supported Tokens

You’ll need a dedicated balance for perps trading inside your wallet – separate from your main account balance. Here’s how it works:

- Fund Your Perpetuals Account with Supported Tokens:

Tap ‘Start trading’ then ‘Add funds. ’ You can deposit any EVM-compatible token such as ETH, BNB, or USDT; it will be automatically converted into USDC for use in perps trading.

The minimum deposit amount is $10 (in equivalent value). Confirm your transaction when prompted by following the app’s instructions.

This seamless conversion reduces friction for users holding different assets but wanting to participate in perps markets quickly.

Selecting Your Market: Long vs Short Trading Pairs

The next critical choice involves deciding which asset you want to trade – and whether you believe its price will rise or fall:

- Select the Trading Pair and Market (Long/Short):

In the ‘Perps’ tab, browse available contracts covering over 150 tokens.

– Choose “Long” if you anticipate price appreciation.

– Choose “Short” if you expect a decline in price.

This flexibility allows traders to profit from both bullish and bearish market conditions directly within their mobile wallet.

If you’re new to long vs short strategies or want a refresher before placing trades, check out MetaMask’s educational resources about what perpetual trading is.

Fine-Tune Your Trade: Leverage, Order Details, and Execution

- Set Leverage and Enter Order Details (Amount, Price, Type):

After selecting your trading pair and market direction, it’s time to customize your position. Use the slider to set your preferred leverage, MetaMask Mobile supports up to 40x leverage for some tokens. Remember: higher leverage magnifies both potential profit and risk.Next, enter the amount you want to trade. You can also choose the order type (market or limit) and specify a price if needed. Double-check all details before proceeding, as these choices directly impact your risk exposure and liquidation threshold.

If you’re unsure about optimal leverage or order types for your strategy, review MetaMask’s official guidance on leverage and liquidation.

Final Steps: Reviewing and Executing Your Perpetual Trade

- Review, Confirm, and Execute Your Trade:

Before hitting the final confirmation button, take a moment to review every parameter: trading pair, direction (long or short), order size, leverage level, and any stop loss/take profit settings you’ve added. MetaMask will show an estimated liquidation price based on your chosen leverage, pay close attention here.Once satisfied with all details, tap “Confirm” to execute the trade. The app will process your transaction almost instantly thanks to its integration with Hyperliquid’s backend.

This streamlined process is designed for both new and experienced traders seeking speed without sacrificing control.

Checklist Before Confirming a Perpetuals Trade on MetaMask Mobile

-

Open MetaMask Mobile and Navigate to the Perps TabEnsure your MetaMask mobile app is updated to version 7.56 or later. Open the app, and tap the Perps tab on the home screen to access perpetuals trading. Confirm that you are in a permitted jurisdiction (not the USA, UK, Ontario, Belgium, or sanctioned countries).

-

Fund Your Perpetuals Account with Supported TokensTap Start trading and then Add funds. Deposit any supported EVM token (e.g., ETH, BNB, USDT); it will be automatically converted to USDC for trading. The minimum deposit is $10. Double-check your wallet balance and ensure sufficient funds for the deposit and gas fees.

-

Select the Trading Pair and Market (Long/Short)Choose from over 150 available tokens powered by Hyperliquid. Select your desired trading pair, then decide whether to go Long (anticipate price increase) or Short (anticipate price decrease). Verify you have selected the correct token and market direction before proceeding.

-

Set Leverage and Enter Order Details (Amount, Price, Type)Adjust your leverage (up to 40x, depending on the token), and enter the order size, price, and order type (market or limit). Remember: higher leverage increases both potential gains and risk of liquidation. Double-check all order parameters for accuracy.

-

Review, Confirm, and Execute Your TradeCarefully review all trade details, including position size, leverage, entry price, and fees. Confirm your understanding of the risks, especially with leveraged positions. Once satisfied, execute your trade and wait for confirmation.

-

Monitor Open Positions and Manage Risk (Stop Loss/Take Profit)After executing your trade, monitor your open positions in the Perps tab. Set stop-loss and take-profit levels to manage risk. Regularly review your positions and be prepared to adjust or close them based on market conditions.

Active Position Management: Monitoring and Managing Risk in Real Time

- Monitor Open Positions and Manage Risk (Stop Loss/Take Profit):

All open positions are visible in the ‘Perps’ tab. Here you can track real-time P and L (profit and loss), current margin ratio, funding rates, and more. It’s crucial to actively manage each position by setting stop-losses (to cap downside) and take-profits (to lock in gains).Adjust these parameters anytime as market conditions evolve. If volatility spikes or news breaks that changes your outlook, don’t hesitate to update your risk controls accordingly.

If you wish to close a position manually before it hits stop-loss or take-profit levels:

- Select the open position from your list.

- Tap ‘Close position’ and confirm.

Withdrawing funds back into your main wallet is just as simple, tap ‘Available balance’ then ‘Withdraw funds, ’ enter the amount you want out, and confirm.

Your Next Steps With MetaMask Perpetuals Trading

The ability to trade perpetual contracts across 150 and tokens, directly from MetaMask Mobile, represents a significant leap for decentralized finance accessibility. Whether you’re aiming for short-term speculation or hedging longer-term positions against market moves, this new feature puts advanced tools at your fingertips without leaving the wallet ecosystem.

If you’re ready to dive deeper into perpetuals concepts or want more detail about how funding rates work behind the scenes, take advantage of official resources like MetaMask’s What is Perpetual Trading?.

The key takeaway? Prioritize risk management at every stage, from funding through execution, and stay disciplined with stop-losses no matter how confident you feel about market direction. In volatile crypto markets, patience is always an investor’s greatest ally.