In a crypto landscape where trust is hard-earned and easily lost, OKX proof of reserves stands out as a model for transparency. While many exchanges talk about safety and user protection, OKX consistently delivers data-backed evidence that users’ assets are fully accounted for. With its 28th consecutive Proof of Reserves (PoR) report released in February 2025, OKX showcased $28.1 billion in primary assets, a staggering 59% year-on-year increase. This isn’t just marketing; it’s a clear signal to anyone seeking the best transparent crypto wallets that OKX is leading the charge.

Why Proof of Reserves Matters for Crypto Wallet Transparency

The collapse of several high-profile exchanges in recent years has made one thing clear: transparency is non-negotiable. Proof of reserves is the industry’s answer to this demand. By publishing regular, independently-audited reports, exchanges allow users to verify crypto reserves and confirm that every deposited asset is actually held on-chain.

The process typically involves comparing on-chain wallet balances with user liabilities derived from a Merkle root, a cryptographic fingerprint representing all customer balances without exposing private details. OKX takes this further by integrating Zero-Knowledge Scalable Transparent Argument of Knowledge (zk-STARK) technology, letting users verify exchange solvency while maintaining privacy. The result? A system where trust isn’t just promised; it’s mathematically proven.

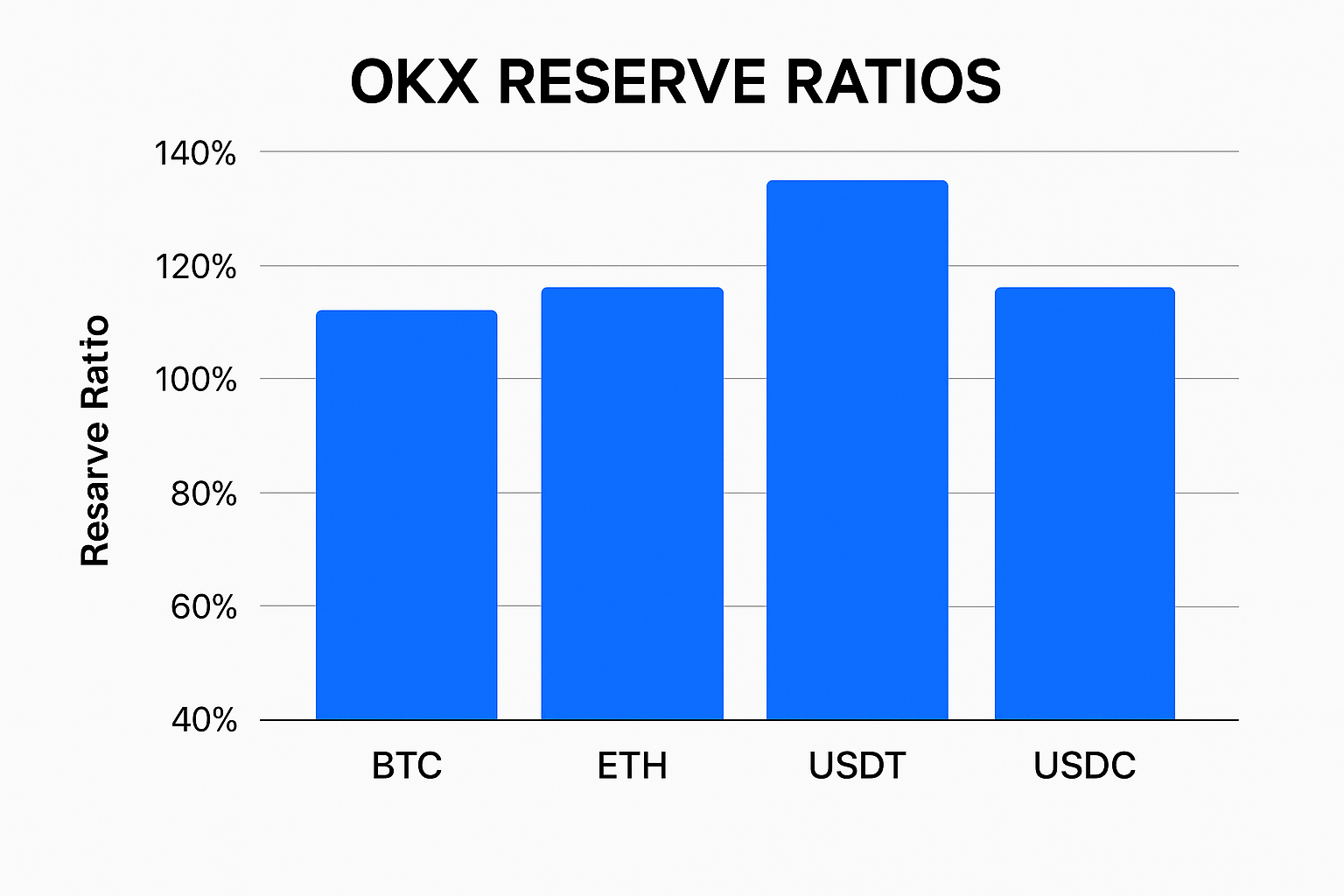

OKX’s Reserve Ratios: Setting the Standard for 1: 1 Asset Backing

The numbers speak volumes about OKX’s approach to crypto wallet transparency. According to their latest audited PoR report:

- BTC: 104% reserve ratio

- ETH: 102% reserve ratio

- USDT: 102% reserve ratio

- USDC: 100% reserve ratio

This means OKX holds more than enough assets on-chain to cover all user balances for these leading cryptocurrencies, surpassing the industry gold standard of 1: 1 asset backing. For users, this provides peace of mind that their funds are not being lent out or rehypothecated behind closed doors.

Top Reasons Traders Trust OKX’s Proof of Reserves

-

Consistent, Transparent Reporting: OKX has published 28 consecutive Proof of Reserves reports, providing ongoing, verifiable transparency about its on-chain holdings and customer asset backing.

-

High Reserve Ratios Across Major Assets: The latest report confirms reserve ratios of 104% for BTC, 102% for ETH, 102% for USDT, and 100% for USDC, all exceeding the industry standard 1:1 ratio.

-

Independent Auditing by Blockchain Security Experts: OKX’s PoR is audited by Hacken, a reputable blockchain security firm, ensuring third-party verification of its asset claims.

-

Advanced Zero-Knowledge Proof Technology: By leveraging zk-STARK cryptography, OKX allows users to verify solvency without exposing sensitive account information, combining transparency with privacy.

-

Robust Security and Insurance Measures: Beyond PoR, OKX protects users with a multi-billion-dollar insurance fund, AI-powered security tools, and educational resources like OKX Protect.

The Technology Behind Verifiable Transparency at OKX

Diving deeper into how OKX achieves such high standards reveals a blend of advanced cryptography and operational discipline. Their use of zk-STARKs ensures every user can independently confirm that their balance is included in total liabilities, without exposing sensitive account info or risking doxxing.

This approach not only reassures retail investors but also attracts institutional players who demand rigorous verification before entrusting large sums to an exchange. The monthly cadence and public availability of these reports mean there are no surprises, just clear, auditable data available for scrutiny by anyone at any time.

OKX’s focus on verifiable transparency doesn’t stop at cryptographic proofs. The exchange partners with leading blockchain security firms like Hacken to audit each Proof of Reserves report. This third-party validation adds another layer of credibility, ensuring that the numbers presented are not just internally verified but externally scrutinized as well. The result is a system where users and institutional clients alike can confidently verify crypto reserves in real time.

Beyond the numbers, OKX has built a robust ecosystem around its transparency initiatives. The introduction of OKX Protect, an educational and security resource hub, empowers users to understand not just how their assets are stored, but also how to safeguard their personal security. The exchange has also implemented AI-powered monitoring tools and maintains a multi-billion-dollar insurance fund, further reinforcing user protection and operational resilience.

How to Independently Verify OKX’s Proof of Reserves

One of the standout features of OKX’s PoR program is the ability for users to independently verify their assets. Here’s a simplified walkthrough:

This process, enabled by zk-STARK technology, means you don’t have to blindly trust the exchange, you can check the math yourself, without revealing your identity or balances to anyone else.

Why This Matters for the Future of Crypto Exchanges

OKX’s proactive approach is already influencing industry standards. As more exchanges face pressure to prove solvency, the demand for transparent, user-verifiable systems will only grow. Exchanges that fail to adopt similar practices risk losing credibility, and ultimately, users, to those that prioritize transparency and 1: 1 asset backing.

For traders and investors seeking the best transparent crypto wallets, OKX’s model offers a clear blueprint: regular, audited reports; advanced privacy-preserving technology; and a commitment to operational openness. These aren’t just buzzwords, they’re practical safeguards that protect your assets in a volatile market.

What Makes OKX a Leader in Wallet Transparency

-

Consistent Proof of Reserves Reports: OKX has published 28 consecutive Proof of Reserves (PoR) reports, allowing users to verify the exchange’s solvency on a monthly basis.

-

High Reserve Ratios Across Major Assets: The latest PoR confirms OKX holds 104% BTC, 102% ETH, 102% USDT, and 100% USDC in reserves, exceeding the industry standard 1:1 ratio.

-

Independent Audits by Blockchain Security Firms: OKX’s PoR is audited by Hacken, a respected blockchain security firm, adding an extra layer of trust and credibility.

-

Advanced Zero-Knowledge Proof Technology: OKX uses zk-STARKs to let users independently verify reserves without exposing personal data, balancing transparency and privacy.

-

Publicly Accessible On-Chain Wallets: OKX’s on-chain wallet addresses are viewable by anyone, enabling real-time, independent verification of assets held.

-

Comprehensive Security and Insurance: OKX backs its transparency with a multi-billion-dollar insurance fund and AI-powered security tools to protect user assets.

As the regulatory landscape evolves and user expectations rise, exchanges will be forced to adapt or fade into irrelevance. OKX’s leadership in the proof of reserves movement sets a powerful precedent, one that’s likely to shape the future of crypto wallet transparency for years to come.