In 2026, prediction markets and perpetuals trading have become cornerstones of sophisticated crypto strategies, letting traders wager on elections, sports outcomes, or crypto price swings with leverage and precision. But as these markets explode – think Kalshi’s regulated events or Polymarket’s decentralized oracles – self-custody wallets stand out for their promise of control. No more handing keys to exchanges amid hacks or regulatory whims. Phantom Wallet, Trust Wallet, and Binance Wallet lead this charge, each blending seamless interfaces with DeFi prowess. Drawing from my years dissecting markets, I’ll unpack why these three shine for self-custody wallets 2026, focusing on their prediction market integrations and perps capabilities.

Forbes and Bitcoin. com News highlight self-custody as paramount in their 2026 wallet roundups, emphasizing hot wallets like these for DeFi and daily action over cold storage for HODLing. Prediction markets demand quick, low-fee bets on USDC or SOL, while perps require deep liquidity and margin management – all without custodial risks. Phantom, Trust, and Binance deliver, but with distinct flavors suited to different risk appetites.

Phantom Wallet Leads with Regulated Prediction Market Access

Phantom’s integration with Kalshi marks a game-changer for phantom wallet prediction markets. As of February 2026, you can trade real-world events – U. S. elections, NFL games, even Bitcoin trends – right from the wallet, funding with SOL, USDC, or their CASH stablecoin. No dApp hopping; it’s embedded, complete with live chat for market buzz. This isn’t gimmicky; it’s prudent design for patient traders eyeing long-term edges, like fading hype on overblown events.

Perps trading gets a boost too, with Phantom launching dedicated futures markets. Leverage up on SOL perps or majors without leaving self-custody. Token support stays Solana-centric, ideal if you’re deep in that ecosystem, but limits multi-chain flexibility. Phantom’s UX feels intuitive, almost addictive, per Cryptonews DeFi wallet guides – perfect for onboarding without steep learning curves.

“Phantom has integrated Kalshi’s regulated prediction markets directly into its interface. ” – Phantom. com update, Feb 2026

Trust Wallet Builds Momentum in Decentralized Predictions

Trust Wallet counters with Myriad protocol integration, letting users browse events, stake positions, and monitor resolutions in-wallet. It’s a nod to trust wallet polymarket aspirations, with Polymarket and Kalshi on the roadmap. This positions Trust as the builder’s choice for multi-chain traders, supporting EVM, Solana, and beyond. No specific perps details yet, but its DEX aggregator hints at future leverage plays.

What sets Trust apart is ecosystem breadth. Forklog notes its prediction section as a user-friendly gateway, echoing Gate. com’s setup guides for beginners. For commodities traders like me, this mirrors hedging bonds across venues – versatile, not siloed. Yet, early Myriad focus means less polish than Phantom’s Kalshi seamlessness today.

| Feature | Phantom | Trust | Binance |

|---|---|---|---|

| Prediction Markets | Kalshi integrated (events, chat) | Myriad and Polymarket planned | DEX-focused, indirect |

| Perps Trading | Native futures markets | Not specified | CEX hybrid leverage |

| Key Tokens | SOL, USDC, CASH | Multi-chain | BNB ecosystem wide |

| UX Strength | Embedded trading | dApp browser | Seamless CEX link |

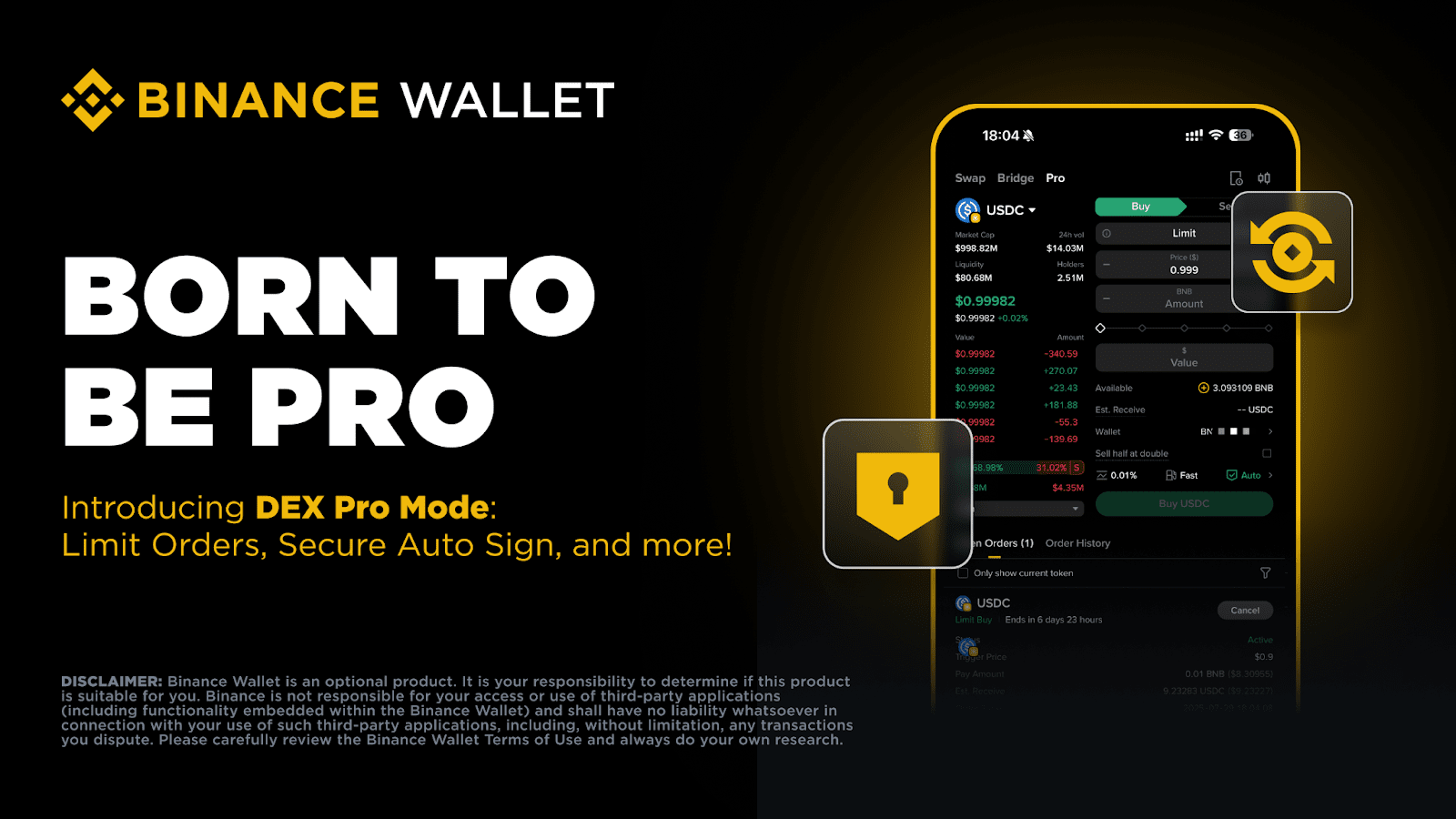

This snapshot reveals Phantom’s prediction edge, Trust’s expansion potential. Binance Wallet, meanwhile, dominates DEX swaps per its 2025 half-year report, funneling volume through BNB Chain. Its binance wallet perps trading leans on centralized exchange ties for hybrid perps access, capturing share via incentives. Check our Binance vs Trust visual breakdown for UX nuances.

Security and Self-Custody Foundations Across the Trio

Self-custody isn’t just buzz; it’s your moat in volatile perps and predictions. All three are non-custodial, with seed phrase control and biometric locks. Phantom’s Solana speed minimizes stuck funds risks, per Coincub’s hot wallet picks. Trust’s Web3 shield audits fend off phishing, while Binance’s chain abstraction eases onboarding. Bitcoin Magazine stresses high-value self-custody – here, it’s battle-tested for DeFi frenzy.

Yet, opinionated take: Phantom suits Solana purists chasing regulated alpha; Trust, the tinkerer bridging chains; Binance, the volume chaser blending CeFi comforts. As prediction volumes swell, these wallets future-proof your stack.

Future-proofing demands scrutinizing the unsexy details: fees, swap speeds, and recovery options. In prediction trading, where margins are thin and events resolve fast, these wallets minimize drag. Phantom’s Solana backbone delivers sub-second confirms at fractions of a cent, ideal for phantom vs trust wallet speed duels. Trust Wallet’s aggregator scans EVM and L2s for optimal routes, though Myriad bets occasionally lag. Binance Wallet shines in BNB Chain liquidity pools, with zero-gas incentives propping perps entries.

Head-to-Head: Prediction Markets and Perps Performance

Drilling into crypto wallet comparison prediction trading, Phantom’s Kalshi embed lets you long election odds with USDC collateral, chat fueling sentiment reads – a trader’s dream for macro plays like Fed rate bets. Trust’s Myriad setup suits decentralized purists, positioning on crypto pumps without KYC walls, though Polymarket rollout will test its mettle. Binance Wallet proxies perps via DEX-CEX bridges, leveraging BNB’s depth for high-leverage SOL or BTC contracts, per its volume surge reports.

Fees, Swap Speeds, and Liquidity Depth Comparison for Prediction/Perps Trading (2026)

| Wallet | Fees | Swap Speeds | Liquidity Depth |

|---|---|---|---|

| Phantom | Low (Solana gas fees) | Ultra-fast (<1s via Solana DEXes like Jupiter) | High (Kalshi prediction markets + new perps futures) |

| Trust Wallet | Low-Medium (multi-chain network fees) | Fast (varies by chain, Myriad integration) | Moderate (Myriad prediction markets, future Polymarket/Kalshi) |

| Binance Wallet | Very Low (BNB Chain + incentives) | Fast (seamless DEX integration) | Very High (dominant DEX swap volume share) |

Perps demand margin vigilance; Phantom’s native markets auto-liquidate smartly, echoing bond portfolio balancers. Trust hints at dApp leverage soon, while Binance’s hybrid pulls CEX tools into self-custody – convenient, yet watch for oracle divergences. From my commodities lens, these integrations hedge like futures on oil swings, but self-custody keeps you sovereign.

Pros & Cons: Phantom vs Trust vs Binance

-

Phantom WalletPros: Direct Kalshi prediction markets integration for events like elections/sports; perpetual futures markets; Solana tokens (SOL, USDC, CASH); live chat; seamless in-wallet trading.Cons: Primarily Solana-focused; limited to supported chains.

-

Trust WalletPros: Myriad prediction markets section for browsing/positions/tracking; planned Polymarket/Kalshi integrations; multi-chain support.Cons: Initial Myriad-only; perps trading unspecified; integrations pending.

-

Binance WalletPros: DEX swap volume leader; seamless Binance CEX integration; incentives; hybrid trading UX; wide token support.Cons: Limited prediction markets/perps details; DEX-focused over direct integrations.

Tailoring Your Choice to Trading Style

Solana loyalists, Phantom’s your anchor – regulated access tempers DeFi chaos, much as I favor treasuries in uncertain bonds. Multi-chain nomads gravitate to Trust, its browser unlocking Polymarket-esque worlds without chain swaps. Volume hunters pick Binance for binance wallet trading features, where DEX dominance feeds perps liquidity. Bitcoin. com and Cryptonews nod to such versatility in 2026 DeFi picks, urging hybrids for active stacks.

Onboarding mirrors this: Phantom’s one-click Solana setup suits novices per Gate. com guides. Trust requires chain adds but empowers tinkerers. Binance auto-links accounts, easing fiat ramps – prudent for scaling positions.

Patience pays here; test small bets on low-stakes events to gauge fit. As markets mature, these wallets evolve – Phantom deepening perps, Trust expanding oracles, Binance fusing chains. In a self-custody era, they empower informed edges without surrender.