In the ever-evolving cryptocurrency landscape of 2026, self-custody remains a cornerstone for investors seeking control over their digital assets. As Bitcoin and Ethereum ecosystems mature alongside emerging chains like Solana and Aptos, the choice between versatile software solutions and unbreachable hardware devices has never been more critical. Enter OKX Wallet versus Ledger: a showdown between multi-chain self-custody that empowers seamless DeFi interactions and hardware security that fortifies assets against digital threats. This comparison dissects their strengths, helping you decide which aligns with your long-term strategy.

OKX Wallet: Empowering Active Traders with Multi-Chain Versatility

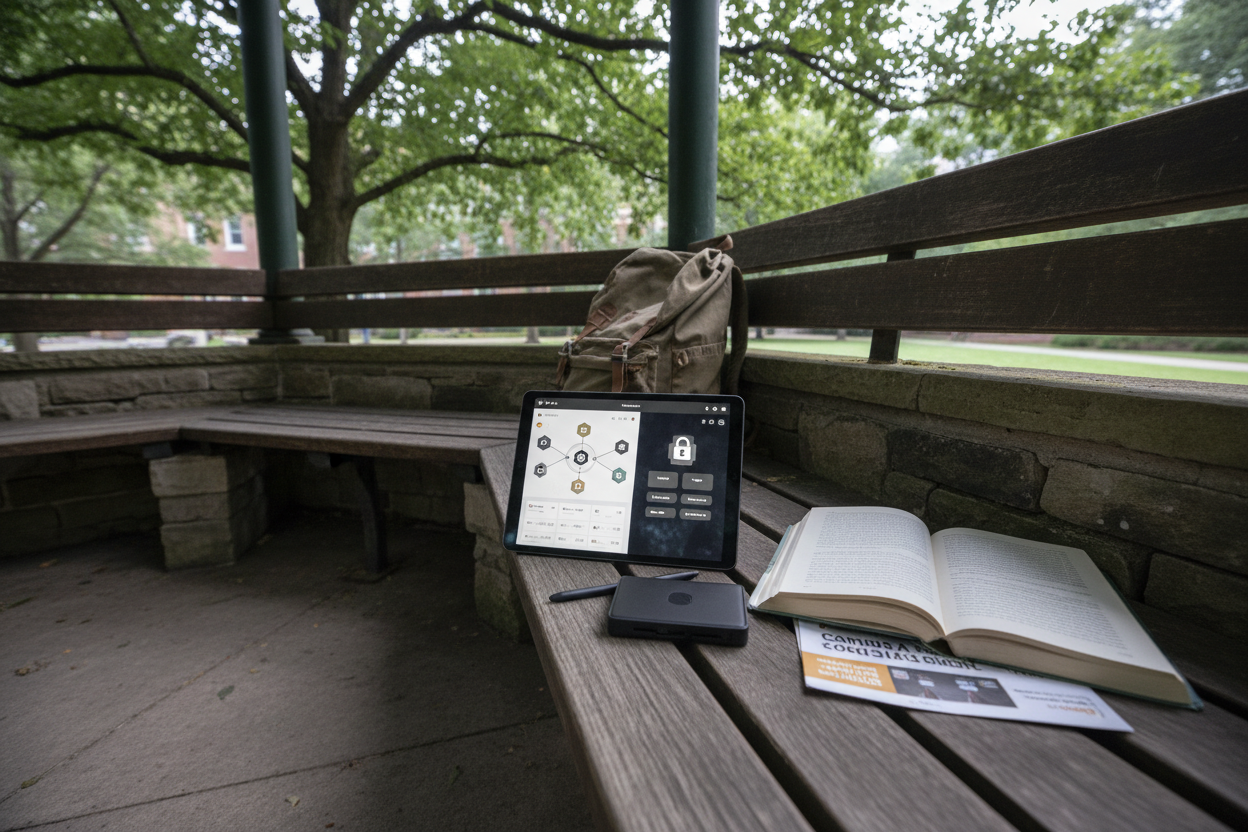

OKX Wallet stands out as a self-custody powerhouse, supporting over 60 blockchains including Bitcoin, Ethereum, BNB Chain, Polygon, Solana, and Aptos. What began as an exchange-tied tool has matured into a full-fledged Web3 super app by 2026. Traders appreciate its built-in DEX aggregator for optimal swap rates, cross-chain bridges that minimize fees, and yield farming opportunities directly from the dashboard. The NFT marketplace and Cryptopedia section for airdrops and quests add layers of utility, turning passive holding into active engagement.

Security-wise, OKX Wallet employs risky transaction detection and domain-risk screening in its browser extension, alerting users to phishing attempts or malicious contracts before signing. Yet, as a software wallet, it hinges on your device’s integrity; a malware-infected phone could expose keys. For airdrop hunters and DeFi participants, this multi-chain wallet comparison favorite offers unmatched convenience, connecting effortlessly to dApps across ecosystems without the friction of multiple extensions.

Recent rankings from sources like FoxWallet and OKX itself crown it the best overall self-custody wallet, praising its tight integration with Web3 access and swaps. If your portfolio spans ecosystems and you value speed over isolation, OKX Wallet delivers a unified experience that keeps you ahead in volatile markets.

Ledger: Unrivaled Hardware Protection for Prudent Holders

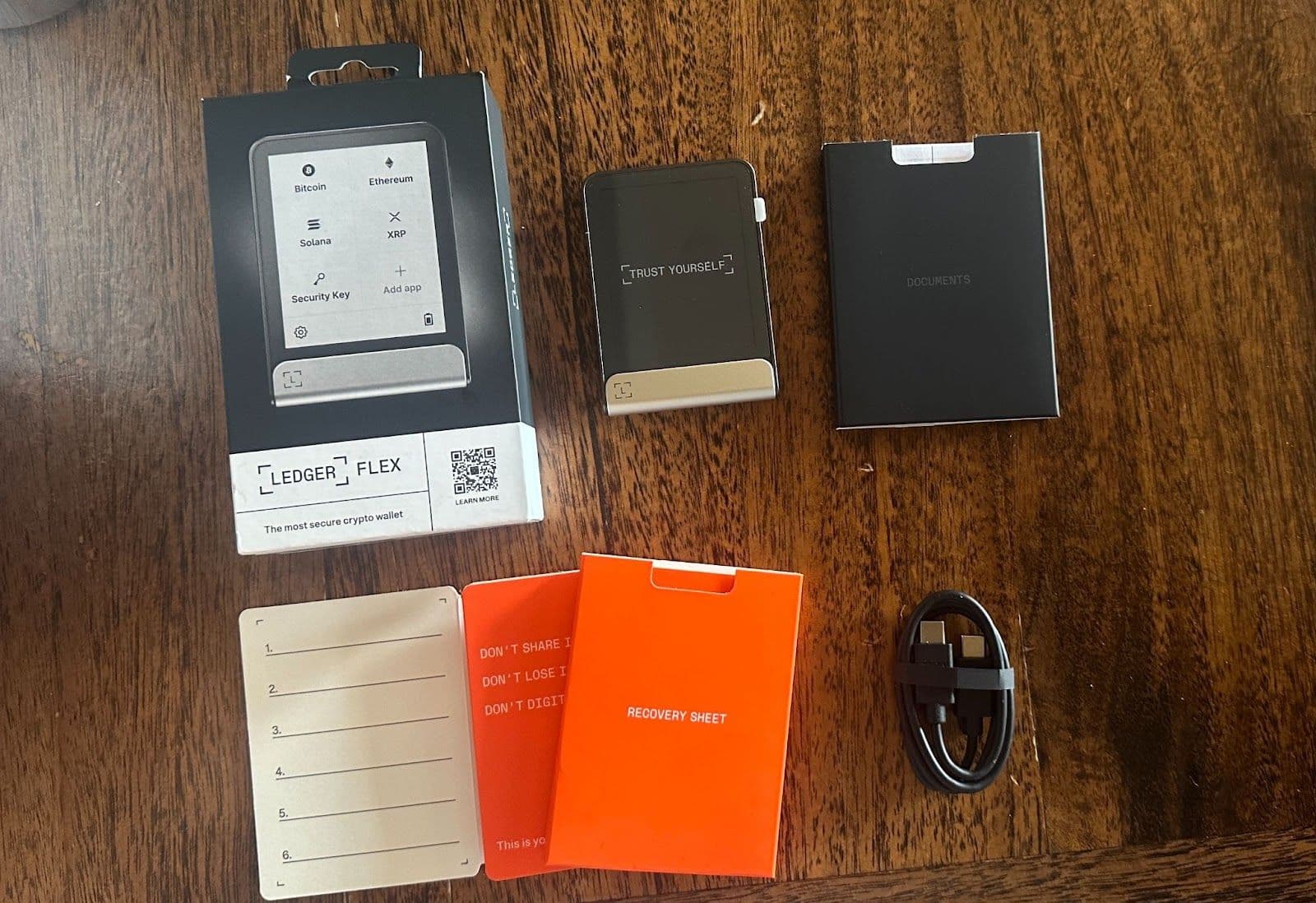

Ledger’s hardware wallets, particularly the Nano S Plus and Bluetooth-enabled Nano X, represent the pinnacle of cold storage in 2026. Supporting over 5,500 cryptocurrencies, these devices pair with Ledger Live software for asset management, staking, and dApp access on desktop or mobile. The Secure Element chip, certified to CC EAL5 and standards, ensures private keys never leave the offline device, shielding them from hacks, keyloggers, and exchange failures that have plagued the industry.

In my view, shaped by years tracking market risks, hardware like Ledger is essential for substantial holdings. The Nano X’s Bluetooth facilitates on-the-go approvals without compromising security, while firmware updates address evolving threats. Despite a 2025 phishing scare with fake Ledger Live apps, Ledger’s response, insisting on official downloads and zero seed phrase sharing, reinforced its reputation. Sites like InsideBitcoins consistently rank it among top cold wallets for its robust defense.

For investors prioritizing Ledger hardware security 2026, this is the prudent choice. It transforms self-custody into a fortress, ideal for long-term strategies where patience outweighs daily trades.

Bridging Worlds: Key Integrations and Feature Face-Off

The landscape shifted dramatically in March 2025 when Ledger integrated OKX DEX into Ledger Live. This allows users to swap tokens across multiple networks directly from cold storage, blending OKX Wallet multi-chain liquidity with hardware safeguards. No more exposing funds to hot wallets for trades; execute with confidence using device-signed transactions.

OKX users can also link Ledger for secure withdrawals from the exchange, merging hot trading flexibility with cold confidence. This synergy addresses a core tension in self-custody crypto wallets: usability versus protection.

Delving deeper, OKX excels in everyday DeFi and NFT interactions, boasting dApp discovery and quests that Ledger matches less fluidly. Conversely, Ledger’s offline signing trumps software in breach scenarios, as evidenced by past exchange insolvencies. Cost considerations favor OKX’s free entry, though Ledger’s one-time fee yields enduring peace of mind. For multi-chain ambitions, Ledger’s evolving support via partners like OKX positions it strongly against pure software rivals.

user experience also factors heavily. OKX Wallet’s intuitive mobile app and browser extension shine for quick swaps and dApp logins, earning praise in 2026 rankings from Ventureburn and Coincub. New users onboard swiftly, discovering quests that reward engagement without steep learning curves. Ledger, while powerful, demands initial setup discipline: generating a seed phrase offline, verifying addresses meticulously. Once mastered, Ledger Live’s clean interface simplifies staking Ethereum or managing Bitcoin, but Bluetooth pairing on Nano X can occasionally frustrate in low-signal areas.

Security Under the Microscope: Real-World Resilience Tested

Both wallets have weathered storms, underscoring why hardware security 2026 debates rage on. Ledger’s 2025 phishing wave via counterfeit apps stole headlines, yet no core device compromises occurred; victims fell to social engineering. Ledger’s countermeasures, including enhanced app verification, fortified trust. OKX Wallet dodged major breaches but flagged risky contracts in high-profile DeFi exploits, its on-chain simulators saving users from rug pulls. Still, software’s device dependency contrasts Ledger’s air-gapped isolation, where even a hacked computer yields nothing without physical approval.

Opinion: For portfolios exceeding $10,000, Ledger’s Secure Element isn’t luxury; it’s insurance against black swan events like quantum threats looming by decade’s end. OKX suits sub-$10,000 active stacks, where speed trumps fortification.

Cryptocurrency Price Performance: Top Assets for OKX Wallet vs Ledger (Past 6 Months)

Performance comparison of BTC, ETH, SOL, BNB – key assets supported by both multi-chain OKX Wallet and Ledger hardware security

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Bitcoin | $66,830.00 | $108,950.28 | -38.6% |

| Ethereum | $1,953.84 | $2,615.51 | -25.3% |

| Solana | $79.98 | $133.28 | -40.0% |

| BNB | $599.17 | $897.60 | -33.2% |

Analysis Summary

Over the past six months, major cryptocurrencies supported by both OKX Wallet and Ledger have faced significant declines amid a broader market downturn. Solana recorded the largest drop at -40.0%, followed closely by Bitcoin at -38.6%, while Ethereum showed relative resilience with a -25.3% change. This volatility underscores the risks in multi-chain strategies despite self-custody benefits.

Key Insights

- All assets declined over 25% in the past 6 months, reflecting market-wide pressure.

- Solana experienced the steepest fall (-40.0%), highlighting high volatility in high-performance chains.

- Ethereum outperformed others with the smallest decline (-25.3%), benefiting from its ecosystem strength.

- Bitcoin’s -38.6% drop emphasizes the need for secure storage like Ledger amid corrections.

- BNB declined -33.2%, impacting users of exchange-linked multi-chain wallets like OKX.

Prices and 6-month changes sourced exclusively from provided real-time CoinMarketCap historical data (e.g., 2025-07-08/08 snapshots). Current prices as of 2026-02-13; changes reflect USD performance from specified past dates.

Data Sources:

- Main Asset: https://coinmarketcap.com/historical/20250708/

- Ethereum: https://coinmarketcap.com/historical/20250708/

- Solana: https://coinmarketcap.com/historical/20250808/

- BNB: https://coinmarketcap.com/historical/20250808/

- XRP: https://coinmarketcap.com/historical/20250808/

- Cardano: https://coinmarketcap.com/historical/20250808/

- Dogecoin: https://coinmarketcap.com/historical/20250808/

- Toncoin: https://coinmarketcap.com/historical/20250808/

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Multi-chain mastery defines 2026’s edge. OKX natively bridges Solana NFTs to Ethereum yields seamlessly; Ledger, via OKX DEX integration, now rivals this without seed exposure. This fusion, detailed in analyses of cross-chain UX transformations, elevates hardware from vault to versatile tool. Hardware innovations are reshaping seamless asset flows, positioning Ledger ahead for hybrid users.

Tailored Choices: Matching Wallets to Your Risk Profile

Day traders and NFT flippers gravitate to OKX Wallet’s ecosystem depth, chasing airdrops on Aptos or yields on Polygon without hardware hurdles. Its free model scales with volume, integrations like OKX exchange withdrawals streamlining flows. Long-term HODLers, conversely, lean Ledger for Bitcoin maximalism or diversified cold stacks; the Nano X’s portability suits travelers fortifying against regional instability.

Hybrid approach? Pair them: Trade hot on OKX, consolidate cold to Ledger. This mirrors prudent strategies I’ve advocated across markets, balancing liquidity with safeguards. User ratings hover close, 4.8/5 for OKX’s verve versus 4.7/5 for Ledger’s reliability, per aggregated 2026 reviews.

Costs seal decisions. OKX demands zero upfront, monetizing via optional exchange links. Ledger Nano X lists at $149, a worthwhile levy for enduring protection. In multi-chain wallet comparison terms, neither dominates universally; synergy prevails.

Looking ahead, expect deeper AI-driven risk screening in OKX and quantum-resistant chips in Ledger iterations. As chains proliferate, the self-custody ethos endures: control your keys, calibrate to conviction. Whether chasing DeFi alpha or anchoring wealth, these wallets equip thoughtful investors to navigate 2026’s frontier with clarity and command.