In 2026, Ledger vs OKX Wallet boils down to one epic choice: ironclad hardware isolation or lightning-fast self-custody. As a high-frequency trader who’s dodged more hacks than most, I live for hardware vs self-custody wallet 2026 battles. Ledger Nano X locks keys offline, while OKX Wallet delivers seamless on-chain action. With Ledger now embedding OKX DEX swaps, the lines blur – but security edges never fade. Let’s dissect this Ledger OKX security comparison to arm you for the next bull run.

Ledger Nano X Dominates Cold Storage

Ledger Nano X isn’t just a wallet; it’s your crypto vault in 2026. This Bluetooth beast has ruled since 2019, blending offline security with daily usability. Review and sign transactions on-device – no PC exposure. Sources like CoinNews hail it as the premium pick for balancing fortress-level protection and convenience.

Key wins: Supports 5,500 and assets across Ethereum, Bitcoin, Solana. CC EAL5 and certified chip keeps private keys air-gapped. Battery lasts weeks; mobile pairing via Ledger Live app. Past firmware hiccups? Fixed and battle-tested. Traders, pair it with OKX for cold withdrawals post-trade – pure confidence.

Ledger, Best Premium Hardware Wallet. Review and sign on-device for extra safety. (Coincub, 2026)

OKX Wallet Fires Up Self-Custody Freedom

OKX Wallet flips the script as a non-custodial hot wallet powerhouse. No KYC, full control, multichain mastery over 100 and networks. Built for speed: In-app DEX aggregator, swaps, staking, NFT gallery. Cryptonews ranks it top for usability in 2026’s self-custody surge.

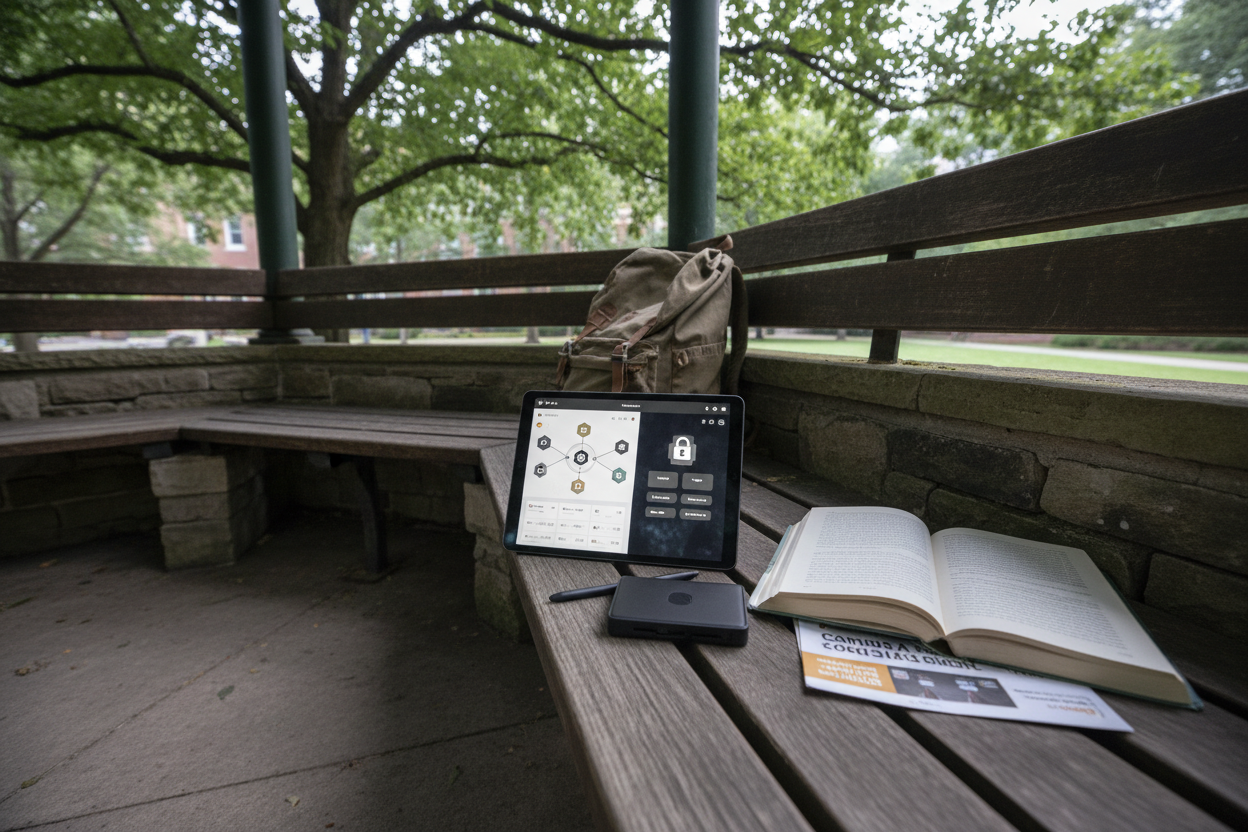

Actionable edge: Connect Ledger for hybrid power. OKX users bridge hot trades to cold storage seamlessly. Recent Ledger-OKX DEX integration? Game-changer. Swap on Ethereum, Arbitrum, Base directly from Ledger, keys never online. The Block reports this on-chain evolution demands secure crypto storage wallets.

OKX shines for mobile nomads: Biometrics, seed phrase backups, dApp browser. But hot wallets tempt phishing – always verify URLs.

Security Face-Off: Hardware Muscle vs Software Shield

Best crypto wallet onboarding guide starts here: Ledger’s edge is physical isolation. Malware on your phone? Irrelevant – keys stay chip-bound. OKX counters with MPC-like recovery options, no single seed risk, but online exposure demands vigilance.

Ventureburn and Coinspeaker nod to Ledger’s Bluetooth perks minus full offline purity. OKX? Frequent updates patch threats fast. Integration tip: Use Ledger for HODL, OKX for DeFi plays – sign via hardware.

Bitcoin. com praises multichain self-custody – OKX nails it, Ledger fortifies. ChangeNOW flags hardware pairings for max security. Seize this: For 90% holdings, Ledger. Daily trades? OKX with Ledger backup.

Hybrid setups crush solo plays. Link OKX Wallet to Ledger Nano X via Ledger Live – trade hot on OKX, sign cold on hardware. New 2026 OKX DEX in Ledger? Execute EVM swaps (Ethereum, Polygon, BNB) offline. No key exposure, zero trust in dApps. Slashdot comparisons spotlight this ledger vs okx wallet synergy for cost-to-security ratio.

Use Case Breakdown: When to Deploy Each

High-stakes HODLers: Ledger Nano X solo. Park BTC, ETH long-term; ignore hot wallet noise. Daily DeFi warriors: OKX primary, Ledger secondary signer. Stake, bridge, yield farm – then vault profits cold. Nomad traders? OKX mobile speed with Ledger Bluetooth checks. Coinspeaker flags Ledger’s past vulns (patched), OKX’s phishing risks – mitigate both with multi-sig layers.

2026 twist: Ledger’s OKX DEX embed turns hardware into a swap machine. Arbitrum gas fees crushed on-chain, keys chip-locked. Bitcoin. com News loves this self-custody evolution. Action step: Test small swaps today – verify Ledger signs every tx.

Bitcoin Technical Analysis Chart

Analysis by Nina Archer | Symbol: BINANCE:BTCUSDT | Interval: 1h | Drawings: 7

Technical Analysis Summary

Aggressively mark the savage downtrend from the Feb 12 peak at $79,000 slicing to the Feb 15 trough at $47,000 with a bold red trend_line connecting (2026-02-12T14:00:00Z, 79000) to (2026-02-15T16:00:00Z, 47000). Overlay horizontal_lines at key support $47,500 (strong) and resistance $65,000 (moderate), plus fib_retracement from high to low for bounce targets at 38.2% ($59,210) and 61.8% ($66,476). Pinpoint entry zone with long_position rectangle around $50,000-$52,000, profit_targets at $65k and $72k, stop_loss below $47k. Blast arrow_mark_up on MACD bullish crossover near recent lows, and callout volume spike on breakdown. Rectangle the consolidation range Feb 16-17 between $55k-$60k. Vertical_line the breakdown event on Feb 15. This setup screams high-octane reversal play – draw it fast and execute!

Risk Assessment: high

Analysis: Volatile post-dump bounce with strong momentum signals but whipsaw potential in crypto wilds

Nina Archer’s Recommendation: Go aggressive long NOW – high tolerance play, position size 3-5% portfolio, trail stops ruthlessly for 2-3x upside!

Key Support & Resistance Levels

📈 Support Levels:

-

$47,500 – Volume-backed panic low, multi-touch base

strong -

$55,000 – Recent swing low in consolidation

moderate

📉 Resistance Levels:

-

$65,000 – Prior breakdown level, now overhead hurdle

moderate -

$79,000 – Major Feb high, psychological barrier

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$50,000 – Aggressive bounce off support with MACD flip, high RR setup

high risk

🚪 Exit Zones:

-

$65,000 – First resistance test, scale out 50%

💰 profit target -

$72,000 – Fib extension target on momentum burst

💰 profit target -

$46,500 – Tight stop below structure break

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: climax selling volume on breakdown, drying up on rebound

Massive red bars on dump confirm capitulation – prime for reversal fuel

📈 MACD Analysis:

Signal: bullish divergence and histogram flip

MACD line crossing signal from below amid price lows – momentum shift alert

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Nina Archer is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

Integrations flex: OKX connects 100 and chains, Ledger 5,500 and assets. Pair for Hyperliquid ecosystem depth or NFT drops. Cryptonews ranks OKX top non-custodial; Ventureburn pairs it with hardware elites.

Onboarding Blitz: Zero to Secure in Minutes

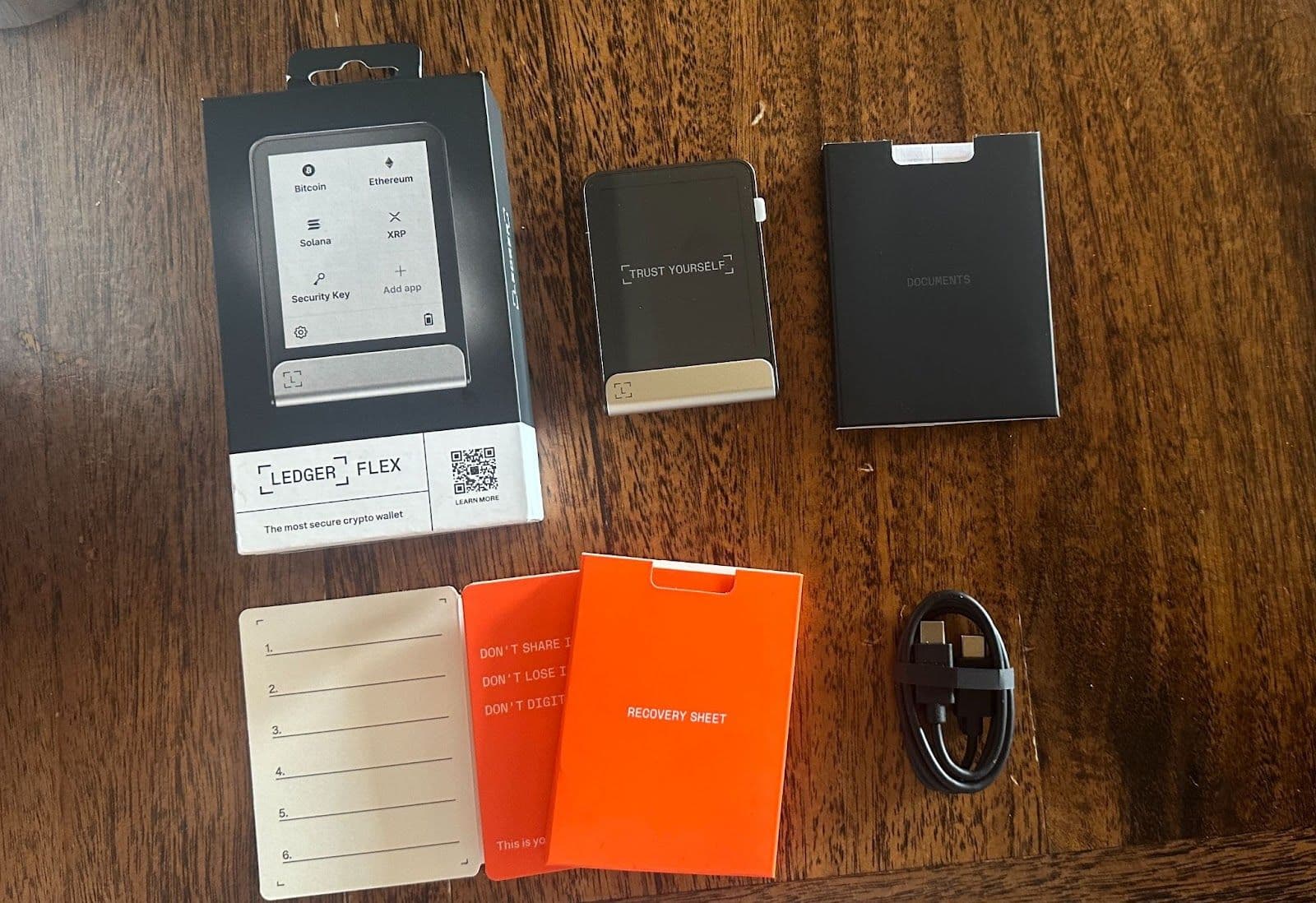

Best crypto wallet onboarding guide for 2026: Ledger first. Unbox, install Ledger Live, generate seed (write offline), verify PIN. Bluetooth pair to phone – done in 5 mins. Fund via OKX withdrawal. OKX? Download app, create/import seed, enable biometrics. Connect Ledger under settings for hybrid mode. Pro tip: Use OKX’s DEX aggregator pre-Ledger for fee scouting.

Troubleshoot fast: Lost seed? Ledger Recover (opt-in MPC) vs OKX social recovery. Always test tx with dust amounts. ChangeNOW urges hardware ties for asset management amps.

Pros ledger: Ultimate offline shield, premium build. Cons: $150 buy-in, slower tx flow. OKX pros: Free, instant, multichain blitz. Cons: Hot risks if sloppy. Verdict? No winner – stack them. 90% Ledger cold, 10% OKX hot action. This hardware vs self custody wallet 2026 mashup scales with bull markets.

Seize the micro-moment: Grab Ledger for core stack, OKX for edge plays. Ledger’s OKX DEX fusion seals it – trade like a pro, sleep like a vault. Your portfolio demands this ledger okx security comparison intel now. Dive in, secure up, trade hard.