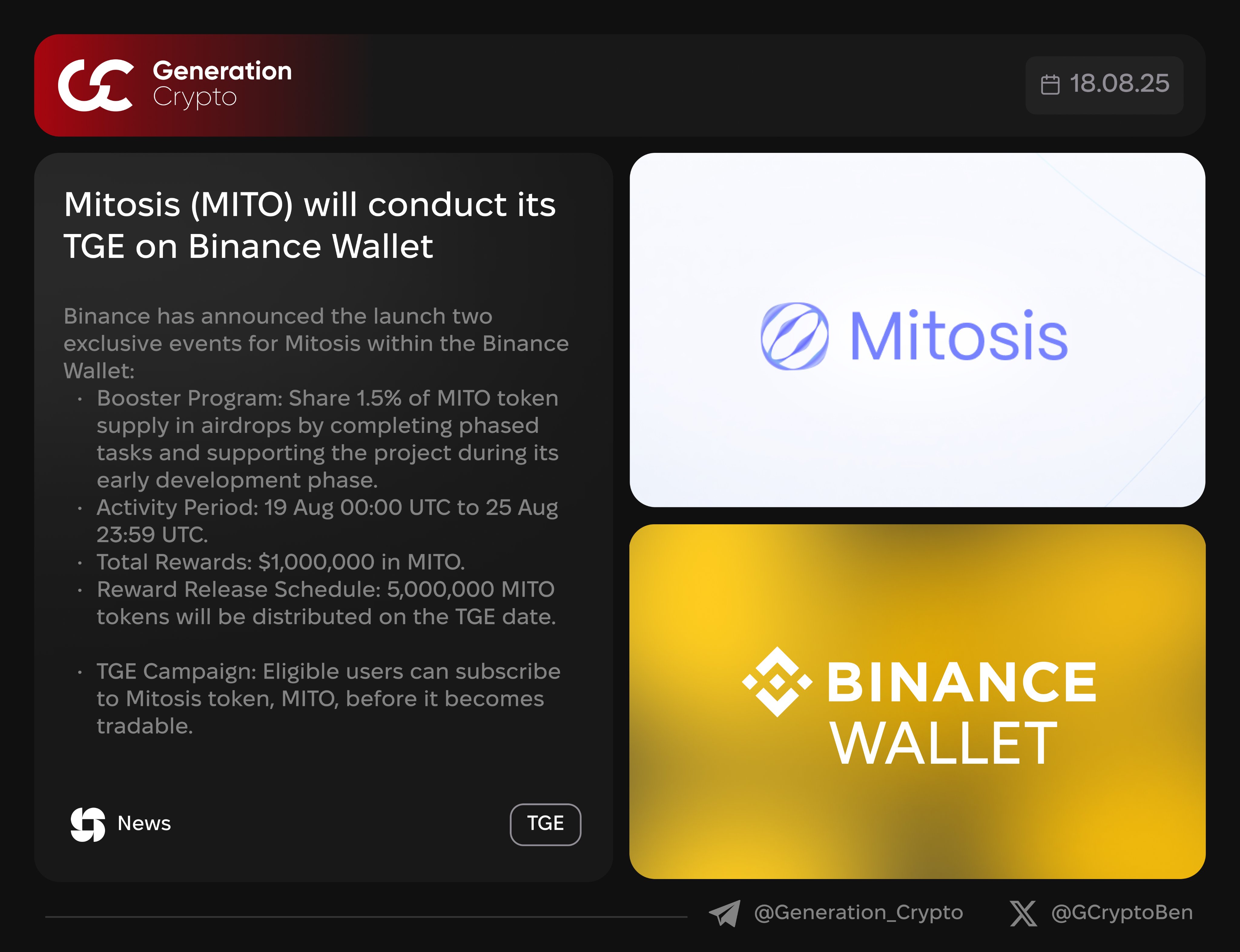

Binance has ignited new excitement in the DeFi yield landscape with its exclusive Mitosis (MITO) Booster Campaign, which began on August 19,2025. This campaign stands out by offering users the ability to earn MITO tokens before they become tradable, simply by depositing BNB or USDT into Mitosis Yield Vaults via the Binance Wallet. With a total of 15 million MITO tokens set aside as rewards and annual percentage yields (APYs) reaching as high as 117.9% for BNB and 66.25% for USDT at launch, this is one of the most lucrative opportunities currently available for yield farmers and crypto enthusiasts alike.

Understanding the Binance Wallet Booster Campaign Structure

The Binance Wallet Booster Campaign is designed to reward early adopters and active participants in DeFi with attractive APYs and a fair token distribution model. Here’s how it works:

- Eligibility: You must use the latest version of the Binance app and activate your Binance Wallet (Keyless Wallet). Sufficient Alpha Points are required for access.

- Subscription Period: The campaign runs in multiple phases. During each phase, users can deposit up to 3 BNB worth of USDT or BNB into Mitosis Yield Vaults.

- Reward Distribution: MITO tokens are distributed proportionally based on your deposit size relative to the total pool. Unused deposits are refunded automatically after each phase ends.

This structure ensures transparency and equitable participation, while also providing a robust incentive for both small and large depositors.

Step-by-Step: How to Participate in the Mitosis Vaults Booster Program

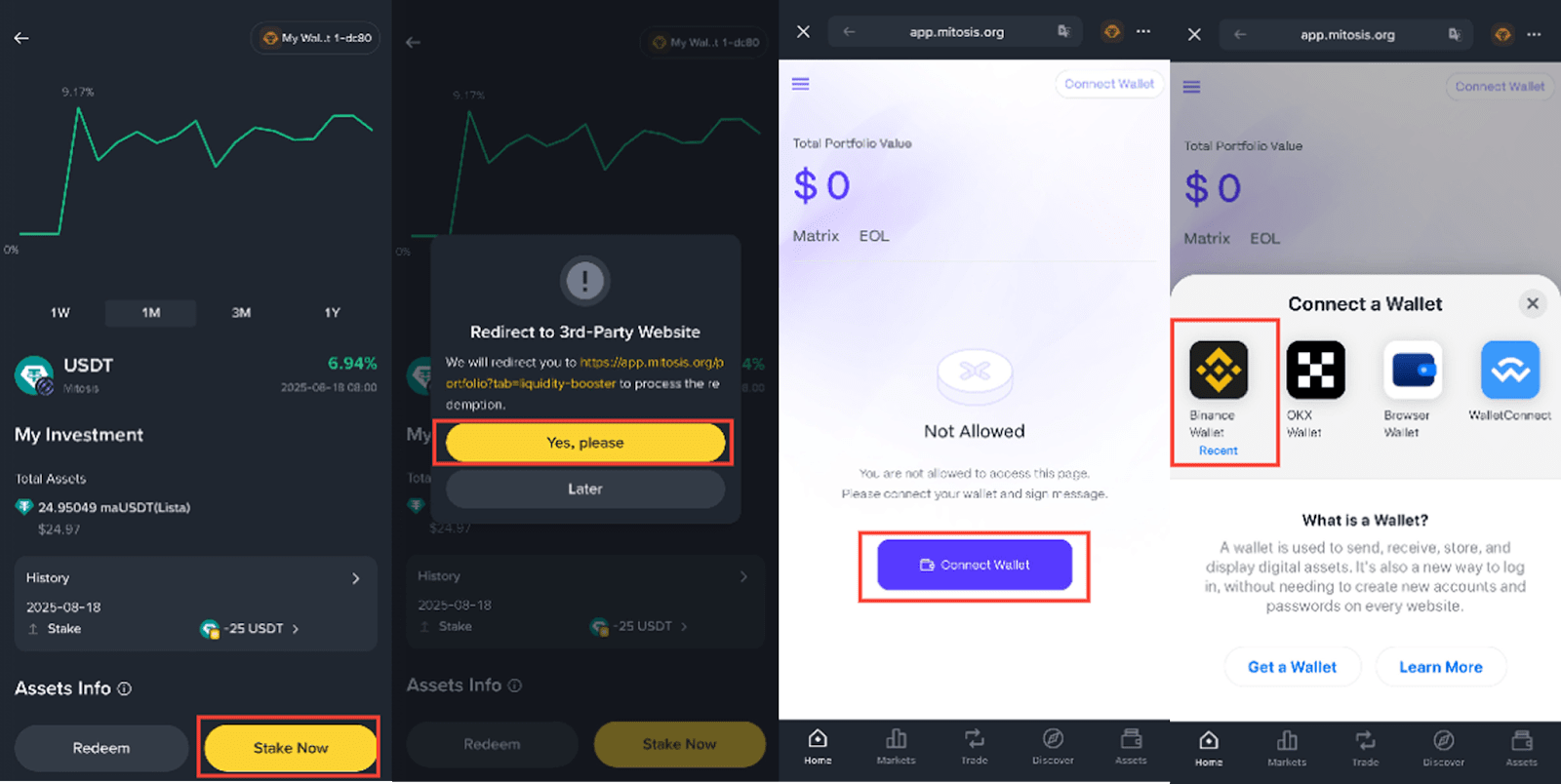

The process to start earning with Mitosis vaults is straightforward but requires careful attention to detail:

After completing these steps, you can monitor your rewards directly within your wallet’s Assets tab, ensuring full transparency over your earned MITO tokens.

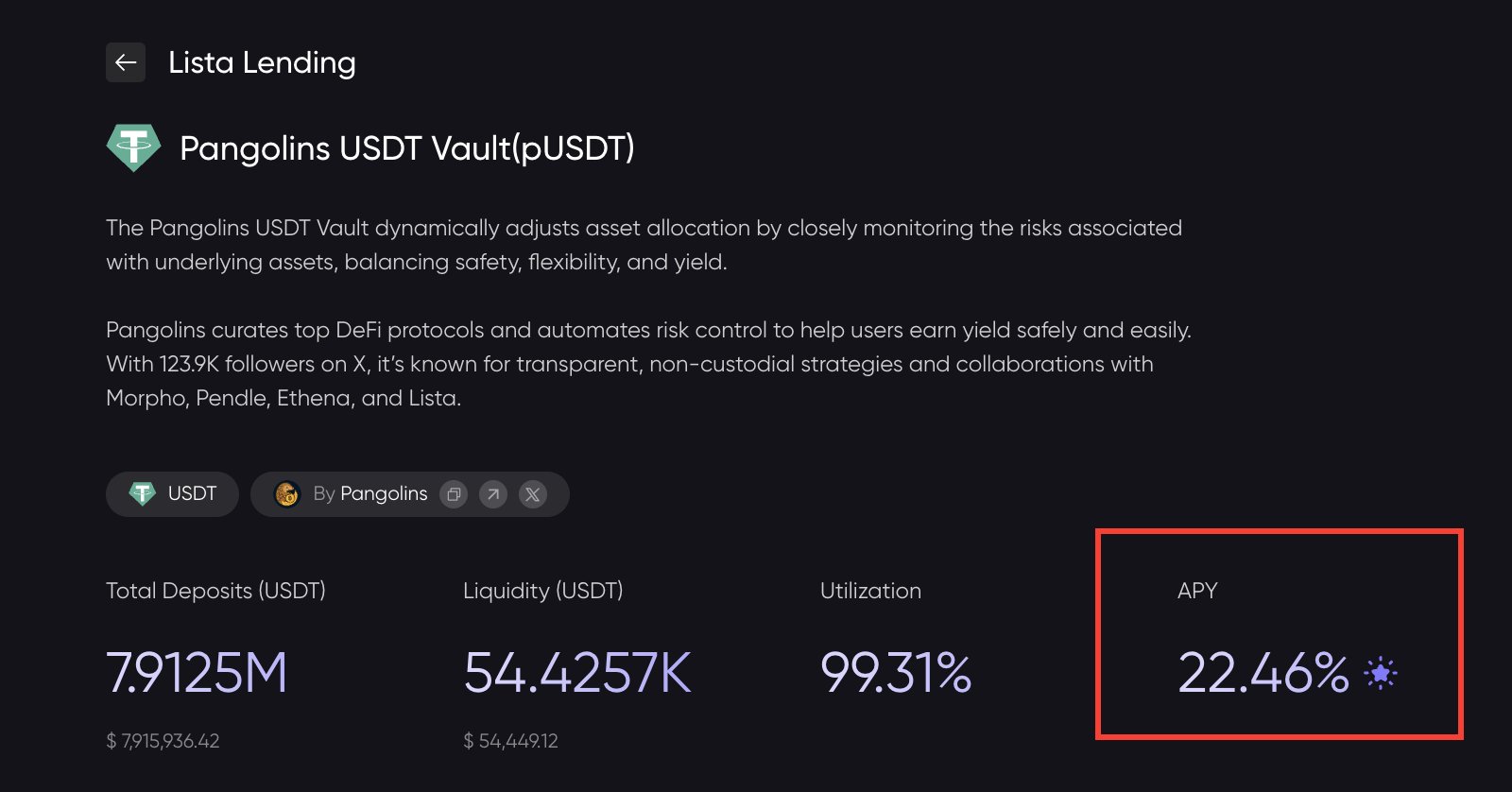

Mitosis Vaults: Maximizing Your Crypto APR Rewards

The core appeal of this campaign lies in its high-yield vaults and user-friendly interface. At launch, APYs were among the highest in DeFi provides 117.9% for BNB pools and 66.25% for USDT pools. These rates are dynamic and may adjust based on demand, but they remain highly competitive compared to traditional staking or farming platforms.

Key Benefits of Using Mitosis Vaults via Binance Wallet

-

High and Transparent APYs: Earn attractive annual percentage yields, with BNB pool APY at 117.9% and USDT pool APY at 66.25% at campaign launch, maximizing your potential returns.

-

Exclusive MITO Token Rewards: Access up to 15 million MITO tokens reserved for Booster Campaign participants by depositing BNB or USDT in the vaults.

-

Early Access Before Trading: Subscribe to MITO tokens before they become tradable, positioning yourself ahead of the market and benefiting from the Token Generation Event (TGE).

-

Seamless Participation via Binance Wallet: Utilize the secure, keyless Binance Wallet to deposit funds, monitor rewards, and claim MITO tokens directly within the app.

-

Automatic Refunds and Locked Rewards: Unused deposits are automatically refunded after the subscription period, and MITO rewards are securely locked until the campaign concludes, ensuring safety and transparency.

-

Step-by-Step Visual Guide: Access a comprehensive in-app visual guide with screenshots and instructions, simplifying the process for both new and experienced users.

It’s crucial to note that all MITO rewards remain locked until the official conclusion of the campaign. Avoid third-party offers claiming early unlocks; only trust information provided directly within your Binance app or from official sources such as blockchainreporter.net.

Security and transparency are at the forefront of the Mitosis vaults guide. Every deposit is handled via the Binance Wallet’s Simple Yield interface, providing real-time updates and detailed breakdowns of your deposited assets, expected APR, and pending MITO rewards. The campaign’s phased approach prevents oversubscription and ensures that early participants are not diluted by latecomers. This structure encourages active engagement throughout each phase, as users can adjust their strategies based on current pool sizes and projected returns.

What Sets the Binance Wallet Booster Campaign Apart?

Unlike traditional yield farming events, the Binance Wallet Booster Campaign integrates several innovative features:

Distinctive Features of Binance’s Mitosis Booster Campaign

-

Exclusive Early Access to MITO Tokens: Users can subscribe to Mitosis (MITO) before it becomes tradable, allowing participation in the token generation event (TGE) directly through the Binance Wallet.

-

Multi-Phase Campaign Structure: The Booster Campaign is organized in multiple phases, distributing a total of 15 million MITO tokens as rewards, ensuring sustained engagement and opportunities for participants.

-

High APYs at Launch: Offers exceptionally high annual percentage yields, with the BNB pool at 117.9% APY and the USDT pool at 66.25% APY during the initial phase, surpassing many standard DeFi yield programs.

-

Alpha Points Requirement for Eligibility: Users must accumulate Alpha Points within the Binance Wallet to qualify, adding a gamified layer and rewarding active engagement in the Binance ecosystem.

-

Integrated Visual Guide & In-App Tutorials: Binance provides a comprehensive visual guide within the app, featuring step-by-step instructions and screenshots, making the campaign accessible even to DeFi newcomers.

-

Automated Refunds for Unused Deposits: After the subscription period, any unused BNB or USDT deposits are automatically refunded, reducing risk and increasing user trust compared to typical DeFi vaults.

-

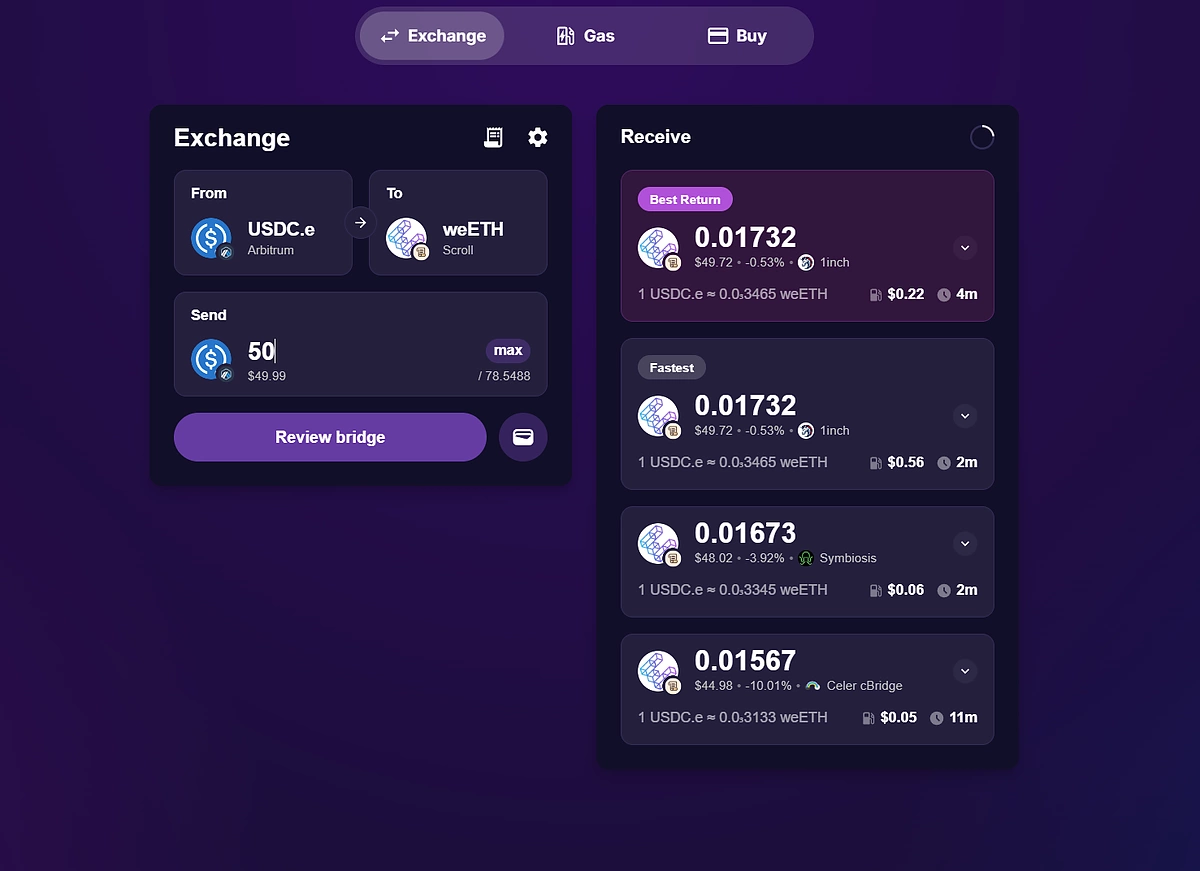

Dual-Chain MITO Token Utility: MITO operates on both the BNB Chain and its native Mitosis Chain, enabling flexible DeFi strategies, staking, and governance participation.

-

Secure Keyless Wallet Participation: The campaign leverages Binance’s Keyless Wallet technology, simplifying asset management and security for users who may be new to DeFi.

The dual-chain utility of MITO (operating on both BNB Chain and Mitosis Chain) adds additional flexibility for users who want to leverage their rewards across different DeFi ecosystems. This cross-chain capability is a strategic advantage for those seeking broader exposure or advanced yield strategies.

Monitoring Your Rewards: Visual Guide and Analytics

Binance has invested in a comprehensive visual guide within the app to help users navigate every aspect of the campaign. From illustrated walkthroughs to APY calculators, these resources demystify each step, from initial deposit to final reward claim. The analytics dashboard provides up-to-date metrics on vault performance, pool sizes, and your proportional share of MITO tokens.

If you ever need guidance during participation, simply tap ‘Help’ or ‘Tutorial’ within the campaign page for instant access to official explanations and screenshots tailored for both beginners and experienced yield farmers.

Critical Considerations Before You Deposit

- Lock-Up Period: All MITO tokens earned will remain locked until the campaign officially ends. There is no legitimate way to unlock or trade these tokens early, be wary of any third-party offers suggesting otherwise.

- Deposit Limits: Each wallet can deposit up to 3 BNB worth of USDT or BNB per phase. Plan your allocations accordingly to maximize your earning potential without exceeding limits.

- Refund Policy: Any unused deposits are automatically refunded after each subscription phase concludes, no manual action required.

This methodical approach ensures that user funds remain secure while maintaining a level playing field for all participants. For full campaign details and real-time updates, refer directly to official sources such as blockchainreporter.net.

Mitosis (MITO) Price Prediction 2026-2031

Professional Forecast Based on Current Market Context, Adoption, and DeFi Trends

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.42 | $0.73 | $1.15 | +120% | Post-TGE price discovery, high volatility as MITO lists on major exchanges. Early DeFi adoption and APY incentives drive growth. |

| 2027 | $0.61 | $1.09 | $1.85 | +49% | Increased integration on BNB Chain and Mitosis Chain, with DeFi TVL growth and more utility. Regulatory clarity boosts investor confidence. |

| 2028 | $0.94 | $1.56 | $2.40 | +43% | Mitosis ecosystem matures; governance and staking adoption grows. Competition from other DeFi protocols may cap upside. |

| 2029 | $1.10 | $2.10 | $3.10 | +35% | Bullish DeFi cycle, broader cross-chain adoption. Macro crypto bull run possible, but subject to overall market sentiment. |

| 2030 | $1.35 | $2.55 | $3.80 | +21% | DeFi mainstream adoption, further product launches, and Layer 2 integrations. Regulatory headwinds could lead to increased volatility. |

| 2031 | $1.20 | $2.10 | $3.20 | -18% | Potential market correction after strong run; consolidation phase with focus on sustainable yields and ecosystem stability. |

Price Prediction Summary

MITO is positioned for significant growth post-TGE, leveraging Binance’s exposure and DeFi incentives. Early years (2026-2028) are likely to see sharp price appreciation driven by high APYs, ecosystem expansion, and new listings. As the DeFi sector matures, growth rates may moderate, with periodic corrections. Prices could be highly volatile, especially around regulatory and macroeconomic events. Long-term sustainability will depend on continued innovation and adoption within the Mitosis ecosystem.

Key Factors Affecting Mitosis Price

- Binance integration and user base driving initial demand and liquidity.

- Attractive APYs and staking incentives boosting short-term interest.

- Expansion of MITO use cases (governance, DeFi strategies) on both BNB and Mitosis Chains.

- Potential for regulatory changes impacting DeFi token valuations.

- Competition from other DeFi protocols and emerging Layer 1/Layer 2 solutions.

- Market sentiment, especially during broader crypto bull/bear cycles.

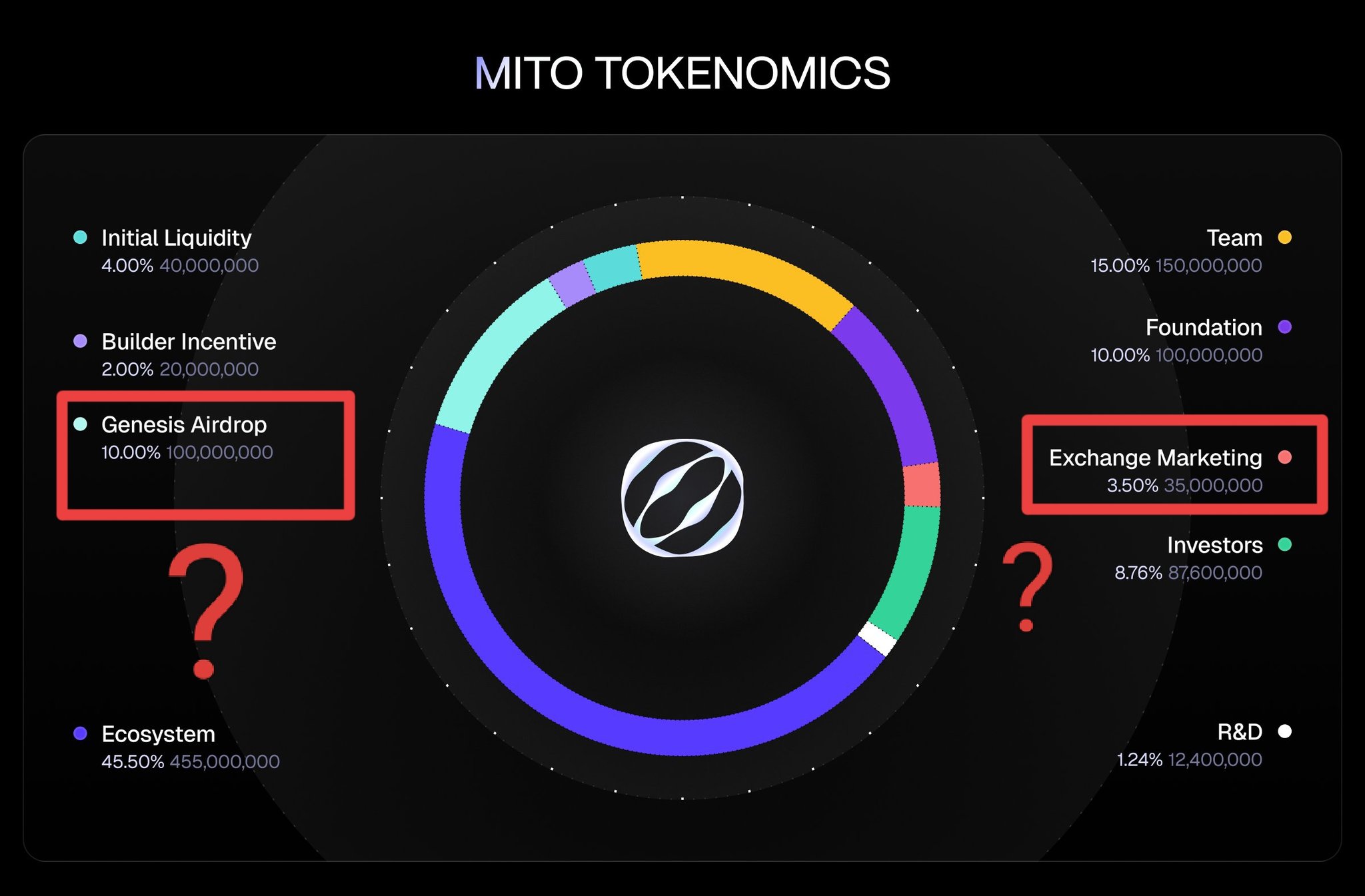

- Tokenomics (supply, unlock schedules, airdrops) and community engagement.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Final Thoughts: Is Yield Farming with Mitosis Vaults Worth It?

The data-driven answer lies in both risk tolerance and strategic timing. With launch APYs peaking at 117.9% for BNB pools and 66.25% for USDT pools, early involvement offers substantial upside, but only if you adhere strictly to best practices around security, eligibility requirements, and official timelines.

This campaign exemplifies how Binance continues to innovate within DeFi by combining high-yield opportunities with robust security protocols and user-centric design. If you’re ready to explore new frontiers in crypto APR rewards, now is an opportune time, just be sure to leverage all available guides, monitor live analytics, and avoid shortcuts offered outside official channels.