Comparing crypto wallets isn’t just about picking the most popular name – it’s about aligning your security needs, trading habits, and user experience preferences with the right technology. In this data-driven head-to-head, we break down Ledger vs Binance Wallet through a visual comparison of their user experience and security features. Each platform targets a distinct audience: Ledger is the go-to for uncompromising self-custody, while Binance Wallet offers seamless integration for active traders who value convenience.

Security Architecture: Cold Storage vs Custodial Convenience

Ledger hardware wallets, such as the Nano X and Nano S Plus, are purpose-built for security. They store private keys offline in Secure Element chips, making them virtually immune to online hacks or phishing attempts. This physical separation is a cornerstone of cold storage security. Users generate and control their recovery phrase (seed), ensuring only they have access to their assets.

In contrast, Binance Wallet operates as a custodial solution. Here, Binance holds users’ private keys on their behalf – making onboarding easy but introducing counterparty risk. While Binance employs robust internal security protocols (multi-factor authentication, withdrawal whitelists), users must trust the exchange’s infrastructure and compliance measures.

“Not your keys, not your coins. ” This adage rings especially true when weighing Ledger’s self-custody against Binance’s managed approach.

User Experience: Setup Complexity vs Platform Integration

The Ledger onboarding process is methodical but can appear daunting to newcomers. Initial setup requires connecting the device to Ledger Live (the companion app), writing down a 24-word recovery phrase, installing firmware updates, and manually adding apps for each supported asset. While this complexity pays dividends in control and transparency, it may deter casual users or those seeking instant access.

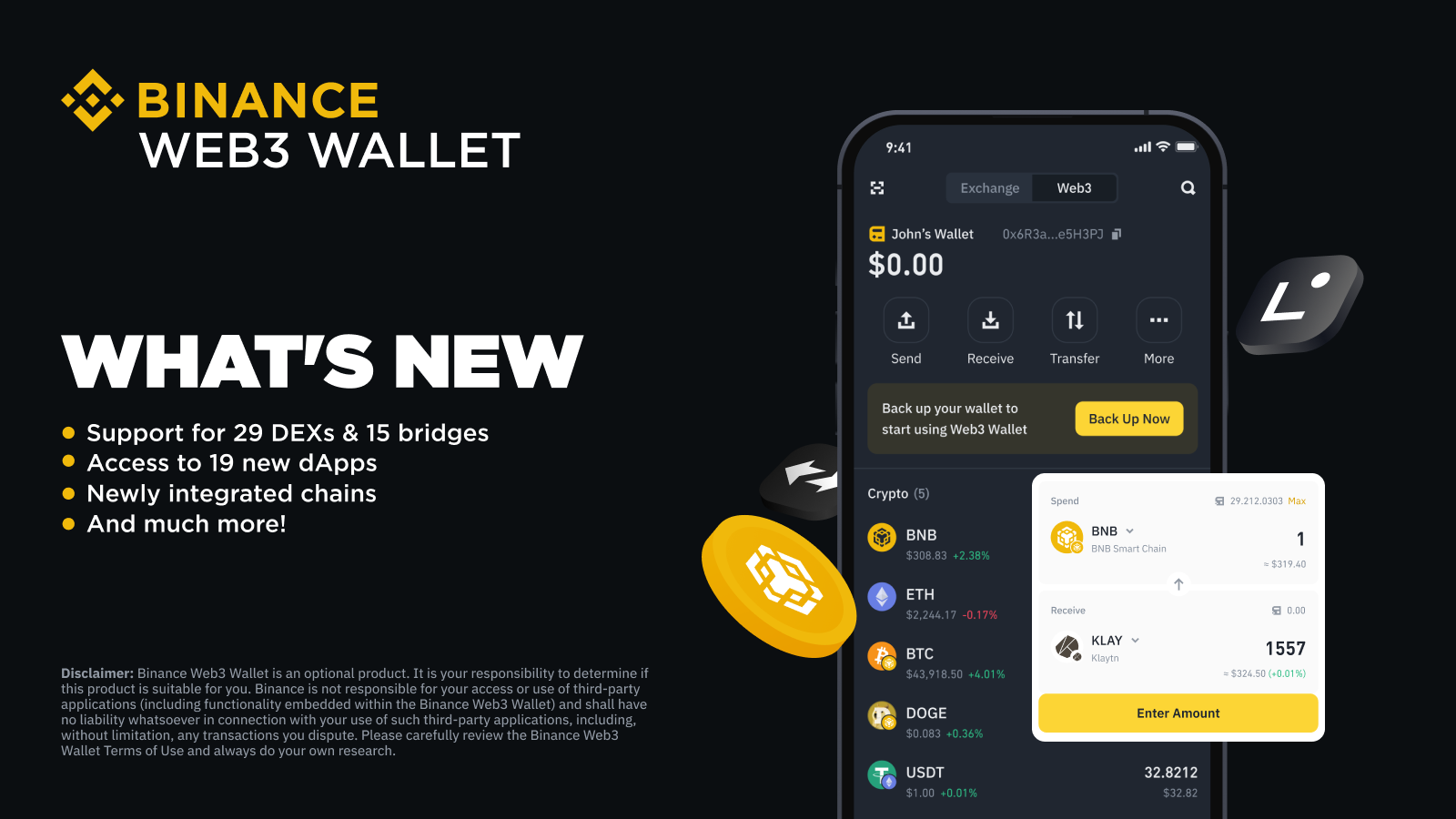

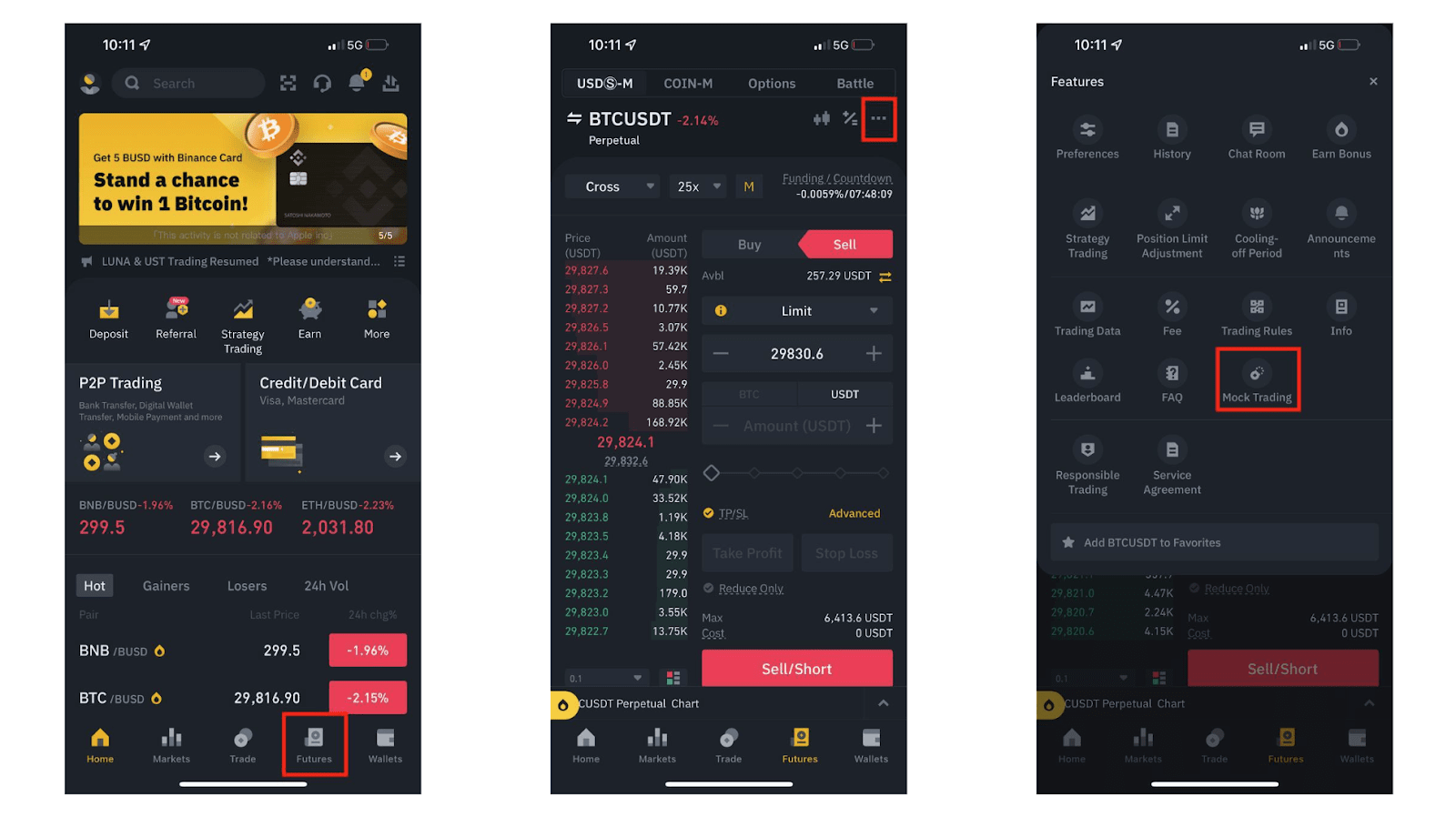

Binance Wallet, on the other hand, is integrated directly into the Binance ecosystem. Users can manage assets alongside trading activities with minimal friction – no device pairing or recovery phrases required at sign-up. For those who prioritize speed and simplicity over granular control, this unified experience is hard to beat.

Key Differences: Ledger Hardware Wallet vs Binance Wallet Onboarding

-

Security Approach: Ledger hardware wallets store private keys offline on a Secure Element chip, offering robust protection against online threats. In contrast, Binance Wallet is custodial, meaning Binance holds users’ private keys, requiring trust in the platform’s security.

-

Setup Process: Ledger requires device initialization, connection to the Ledger Live app, and secure backup of a recovery phrase—a process with a learning curve for beginners. Binance Wallet is integrated into the Binance platform, allowing for immediate use after account creation.

-

Control Over Private Keys: With Ledger, users retain full control and responsibility for their private keys (self-custody). Binance Wallet manages keys on behalf of users, which may not suit those prioritizing autonomy.

-

Asset Support: Ledger supports over 5,500 cryptocurrencies, including major coins and tokens. Binance Wallet supports a wide range of assets available on the Binance exchange, but typically fewer than Ledger.

-

Cost Structure: Ledger requires an upfront hardware purchase (e.g., Ledger Nano X at ~$149). Binance Wallet is free to use, with standard trading and transaction fees applied within the Binance platform.

Asset Support and Flexibility: Breadth vs Depth

Ledger supports over 5,500 cryptocurrencies, from major coins to niche tokens – an unmatched breadth that appeals to portfolio diversifiers and early adopters alike (source). However, managing multiple assets often requires installing separate apps on the device due to storage constraints.

Binance Wallet covers a wide spectrum of digital assets available on its exchange (source). While its range may be narrower than Ledger’s exhaustive list, it conveniently supports all major trading pairs and newly listed tokens without additional configuration steps.

Cost Considerations and Fee Structures

The up-front investment for a Ledger Nano X stands at $149. This one-time cost secures lifetime access to cold storage but does not include network fees or third-party swap charges within Ledger Live (source). In contrast, Binance Wallet is free to use; fees are only incurred during trades or blockchain withdrawals on the platform (source). For high-frequency traders or those starting out with smaller balances, this cost structure can be more attractive initially.

Beyond the purchase price, it’s important to factor in ongoing operational costs and fee transparency. Ledger Live often routes swaps through third-party providers, resulting in higher fees compared to direct trading on exchanges or decentralized aggregators. Savvy users sometimes choose to connect their Ledger device to external DEX interfaces for better rates, but this adds another layer of complexity and risk. In contrast, Binance Wallet charges trading fees that are clearly displayed before each transaction, and offers discounts for using BNB (the native Binance token), making cost calculations more predictable for active traders.

Control and Custody: Self-Sovereignty vs Delegated Trust

The core philosophical divide in the Ledger vs Binance Wallet debate is about who holds the keys. With Ledger, users retain full custody of their assets, your private keys never leave your device. This aligns with crypto’s original ethos of financial sovereignty but demands personal responsibility: lose your recovery phrase, and your funds are irretrievable.

Conversely, Binance’s custodial model delegates key management to the exchange. This shields users from some operational risks (such as losing a seed phrase) but exposes them to others, like exchange hacks or regulatory actions that could freeze access. For some, this trade-off is acceptable in exchange for simplicity; for others, it’s a non-starter.

Visual Comparison: Interface and Accessibility

A visual tour quickly reveals the user experience priorities of each wallet. Ledger Live’s dashboard focuses on security status, firmware updates, and asset management, everything is designed around safeguarding private keys and facilitating secure transactions. The interface is clean but utilitarian; advanced features like staking or NFT support require additional navigation.

The Binance Wallet interface, on the other hand, puts trading front and center with real-time charts, order books, and instant access to spot markets. Educational prompts and 24/7 support are built-in, a nod to onboarding new users at scale. For those who want everything under one roof (from fiat onramps to DeFi), Binance’s UI feels modern and frictionless.

Which Wallet Fits Your Crypto Journey?

Your choice ultimately hinges on what you value most: absolute control or seamless convenience? If you’re building a long-term portfolio with an emphasis on security, and are willing to invest time learning best practices provides Ledger hardware wallets are hard to beat for peace of mind. They’re especially suited for storing significant balances or rare tokens not supported by mainstream exchanges.

If you prioritize speed of execution, integrated trading tools, and don’t mind trusting a reputable third party with custody (and its associated risks), Binance Wallet provides an all-in-one solution that keeps friction low for day-to-day activity.

Pros & Cons of Ledger vs Binance Wallet for Different Users

-

Ledger: Maximum Security for Self-Custody AdvocatesLedger hardware wallets, such as the Nano X and Nano S Plus, store private keys offline using Secure Element chips. This offers robust protection against online threats, making them ideal for users prioritizing security and full control over their assets. However, setup involves securing a recovery phrase and can be complex for beginners. There is also an upfront cost (e.g., Nano X at ~$149).

-

Binance Wallet: Convenience and Seamless Trading for Active UsersIntegrated within the Binance platform, the Binance Wallet provides an easy, all-in-one solution for trading and managing cryptocurrencies. Users benefit from a seamless experience and free wallet access, though they must trust Binance with custody of their private keys. Asset support is broad but may not match Ledger’s extensive range.

-

Ledger: Broad Asset Support for Diversified PortfoliosLedger supports over 5,500 cryptocurrencies, including major coins and tokens, providing flexibility for users with diverse holdings. This makes it suitable for investors who require access to a wide range of assets beyond those listed on Binance.

-

Binance Wallet: Lower Entry Barrier for New Crypto UsersWith no hardware purchase required and a user-friendly interface, Binance Wallet is accessible to newcomers. Its custodial nature removes the need to manage private keys directly, though this comes at the expense of personal control and security.

-

Ledger: Higher Costs but Enhanced SecurityUsers must purchase a Ledger device (e.g., Nano X at ~$149), and transaction fees may be higher when swapping assets via Ledger Live compared to decentralized exchanges. The trade-off is enhanced security and self-custody, appealing to long-term holders and those with significant crypto assets.

-

Binance Wallet: Integrated Trading but Custodial RisksBinance Wallet offers instant access to trading, staking, and DeFi features within the Binance ecosystem. However, users must accept the risk of platform custody, which may not be suitable for those concerned with exchange security or regulatory issues.

Expert Takeaways: Security Isn’t One-Size-Fits-All

The crypto wallet landscape isn’t binary, it’s a spectrum between self-sovereignty and managed convenience. Both Ledger and Binance Wallet have carved out loyal followings by excelling at opposite ends of this range:

- Ledger: Best-in-class cold storage security; ideal for long-term holders who want maximum autonomy.

- Binance Wallet: Streamlined UX; perfect for traders who value liquidity access over key management responsibility.

No single wallet can be crowned “best” without considering your habits, goals, and risk tolerance. As always in crypto: educate yourself before committing significant assets, and remember that robust security starts with informed choices.